As we pass the mid-year mark, financial markets remain in solid shape, bolstered by a resilient economy, slowing inflation, and early signs of central bank easing. The S&P 500 experienced a significant increase of 3.59% last month, primarily driven by the sustained momentum of AI stocks, which benefited from disinflation and strong economic growth. US equities have achieved impressive annualized returns of 15.29% year-to-date. In contrast, the S&P TSX declined by 1.42% for the month due to declines in the technology, utilities, and banking sectors. Despite the drop, the S&P TSX has maintained a solid 6.05% gain YTD.

In June, the Bank of Canada (BoC) and the European Central Bank (ECB) initiated easing cycles by reducing key interest rates by 25 basis points. The BoC is projected to implement further cuts, totaling 100 basis points in 2024 and an additional 100 basis points in 2025, bringing the overnight rate back to a neutral 3%. On the other hand, the Federal Reserve is anticipated to be among the last to lower rates, probably not until September, as robust demand for services continues to moderate, driving inflation down sustainably.

| Index | May-2024 | June-2024 |

| S&P 500 Total Return | 4.96% | 3.59% |

| S&P/TSX Total Return | 2.55% | -1.42% |

Canada

Canadian stocks experienced a setback in June as the S&P/TSX closed the month with a 1.42% decrease. The Bank of Canada (BoC) cut the policy rate by 25 basis points to 4.75% in response to economic underperformance and rising unemployment. However, unexpectedly high inflation data for May, with both headline and core CPI increasing by over 0.3%, caused bond yields to rise sharply and reduced expectations for further rate cuts in July.

Looking ahead, the BoC’s ability to significantly diverge from the US Federal Reserve remains limited. BoC Governor Tiff Macklem has acknowledged the constraints of diverging too far from the Fed’s policy stance, as this could weaken the Canadian dollar and undermine disinflation efforts by increasing the cost of imported goods.

Population Growth: Canada’s population reached 41 million on April 1, 2024, driven by a net international migration of 1.24 million, including 828,000 temporary immigrants. The population grew by 3.2% over the past year, marking the largest increase since 1958. However, the federal government plans to reduce temporary immigration, which is expected to slow overall population growth to around 1%.

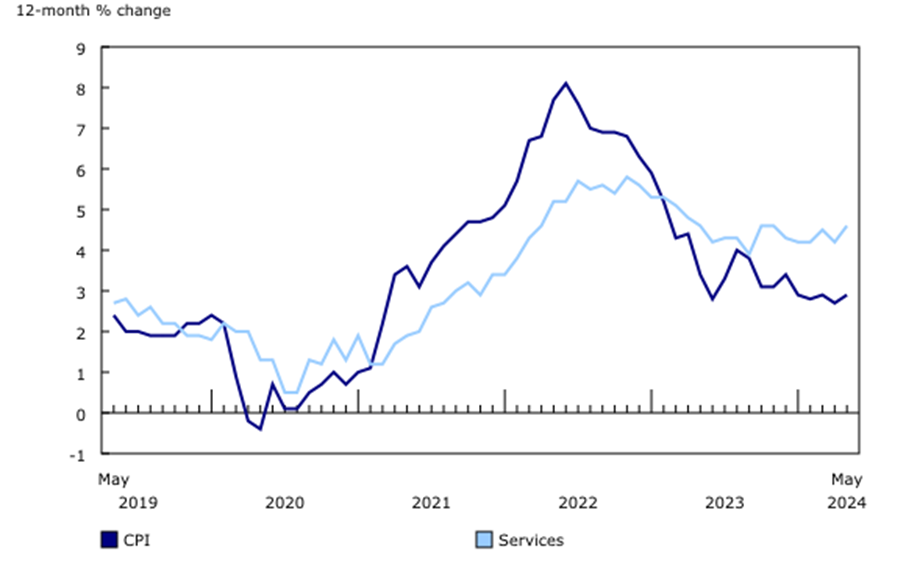

Inflation: In May, the Consumer Price Index (CPI) rose by 0.6% (0.3% seasonally adjusted), pushing the annual inflation rate to 2.9%. Core inflation metrics also increased, with the median CPI and trimmed mean both rising to just below 3%.

Unemployment: The unemployment rate increased from 5.4% to 6.2% over the past year, driven by insufficient job growth relative to high immigration.

GDP Growth: Real GDP rose by 0.3% in April and is expected to increase by 0.1% in May, putting Q2 on track for nearly 2% annualized growth. Annual GDP growth for 2024 is expected to be around 1%.

Housing Market: In May, new listings increased by 13.5% year-over-year, while sales were down 0.6% seasonally adjusted and 5.9% below year-ago levels. The national month’s supply of inventory rose to 4.4, the highest in four years. Housing starts rose to 264,500 annualized units, the strongest since September, with the 12-month average at 251,000 units.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and service prices

United States

The S&P 500 reached a new all-time high in June, propelled by gains in the technology sector and driven by market focus on artificial intelligence (AI) and a preference for quality amidst high macro and market uncertainty. The tech sector has been leading the gains this year, significantly outpacing the broader S&P 500. However, the rapid rise has led some tech stocks to become overbought, leading to a stabilization phase. Financial markets closed the first half of 2024 strongly, with the S&P 500 advancing 15%, reaching record highs.

Interest Rates: In June 2024, the Federal Reserve maintained the overnight federal funds rate at 5.25% to 5.5%, the highest range in 23 years. The Fed remains committed to reducing inflation to 2% and achieving maximum employment, with economic uncertainties persisting. The year-end median federal funds forecast is 5.1%, implying a single 25 basis point cut by the end of the year and four cuts in 2025.

