As the first month of 2024 ended, the US economy, bolstered by the Federal Reserve’s December 2023 meeting, defied expectations with robust economic indicators. Despite a slowdown from the previous quarter’s growth of 4.9%, the US GDP increased by 3.3% in Q4 2023, surpassing the predicted 2.0%. This robust performance is reflected across various sectors, as evidenced by PMI indices reaching their peaks in months. Moreover, consumer spending continues to exhibit a solid upward trend.

Meanwhile, the Canadian economy navigates through a phase of continued sluggishness. The Bank of Canada, maintaining its overnight rate at 5% and continuing its policy of quantitative tightening, reflects a cautious approach amidst a global economic deceleration. Inflation, although gradually easing, continues to exert pressure, with expectations of it returning to the target only by 2025.

| Index | Dec-2023 | Jan-2024 |

| S&P500 Total Return | 4.54% | 1.68% |

| S&P/TSX Total Return | 3.91% | 0.55% |

Canada

In January 2024, the S&P/TSX Total Return increased 0.55% as the Canadian market presented a mixed landscape of economic indicators, reflecting both the challenges and the resilience of the economy under current global conditions.

Job Market: One of the key indicators, the job market, showed a noticeable stagnation in December 2023. The total number of jobs barely changed, with the economy adding just 100 jobs in the final month of the year. This minimal growth in employment levels was seen against the backdrop of a steady unemployment rate of 5.8%. The stagnation in job growth is perceived as a consequence of the high-interest rates that have been influencing economic activity.

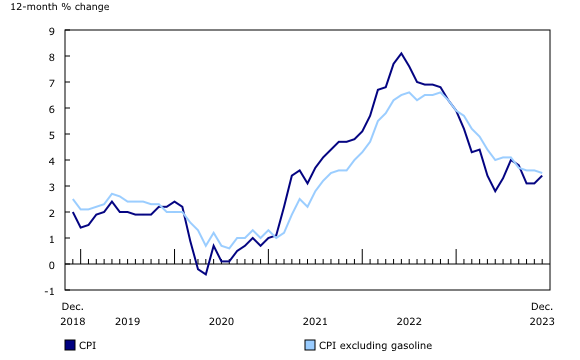

Monetary Policy: The Bank of Canada’s monetary policy played a crucial role in shaping these economic trends. Maintaining its overnight rate at 5%, the Bank continued its quantitative tightening approach. The broader global economic slowdown and a gradual decrease in inflation across various economies largely influenced this policy decision. The Bank projected that inflation would hover around 3% through the first half of 2024, with expectations of returning to the target level by 2025. However, annual inflation in December accelerated to 3.4%, which was higher than the central bank’s target of 2%. This has led analysts to anticipate a challenging period in the months ahead before achieving price stability.

Economic Growth: The Canadian economy experienced a period of near-stagnation towards the end of 2023. October and November saw minimal growth, primarily due to the impact of the Bank of Canada’s rate hikes initiated in March 2022. Despite this sluggishness, a slight uptick in GDP was observed in November, attributed to increases in sectors such as manufacturing, transportation, and agriculture. Nevertheless, this marginal improvement was not substantial enough to indicate a significant positive shift in the economic trajectory. In contrast to the resilience shown in the U.S. economy, Canada’s GDP growth dipped into negative territory in the third quarter, with an annualized rate of -1.1%, and expectations for the fourth quarter were not much brighter, forecasted to be below 0.5%.

12-month change in the Consumer Price Index (CPI) and CPI excluding gasoline

Source: Statistics Canada

United States

The S&P 500 Total Return index ended the first month of 2024 on a positive note, with a significant rise of 1.68%. This increase is largely attributed to market expectations of multiple rate cuts throughout 2024. Despite these anticipations, the Federal Reserve maintains a firm stance on sustainably achieving its inflation targets. Consequently, the Fed has signaled its readiness to maintain the current interest rate range for a prolonged period if needed, balancing market optimism with a cautious approach toward monetary policy.

Labor Market: January 2024 saw a notable deceleration in private payroll growth in the U.S., with companies adding only 107,000 workers, a significant drop from December’s revised figure. This slowdown hints at a potential cooling in the U.S. labor market. Despite this, wage growth remained robust, with a reported annual increase of 5.2%, outpacing the government’s average hourly earnings measure.

