Summary

- Higher interest rates go in hand with improved profit margins for financials and lead to that sector’s outperformance.

- It is still the time to adjust the sector allocation to favor companies that are expected to benefit from the stronger economy.

- We added Bank of America, Charles Schwab, Goldman Sachs, and PayPal Holdings to our portfolio.

Introduction

Markets are experiencing volatility on largely priced-in events: expected economic recovery, positive vaccine news, and large stimulus packages. This sell-off caused the yield curve to steepen, with the 10-year US treasury yields reaching 1.63% last week, while that rate began 2021 at only 0.93%.

The upward trajectory of yields is usually a reflection of higher growth and inflation ahead. As a result, this translates into higher risk premia for equities. Investing in the right sector during this stage of the economic cycle is crucial for investors seeking to outperform the market.

Yields and Financials

Changes in interest rates have a significant impact on the return of the financial sector. Higher rates go in hand with improved profit margins for financial institutions and lead to that sector’s outperformance.

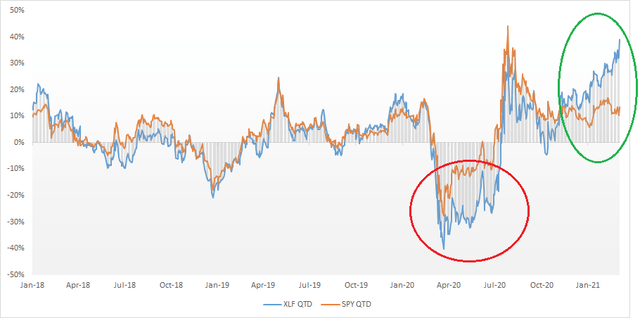

If we look at the six-month rate of change, financials are considered one of the best performing sectors. The Financial Select Sector SPDR Fund (XLF), has outperformed the S&P 500 (SPY) since the US elections.

We attribute this outperformance to the rotation in financials, energy and industrials. We began shifting our sector allocation to overweight financials in November. Please read our article “This Sector Rotation Strategy Made 17% Each Year Since 1991” for more information on our sector call.

Source: FactSet & Factor-Based

The above chart shows this dynamic. In 2020, financials were hit hard when the COVID-19 pandemic emerged. During the recovery period, promising economic data helped the market regain confidence in the sector.

Economists surveyed last February expected a US GDP growth rate of 4.9% in 2021. A year later, Goldman Sachs analysts are now anticipating an output of 6.8% this year. Regarding inflation, JP Morgan analysts are expecting inflation to exceed 2% in Q4 2021.These growth and inflation forecasts are strong tailwinds favoring higher earnings of financial stocks.

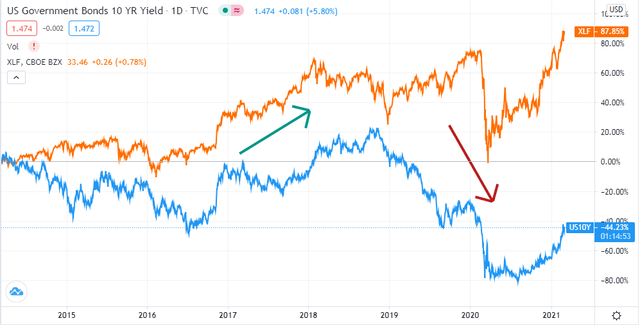

Source: TradingView & Factor-Based

The correlation between financials and the 10-Year US Treasury bonds yield is evident. Since 2021, the long yields posted their most significant surge since 2016. Banks benefited from this recent move in yields, and the XLF ETF started its outperformance, thanks to the steeper yield curve.

If we dig deeper into last year’s performance, banks were negatively impacted by massive allowances for credit losses during the first half of 2020. Conversely, quarterly earnings were boosted during the last quarter of the year due to reserves releases. The recovery period has shown many signs in the sector driven by many stimulus rounds. Throughout 2021, higher reserves releases are expected to occur if the economic forecasts continue to improve, and the sector is expected to show higher earnings.

