With the close of February just behind us, the financial landscape for the rest of 2024 is being closely monitored and analyzed. The year kicked off with predictions of up to six Federal Reserve rate cuts, initially expected to begin in March. However, this outlook has been adjusted due to stronger-than-anticipated economic performance and persistent inflation levels. The anticipated first-rate reduction is now deferred to June, attributed to better-than-expected economic indicators and a stickier inflation scenario than previously projected. January’s labor market data showcased an unexpectedly strong resilience, suggesting sustained economic resilience in the near term.

Shifting focus to Canada, the economic outlook is similarly complex yet cautiously optimistic. The Bank of Canada holds a wary posture, with projections hinting at interest rate cuts beginning in June, aiming for a total reduction of 100 basis points by year-end. This cautious approach comes in the wake of unexpectedly strong Q4 GDP growth alongside robust retail sales and employment figures. However, inflation’s failure to meet expectations has influenced the policy outlook significantly. This scenario underscores a global revaluation of monetary policies, with the Canadian dollar’s trajectory garnering particular attention.

| Index | Jan-2024 | Feb-2024 |

| S&P 500 Total Return | 1.68% | 5.34% |

| S&P/TSX Total Return | 0.55% | 1.82% |

Canada

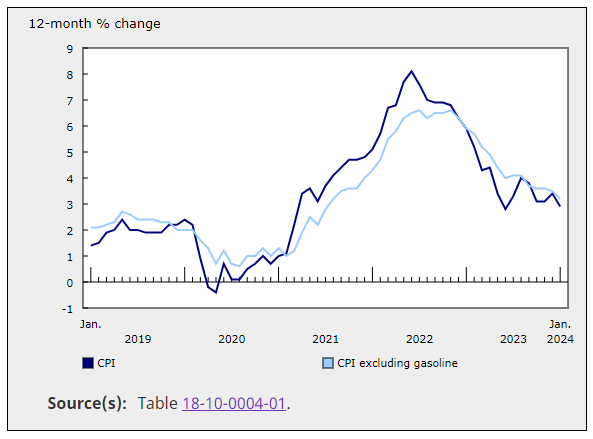

In February 2024, the S&P/TSX Total Return increased by 1.82%, with varied economic indicators released during the month, showcasing a mixed but cautiously optimistic outlook. GDP growth outperformed expectations in Q4, yet January’s expansion was modest. Retail sales remained strong, and the job market was surprisingly resilient, contrary to expectations. However, inflation rates fell short of forecasts, with headline CPI dropping to 2.9% from December’s 3.4%, and core inflation rates also decelerated.

GDP Growth: Canada’s GDP growth in Q4 exceeded expectations, signaling a recovery from previous declines. Statistics Canada reported 1.0% annual growth for the October–December period, reversing a 1.1% annual contraction. Furthermore, the economy showed 0.2% growth compared to the previous quarter, with preliminary estimates suggesting a 0.4% expansion in January.

Inflation: In January, the inflation rate decreased to 2.9% from the previous month’s 3.4%, largely due to falling gasoline prices. Core inflation, however, saw a lesser drop, signaling ongoing price pressures aside from energy costs. The period also marked a shift in consumer behavior, with increased seasonal discounting across various sectors. Notably, shelter costs continued to challenge monetary policy adjustments. Additionally, food and travel prices saw reductions, contributing to the overall slowdown in the consumer price index.

Retail Sales: After a strong finish in the previous year, Canadian retail sales experienced a sharp decline in January, marking the most significant drop since March 2023. This pullback indicates a shift in consumer spending behavior following a period of robust retail activity. Retail receipts dipped by 0.4%, contrasting with a 0.9% increase in December, which had exceeded expectations. Despite the drop in value, the volume of retail sales actually saw a modest increase. This dynamic underscores a complex retail landscape at the start of the year.