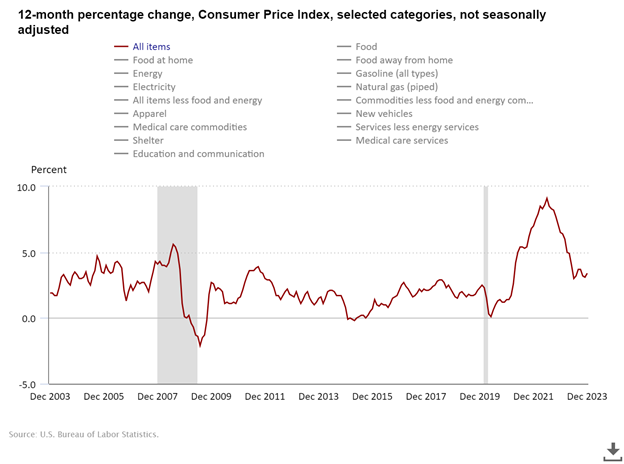

Inflation: In January, the U.S. saw a positive shift in inflation trends. The PMI Prices Charged Index decreased to 51.7, indicating a gradual reduction in inflationary pressures. Concurrently, consumer spending in December exceeded forecasts, growing by 0.7%, while personal income growth slightly dipped to 0.3%. The Core PCE index, closely monitored by the Federal Reserve, rose 0.2% monthly and 2.9% annually in December. Together with the stable annual headline inflation rate of 2.6%, these indicators suggest a trend toward moderating inflation and consistent consumer spending, key factors in the U.S. economy’s stability.

Economic Activity: U.S. business activity experienced an upswing in January, as indicated by the S&P Global Composite PMI Output Index, which climbed to its highest point since the previous June. This increase, propelled by growth in both the manufacturing and service sectors, suggests a steady yet moderate economic expansion. Additionally, Q4 GDP was reported at 3.3%, down from Q3’s 4.9% but significantly above the 2.0% consensus estimate.

Monetary Policy: As expected, the FOMC left the target range for the fed funds rate unchanged at 5.25%–5.50% at the end of the first policy meeting of 2024. Chair Jerome Powell expressed a conservative outlook regarding future rate cuts. He suggested that a rate reduction at the upcoming March meeting is unlikely, aligning with the Fed’s cautious approach amidst current economic conditions. He emphasized the need for stronger evidence of sustained inflation reduction before considering any rate cuts, indicating that the Fed’s primary focus remains on ensuring inflation aligns with its 2% target. Powell acknowledged the progress made so far but clarified that the journey towards a “soft” landing” (cooling the economy without triggering a recession) still has a considerable way to go.

International Markets

Europe: In Europe, disruptions in the Red Sea presented logistical challenges, potentially impacting supply chains and increasing inflationary pressures. However, the eurozone exhibited signs of economic recovery, with a slight improvement in the composite PMI driven by manufacturing gains. The ECB’s governing council members indicated a reluctance to cut interest rates early, considering June as the earliest point for assessing inflation control. December 2023 saw Euro area inflation rise to 2.9%, an increase from 2.4% in the previous month.

United Kingdom: The UK’s economic landscape faced challenges from Middle East geopolitical tensions. Despite these hurdles, the UK’s business activity showed resilience, with the preliminary PMI exceeding expectations and hinting at the possibility of avoiding recession. However, December’s unexpected inflation rise, with consumer prices increasing annually by 4% from 3.9% in November, led to a substantial sell-off in gilts. This inflationary spike has altered expectations about the Bank of England’s timeline for interest rate cuts.

China: In China, the government implemented robust measures to bolster the economy, positively impacting market sentiments. These measures included the People’s Bank of China (PBOC) cutting reserve ratio requirements and interest rates, aimed at rejuvenating consumer confidence and addressing the property market’s downturn and deflationary risks. Despite achieving a 5.2% growth in 2023, the economy’s recovery appeared more fragile than anticipated, with concerns such as a deepening property crisis and subdued demand impacting the economic outlook for the year ahead.

Japan: Japan’s economy reflected the Bank of Japan’s commitment to maintaining its ultra-loose monetary policy, with speculation about ending negative interest rates. Tokyo’s inflation showed signs of slowing, which may influence the timing of an anticipated rate hike by the Bank of Japan. Despite these monetary policy developments, Japan continued to see robust exports and rising real estate prices in Tokyo, which were attributed to limited supply and escalating construction costs.

Conclusion

In conclusion, the outlook for 2024 in various global markets is shaped by a combination of cautious monetary policies, economic recovery efforts, and the impact of geopolitical tensions. The U.S. Federal Reserve’s approach, focusing on sustainable inflation targets and readiness to maintain current interest rates, reflects a measured response to ongoing economic challenges. Canada’s economy exhibits a complex dynamic of labor market stagnation and cautious monetary policies, emphasizing the balance between inflation management and growth support. Globally, the economic landscape varies, with resilience in some markets amid rising geopolitical tensions and others experiencing policy shifts and economic fragility.

The Portfolio Management Team