April presented a challenging landscape for financial markets in both the United States and Canada, each facing distinct economic pressures. In the U.S., financial markets experienced a significant downturn, the first monthly decline since October, primarily driven by diminished expectations for near-term interest rate cuts and ongoing concerns about persistent inflation, which continues to exceed the Federal Reserve’s target. The Federal Open Market Committee (FOMC) maintained the federal funds rate at a 23-year high, highlighting a cautious stance amid fluctuating economic signals.

Conversely, in Canada, while the economy saw moderate growth of 1.2% in 2023, according to StatCan’s provincial GDP release, the expansion was unevenly spread across provinces. This pattern of disparate growth persisted into the first quarter of 2024, influenced by continuous adjustments in monetary and fiscal policies in response to both domestic and global challenges. Additionally, escalating conflicts in the Middle East have heightened concerns about potential broader wars and disruptions in global oil supplies, adding layers of uncertainty to the investment climate. These geopolitical tensions, coupled with a ‘higher for longer’ interest rate environment due to sticky inflation, have tempered expectations for rate cuts and impacted equity valuations, although markets remain up on a year-to-date basis.

| Index | Mar-2024 | Apr-2024 |

| S&P 500 Total Return | 3.22% | -4.08% |

| S&P/TSX Total Return | 4.14% | -1.82% |

Canada

In April 2024, the S&P/TSX Total Return Index experienced a 1.82% decrease, largely due to persistently high-interest rates aimed at curbing inflation and suppressing economic activity. Moreover, sector-specific challenges, especially in real estate and consumer spending, added to market strains amid global economic uncertainties. The Canadian economy exhibited moderate growth in 2023, with a 1.2% expansion in provincial GDP, as reported by StatCan, although this growth was not uniformly distributed across all provinces. Furthermore, ongoing inflation trends and the recent depreciation of the Canadian dollar, coupled with the central bank’s readiness to modify interest rates if inflation continues to decline, underscore a cautious but flexible approach to monetary policy as the year progresses.

Economic growth: While nine out of ten provinces recorded growth, Newfoundland and Labrador faced a contraction of 2.5%, primarily due to challenges in the oil and gas and mining sectors. This disparity in provincial growth rates reflects the diverse economic drivers and sectoral dynamics within Canada, suggesting that regional policies may need to be tailored to address specific local economic conditions.

Real estate: Canadian real estate activity throughout 2023 was significantly shaped by several economic pressures, including aggressive monetary tightening and constraints in the construction sector’s capacity. These factors led to challenges in meeting the robust demand driven by population growth, evident in the widespread downturn in residential construction across the provinces. Additional indicators provided a mixed view of the housing market: housing starts in March recorded a 7% month-on-month decrease, settling at 242.2k annualized units, down from February. In contrast, the total value of building permits saw a notable increase of 9.3% month-on-month, reaching $11.8 billion in February.

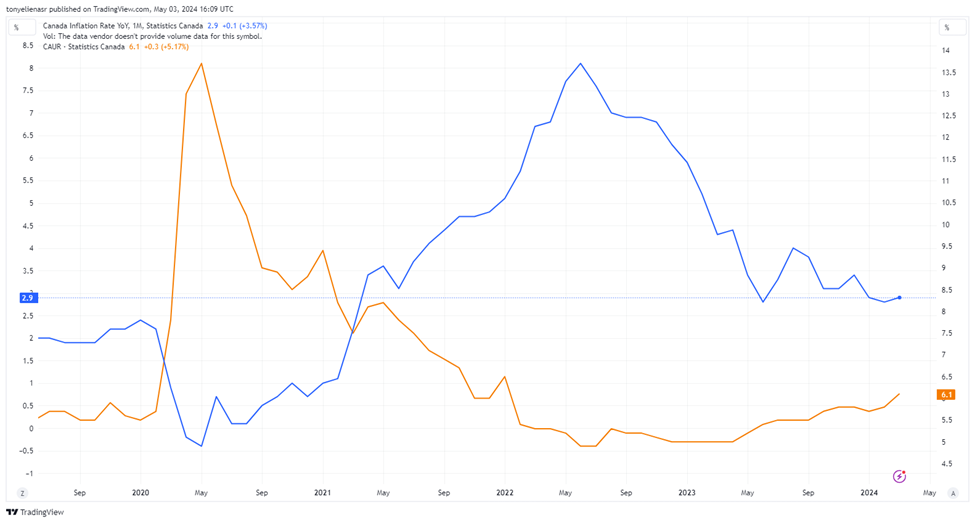

Labor market: A notable rise in unemployment to 6.1% from 5.8% in February was attributed to a surge in the labor pool by 60,000 individuals either seeking jobs or returning from temporary layoffs. This uptick in unemployment occurred despite relatively stable overall employment numbers, signaling a complex labor market scenario that combines fast population growth with shifting employment patterns.