Job Market: In January, Canada’s job market saw a surge, creating 37,000 positions and cutting the unemployment rate to 5.7%, a significant improvement since December 2022. This growth, mainly in part-time roles, pushed wages up by 5.3% year-over-year, reflecting inflation adjustments. Despite this positive trend, analysts anticipate the Bank of Canada will delay interest rate cuts until June. Job increases were observed in sectors like wholesale, retail trade, and finance, while accommodation and food services declined, following a year where high-interest rates dampened the labor market.

Outlook: The Bank of Canada is exercising caution, not anticipating immediate rate reductions. Nonetheless, positive inflation trends and steady economic signals could lead to adjustments in monetary policy by mid-year. The economic forecast hinges on expected rate cuts, which could stimulate growth later this year and into 2025, backed by robust retail activity and a solid job market. While rate cuts seem unlikely for the March and April meetings, there’s optimism for policy easing beginning in June, aligning with gradual improvements in inflation.

Source: Statistics Canada

United States

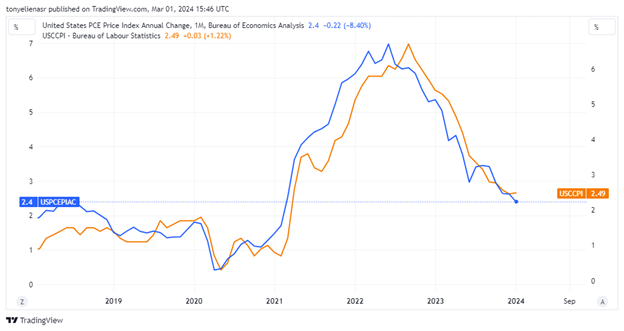

The S&P 500 Total Return Index concluded February 2024 on a high note, registering a notable increase of 5.34%, as it successfully navigated the intricate balance between maintaining bullish momentum and fostering growth, all while managing inflation in a fluctuating market environment. Both the S&P 500 and Nasdaq Composite Indices reached new highs following the alignment of Personal Consumption Expenditures (PCE) inflation data with projections. The Federal Reserve’s anticipated first rate cut, initially expected in March, has been deferred to June due to a confluence of economic data and Fed commentary. Fed officials are looking for further signs of a downward inflation trend before deciding to lower interest rates, as noted in the minutes of the central bank’s most recent meeting. While there is no anticipation of rate increases in this economic cycle, the readiness for rate cuts has yet to be established.

Market Performance: Market optimism has been buoyed by impressive earnings reports, notably from NVIDIA, which surpassed high expectations with its fourth-quarter net revenue and earnings, igniting further enthusiasm for Artificial Intelligence investments. This positive sentiment is reflected in the S&P 500 and Nasdaq Composite Indexes, which finished higher, underscoring the market’s resilience and growth prospects.

Consumer Prices: January witnessed a 0.3% rise in consumer prices, primarily driven by higher shelter costs, which accounted for over two-thirds of the monthly increase. This uptick in inflation, particularly in core prices excluding shelter, remains a concern for the Fed, as it exceeds their comfort level, indicating persistent inflationary pressures.

PCE Index: January’s personal consumption expenditures (PCE) price index recorded a 0.3% increase from December to January, with the core index, excluding food and energy costs, climbing by 0.4%, in line with market anticipations. On an annual basis, the core PCE decelerated to 2.8%, a reduction from December’s 2.9% and marking the smallest yearly increase since March 2021. This moderation in the PCE figures helped to alleviate some concerns about inflation following higher-than-anticipated increases in both the Consumer Price Index (CPI) and Producer Price Index (PPI). Nonetheless, the PCE data did not significantly impact the likelihood of rate cuts, nor did it conclusively suggest that the recent rises in CPI and PPI were anomalies.

Source: TradingView

Retail Sales: Retail sales experienced a 0.2% decline from a year ago, with consumers showing restraint in their spending habits. The shift towards more competitive online pricing, particularly in department stores, reflects a broader consumer trend towards price sensitivity and could signal a moderation in the spending surge seen in previous periods.