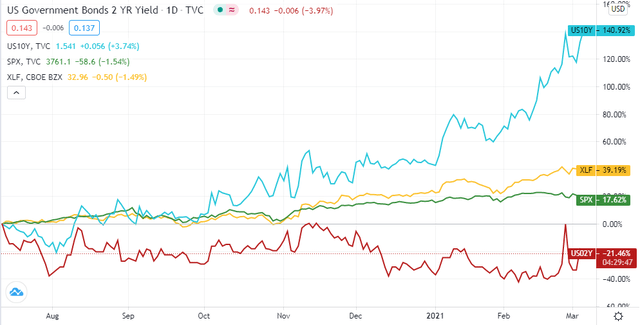

Source: TradingView & Factor-Based

Bond Market Consolidation

Near-term consolidation is expected in the bonds market following the recent sell-off. Starting next quarter, as the vaccination process is becoming more widespread, additional potential progress towards reopening COVID-affected industries is anticipated. This market optimism should put an end to the 2020 contraction and positively impact both growth and inflation.

When the pandemic pushed the economy to a halt last year, market liquidity suddenly became a concern. Central banks’ quantitative easing and stimulus packages, in addition to Basel III regulatory measures, such as the liquidity coverage ratio (LCR), and the net stable funding ratio (NSFR) were the main lines of defense against liquidity shortages for banks. Market volatility decreased compared to last year. However, it is expected to return in the near term, given the uncertainty of the Fed’s response to higher long rates.

US Large Equity Strategy

Our allocation to financials represents 30.2% of the portfolio. Our Sector Rotation Strategy backs this shift towards financials. Our current financial holdings cover the sector from various sub-industries:

- Banks offering diversified services in the US and worldwide: JPMorgan Chase (JPM), Citigroup (C) and Bank of America (BAC);

- Financial market broker: Charles Schwab (SCHW);

- Asset management and custody services: BlackRock (BLK);

- Investment banking and wealth management: Goldman Sachs (GS);

- Payment processing: PayPal Holdings (PYPL).

Many financial companies are rated in the first decile (90%+) in our ranking system. Following the quarterly rebalancing of March 1st, we added four new financial companies: Bank of America (BAC), Charles Schwab (SCHW), Goldman Sachs (GS), and PayPal Holdings (PYPL).

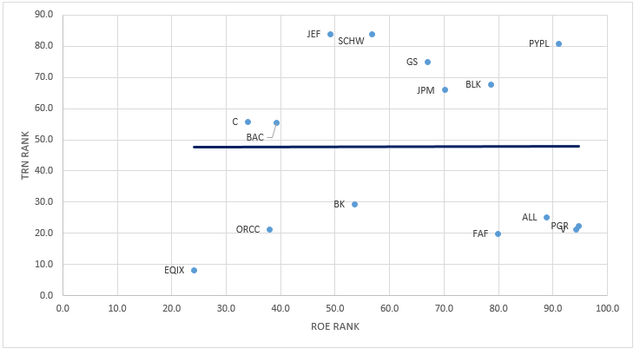

The latest ranking of the financial companies held in our 25 stocks portfolio is shown below:

| Ticker | Company Name | Weight (%) | Ranking |

| JPM | JPMorgan Chase & Co | 4.9 | 93.5 |

| C | Citigroup Inc. | 4.6 | 88.7 |

| BAC | Bank of America Corp | 4.1 | 91.2 |

| SCHW | Schwab (Charles) Corp | 4.1 | 94.9 |

| BLK | Blackrock Inc. | 4.0 | 88.1 |

| GS | Goldman Sachs Group Inc. | 3.8 | 96.5 |

| PYPL | PayPal Holdings Inc. | 3.8 | 98.4 |

Source: FactSet & Factor-Based

Catalysts of Financial Holdings

- JPMorgan Chase: JPM is expanding its presence in new regions and is expected to open around 400 branches in 15-20 new markets by the end of 2022. The company successfully closed many strategic acquisitions and has a strong liquidity position which supports its potential profitability.

- Citigroup: The bank is well-capitalized despite last year’s disruptive business environment. The company is expected to resume its repurchase activity this quarter. Last quarter, its fixed income markets revenues and equity markets revenues increased by 7% and 57%, respectively.

- Charles Schwab: In January 2021, new brokerage accounts increased by 200% compared to January 2020, thanks to issues and controversies surrounding Robinhood. Charles Schwab will further benefit from its recent aggressive efforts to increase its client base driven by the acquisition of TD Ameritrade and USAA’s Investment Management Company.