Retail sales: In February, Canada’s retail sales declined for the second consecutive month, falling by 0.1% following a 0.3% drop in January, contrary to analysts’ expectations of a modest increase. This contraction, led primarily by reduced sales at gasoline stations and fuel vendors, highlights the ongoing economic pressures from high-interest rates.

Inflation: The annual inflation rate nudged up to 2.9%, aligning with expectations and fueling speculations of a potential June interest rate cut by the Bank of Canada. Higher gasoline prices largely drove this increase amid global supply concerns. However, excluding gasoline, inflation eased slightly to 2.8%. Underlying inflation pressures continued to ease, as evidenced by declines in the BoC’s preferred measures, CPI-median and CPI-trim.

Monetary policy: The Bank of Canada maintained its key interest rate at 5%, but Governor Tiff Macklem opened the door to a possible rate cut in June if the recent downtrend in inflation continues. This statement in the bank’s quarterly Monetary Policy Report, which also revised 2024’s growth forecast upward due to strong immigration and increased household spending, marks a tentative step towards easing.

Canada Inflation & Unemployment Rate – Source: TradingView

United States

April witnessed a notable downturn in the S&P 500 Total Return Index, marking a 4.08% decline and the first monthly decrease since October. This setback in the stock market emerged as expectations for interest rate cuts diminished. Persistent discussions around sticky inflation have dominated recent headlines, influencing market sentiments. Despite this overall market pullback, the ‘Magnificent 7’ (comprising Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, and Tesla) remained significant contributors to the S&P 500’s year-to-date performance.

Monetary policy: During its latest meeting, the Federal Open Market Committee (FOMC) held the federal funds rate steady at a 23-year peak of 5.25%–5.50%, maintaining a cautious stance amid fluctuating economic indicators. Chair Jerome Powell underscored the Fed’s readiness to keep rates elevated “as long as is appropriate,” signaling a preparedness to manage inflation persistently hovering above the 2% target. Changes to the policy statement, most notably the focus on the recent lack of progress towards the inflation target, which implies rate reductions are not on the table for the near future, further reinforce this position. Another significant policy shift was the adjustment of the quantitative tightening (QT) program, with the Fed reducing the monthly run-off cap for Treasuries to $25 billion from $60 billion, starting June 1.

Labor market: The labor market displayed a complex picture; the JOLT survey indicated a decrease in job openings to 8.5 million in March, yet the ADP employment report exceeded expectations with 192,000 jobs added in April. These figures illustrate an ongoing robustness in job creation, albeit with some signs of cooling. On the other hand, nonfarm labor productivity growth decelerated sharply to 0.3% in the first quarter, marking the slowest pace since early 2023, while a significant uptick in unit labor costs of 4.7% was recorded. These dynamics suggest persistent wage pressures, which could translate into sustained inflation, challenging the Fed’s inflation targeting.

Sectors overview: The manufacturing sector showed signs of contraction, with the ISM Manufacturing Index falling to 49.2 in April, indicating a slight sectoral decline after a brief period of growth. This aligns with the subdued manufacturing activity reported by the Fed since the onset of rate hikes in March 2022. The construction sector also exhibited weakness, with a slight drop in spending in March, primarily driven by declines in both private residential and non-residential spending. Despite these setbacks, structural investments in sectors like electric vehicles and microchips suggest a potential rebound.