GDP Growth: The economy slowed in the first quarter of 2024, with GDP growing at a modest 1.4% annualized rate.

Employment: The labor market showed mixed signals, with a solid jobs report but underlying signs of slowing. The unemployment rate rose to 4%, the highest in over two years. Job openings fell to 8.06 million in April, down nearly 300,000 from March, indicating a potential weakening in the labor market. In contrast, wage growth remains strong, with average hourly earnings up 0.4% month-over-month and 4.1% year-over-year, partly due to an increase in California’s state minimum wage for fast food workers. The ADP report showed 152,000 nonfarm private jobs added in May, down from 188,000 in April.

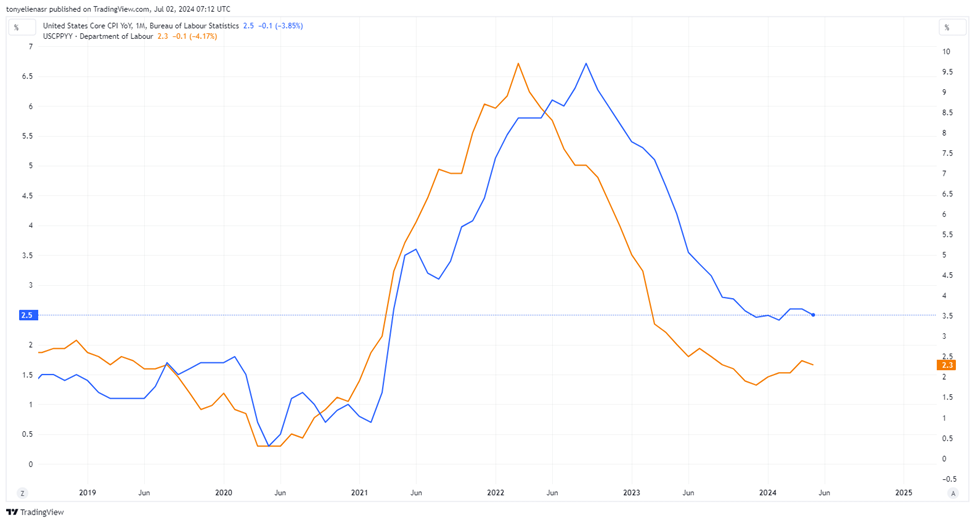

Inflation: In May, energy prices fell by 2%, easing the headline CPI. Core CPI increased by 0.2% month-over-month, while the PPI for final demand fell by 0.2%. Additionally, the PCE Price Index, the Fed’s preferred inflation gauge, edged lower to 2.6% year-over-year in May, indicating easing inflation pressures. The core PCE Price Index, excluding food and energy, also decreased to a 2.6% annual increase from 2.8% in April, with a modest 0.1% month-over-month rise.

Consumer Spending: Real consumer spending increased at a 1.5% annualized rate, a significant drop from the previous estimates and the growth seen in late 2023. Durable goods spending plunged significantly, reflecting the broader trend of consumer strain. This moderation in consumer spending, coupled with higher interest rates, has tempered economic growth prospects for the remainder of the year. Personal income growth accelerated to a robust 0.5% in May, above consensus expectations, and following a solid 0.3% gain in April.

Corporate Earnings: The first quarter of 2024 saw impressive earnings, with the majority of S&P 500 companies exceeding expectations and earnings growth at its highest since Q1 2022. About 79% of these companies surpassed EPS estimates. The Magnificent Seven led this surge, with earnings rising by over 50% year-over-year, while the remaining S&P 493 posted a modest 3% growth. Despite this disparity, the quarter marked the beginning of an earnings recovery for the broader market. Looking ahead, industry analysts expect the earnings growth gap between the Magnificent Seven and the rest of the S&P 500 to narrow.

Source: TradingView. US CPI and US PPI Y/Y Change.

International

The international markets experienced varied performances influenced by economic, geopolitical, and sector-specific developments:

Europe: Political uncertainty in France ahead of a snap election contributed to a decline in the pan-European STOXX 600 Index. The European Central Bank reduced interest rates by 25 basis points, signaling a moderation in monetary policy restrictions. This came as France and Spain saw slower inflation due to lower fuel and food prices. Meanwhile, Germany faced rising unemployment and weakening business confidence, prompting increased consumer caution and savings. Overall, Eurozone confidence was mixed, with business sentiment declining but a slight improvement in consumer outlook.

United Kingdom: UK inflation fell to 2% in May, hitting the Bank of England’s target for the first time in nearly three years due to a sharp decrease in food prices. This achievement places the UK ahead of other G7 nations in managing inflation. Despite this progress, the possibility of a rate cut in August depends on further progress as services inflation remains high at 5.7%.

Japan: Japanese markets rose, supported by a weak yen boosting exports. Despite expectations for intervention, authorities only issued verbal warnings against excessive currency volatility. Economic data showed stronger-than-expected growth in retail sales and industrial production however core inflation rose 2.5% in May staying above the central bank’s 2% target rate.

China: Chinese stocks declined due to concerns about the slowing economy. Industrial profits grew modestly in May, driven by higher commodity prices, but overall consumption remained sluggish amid a prolonged property downturn. Foreign investors sold a significant amount of onshore shares, contributing to market weakness, as many Chinese companies reported disappointing quarterly earnings.

Source: TradingView. EURUSD GBPUSD JPYUSD May Performance.

The Portfolio Management Team