- Blackrock: The company’s board approved a 14% increase in quarterly cash dividend while its last quarter earnings per share increased by 13.5% year-over-year. Assets under management jumped from $7.43 trillion a year ago to a record $8.68 trillion. The company’s CEO stated that they are “well-positioned” for 2021. Recently, Blackrock has built a 5.21% stake in Toshiba Corp becoming the third-largest shareholder.

- PayPal Holdings: PayPal CEO said that a vast majority of consumers would likely continue to shop online after the pandemic period. In 2021, PYPL revenues are expected to grow by 19% as it allowed customers to use their crypto balances to fund their shopping activity.

Rankings

Our ranking system is made of nine metrics equally weighted among quality, value, and momentum factors. Let’s check how our financial holdings stand against peers and other major sectors in the market:

Return on Equity (ROE) is a quality metric capturing the company’s profitability. Compared to others, the financial sector had an average ROE of 7.09%, which is relatively higher than most of the other sectors.

| Sector | ROE TTM % | Price Change 1M% | Price Change 3M% |

| Telecommunications | 8.91% | 3.18% | -0.39% |

| Utilities | 7.74% | -5.48% | -3.91% |

| Financials | 7.09% | 7.53% | 13.61% |

| Industrials | 4.35% | 4.36% | 8.93% |

| Consumer Cyclicals | 4.11% | -9.35% | 6.01% |

| Business Services | 1.88% | 0.51% | 1.23% |

| Consumer Non-Cyclicals | 1.27% | -4.64% | -2.73% |

| Technology | -0.25% | -4.77% | 3.51% |

| Non-Energy Materials | -8.41% | 3.02% | 8.33% |

| Consumer Services | -15.52% | 6.23% | 13.48% |

| Energy | -15.98% | 22.59% | 34.70% |

| Healthcare | -39.84% | -4.34% | 2.57% |

TREN is a momentum metric measuring the company’s stock price slope. It is calculated as the 63-Day VMA divided by the 252-Day VMA (Volume Weighted Moving Average). A higher TREN ratio implies that the stock is trading in a medium upward trend. If we plot the ranking of TREN against ROE, we can conclude that all our picks are better positioned relative to other financials in the top decile of our investment universe.

Source: The Author

Conclusion

Financials are set to outperform as their performance is correlated with the 10-year yields’ movement. Of course, rising treasury yields increase expected economic growth and are a sign of a probable tighter monetary policy. It is now the appropriate time to adjust the portfolio’s asset allocation to favor companies that are expected to benefit from the stronger economy.

Economic recovery is expected to push yields higher, especially longer-maturity ones, and the financial sector is likely to behave similar to its historical correlation with yields. Accordingly, our latest portfolio rebalancing considered the expected recovery while choosing top-ranked financial stocks in our factor-based model. While last year’s earnings were lagging for most US banks, fourth-quarter earnings came better than expected with substantial reserves releases and manageable credit loss levels.

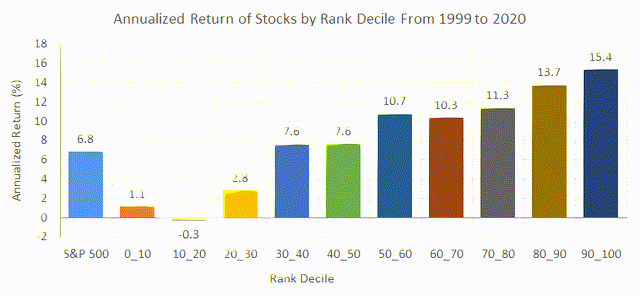

Bank of America (BAC), Charles Schwab (SCHW), Goldman Sachs (GS), and PayPal Holdings (PYPL) are the new additions to our Factor-Based US Large Cap Equity Strategy and are considered opportunities with limited downside risk. Companies in the first decile of our ranking system have historically outperformed the S&P 500 TR by 8.6% each year, as shown below.

Source: FactSet & Factor-Based

Looking for a model portfolio strategy with stocks like these ones? The mentioned companies are included in our Factor-Based US Large Cap Equity Strategy since March 1st, 2021. Our Strategy holds 25 quality companies trading at a reasonable price that consistently generates wealth for their shareholders.