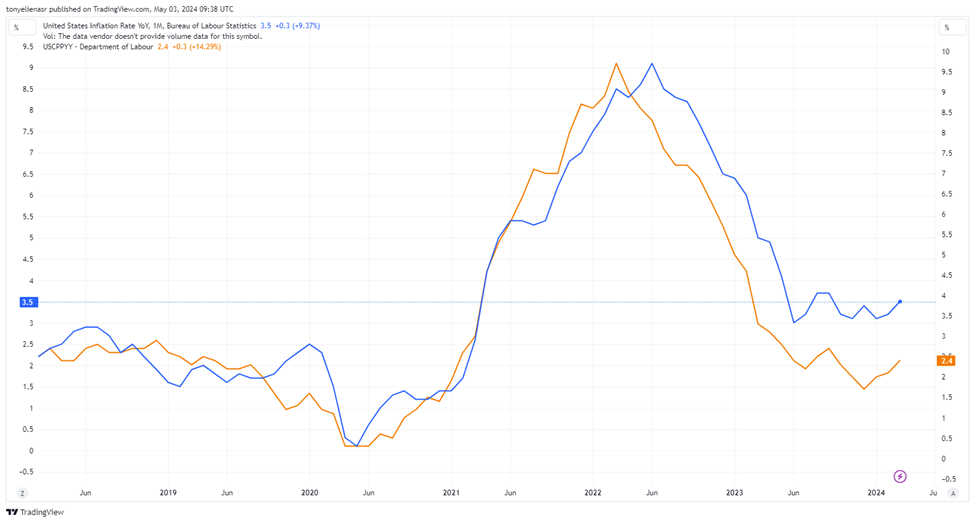

Inflation: In March 2024, the Consumer Price Index for All Urban Consumers (CPI-U) showed a persistent inflation rate, rising 0.4% month-over-month for the third consecutive month and a year-over-year increase to 3.5% from 3.2% in February. The rise in March’s CPI was driven largely by increases in shelter and energy costs, with gasoline prices pushing energy expenses higher and contributing to reduced consumer purchasing power. Meanwhile, core CPI, excluding food and energy, rose 0.4% monthly and 3.8% annually, with shelter costs making up the majority of this increase. Moreover, the recent Producer Price Index (PPI) figures also highlight ongoing inflationary pressures at the wholesale level, with a 12-month increase of 2.1% in March, the highest since April 2023. This suggests that inflation could remain elevated for longer than many economists had anticipated, influencing the Fed’s monetary policy decisions moving forward.

US CPI and US PPI Y/Y Change – Source: TradingView

International Markets

April proved challenging for global financial markets. A mix of geopolitical tensions and economic data hinted at a less accommodating monetary future than previously expected, leading to declines across both the equity and bond markets.

Europe: Eurozone inflation remains steady at 2.4% year-on-year, with a significant reduction in the services sector’s inflation. This subdued inflationary environment, coupled with slow growth forecasts, has enhanced expectations for potential ECB rate cuts. However, market projections now anticipate only two cuts by the end of the year. Meanwhile, unemployment rates in the Eurozone held firm at 6.5% in March 2024, unchanged from February and slightly improving from 6.6% in March 2023. Economic growth in the Eurozone and the EU showed modest gains, with both areas seeing a 0.3% increase in seasonally adjusted GDP for the first quarter of 2024, according to Eurostat’s preliminary estimates. Similarly, the UK’s inflation receded slightly, aligning market expectations with a slower approach to rate cuts, anticipated to begin in September by the BoE.

Japan: In Japan, the financial markets faced challenges as widening interest rate differentials with other developed markets put downward pressure on the yen. This weakening of the currency fueled concerns about imported inflation, potentially dampening domestic demand and negatively impacting investor confidence. Additionally, Japan’s core inflation experienced a slowdown in March, primarily due to moderate increases in food prices, yet it remained above the central bank’s 2% target. The nationwide core CPI, which excludes fresh food, increased by 2.6% year-over-year in March, a slight decrease from the 2.8% rise observed in February, aligning with median market expectations.

Middle East: The Middle East saw heightened military activity with exchanges of airstrikes between Israel and Iran, raising significant concerns over regional stability and its implications for global oil supplies. Despite these developments, market volatility remained surprisingly modest, with energy stocks and commodities like crude oil outperforming due to the potential risks to oil supply and transport, particularly through the critical Strait of Hormuz.

China: Chinese stocks have shown notable strength amid global economic challenges, buoyed by optimistic growth projections and a growing interest in commodity-related assets. In Hong Kong, the Hang Seng Index experienced a significant surge, climbing over 7% in April, making it the top-performing major index globally. This surge has propelled the index toward bull market territory, marking an almost 20% increase since its January low.

EURUSD GBPUSD JPYUSD April Performance – Source: TradingView

The Portfolio Management Team