Economic Growth: The U.S. economy’s growth rate at a 3.2% annual pace in the final quarter underscores a resilient economic expansion, albeit at a slightly decelerated rate from the previous quarter. This sustained growth trajectory, despite high interest rates, highlights the economy’s resilience against recessionary fears.

Labor Market Dynamics: The labor market shows signs of softening, with a decline in job openings and a downward trend in the job openings-to-unemployed ratio. Despite this softening, the strong January employment report, with a significant surge in payrolls, highlights an unexpected momentum in job creation, indicating a still-robust labor market.

International Markets

International markets have demonstrated strong performance, highlighted by a surge in European private sector activity to its highest level in eight years, signifying a robust increase in the region’s economic vitality. Concurrently, Japan’s Nikkei reached a new record high as it transcended its previous 1989 level, just before the country fell into decades of a deflationary spiral. Market participants are keenly anticipating central banks to initiate rate cuts, although expectations are set for these adjustments to occur in the second quarter or possibly later. This anticipation reflects a cautious optimism, suggesting that while immediate rate reductions may not be on the horizon, there is a growing belief in the potential for monetary policy easing in the near future, which could further influence market dynamics and investor strategies.

Europe: In Europe, inflation rates showed a slight decrease, with January’s headline inflation at 2.8%, down from December, and core inflation cooling for the sixth month in a row to 3.3%, the lowest since March 2022. The manufacturing sector experienced a slight downturn, with the HCOB manufacturing PMI dipping to 46.1 in February. Conversely, the services sector saw improvement, with its PMI climbing to 50, indicating expansion and suggesting a diversifying strength within the European economy.

China: Chinese stock markets experienced significant gains as optimism for economic recovery grew, fueled by strong holiday spending during the Lunar New Year. Although Lunar New Year tourism data revealed a surge in revenue and domestic and international trips, surpassing pre-pandemic levels, a decline in average spending per trip indicated continued consumer caution. In response to these economic signals, the People’s Bank of China (PBoC) injected RMB 500 billion into the banking system. It reduced the five-year loan prime rate by 25 basis points to 3.95%, aiming to support liquidity and stimulate demand in the property sector. It was the first rate cut since June 2023 and the largest since that rate was introduced in 2019. Meanwhile, new home prices recorded a seventh consecutive monthly drop, highlighting ongoing challenges in the real estate market.

Russia-Ukraine: Two years into Russia’s conflict with Ukraine, Europe’s strategic move away from Russian gas demonstrates a successful pivot. The continent’s shift, driven by milder winters, energy efficiency measures, and an influx of global LNG supplies, alongside a surge in renewable energy, signifies a profound change in its energy landscape. European officials’ statements suggest a firm stance against reverting to Russian gas imports, signaling a long-term transformation in energy sourcing.

United Kingdom: In the UK, economic indicators have shown positive momentum, with the composite Purchasing Managers’ Index (PMI) output index climbing to 53.3 in February, up from 52.9 in January, signaling a notable boost in customer demand. During a session with a parliamentary committee, the Bank of England Governor expressed his comfort with the market’s expectations for rate reductions within the year while also highlighting the economy’s recovery signs following a recession the previous year.

Japan: The Japanese equity markets experienced impressive growth, with the Nikkei 225 Index reaching an all-time high. This surge was supported by ongoing economic expansion and corporate earnings strength. Despite experiencing a brief downturn, a rally preceding a national holiday propelled the indices to new heights. Contributing to this positive trend, exports in January soared by 11.9%, marking a second month of significant growth and substantially reducing Japan’s trade deficit compared to the previous year. On the other hand, the manufacturing sector faced challenges, as evidenced by a Purchasing Managers’ Index (PMI) of 47.2, signaling continued contraction. In contrast, the services sector demonstrated resilience, with its PMI slightly decreasing but remaining in expansion territory, reflecting a diverse yet predominantly optimistic outlook for Japan’s economic future.

The Portfolio Management Team