Summary

- Alphabet’s stellar growth is returning to pre-pandemic levels; its Google Search segment is expected to improve in the fourth quarter.

- The company is benefiting from the latest sector rotation into cyclicals as SMEs are advertising again in hope of a return to normalcy.

- The U.S. DOJ lawsuit filed on October 20th should drag over with no resolution in sight, minimizing litigation risks in the short-term.

- The stock is the best QARP (Quality At Reasonable Price) and short-term performer among its peers, with more upside potential ahead.

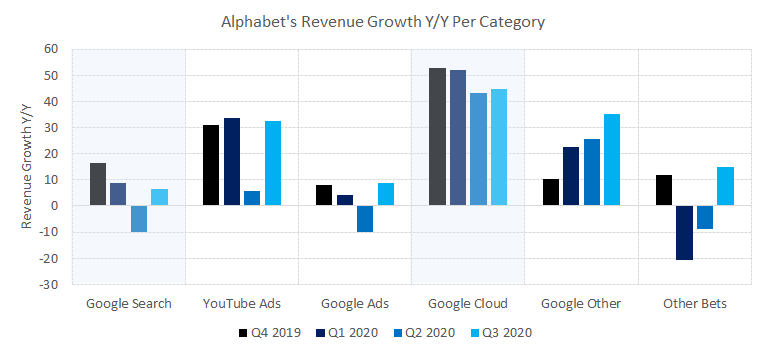

Alphabet’s (GOOG, GOOGL) Q3 2020 results of October 29th were reassuring for investors. The company managed to grow its revenues by 14% Y/Y in a tough environment. If we look at the chart below, the growth of its revenues is back to pre-pandemic levels except for Google Search and Google Cloud.

Google Search

CFO Ruth Porat said they have seen a pickup of activity in August. As we are writing this article, advertisers are increasing their marketing efforts ahead of next year’s mass vaccination, hoping business is going back to usual. For this reason, we are optimistic that this segment, which is the largest at 57% of revenues, may exceed analyst expectations in the fourth quarter.

Google Cloud

This segment has been firing from all cylinders for Alphabet. With a growth rate of 44% Y/Y, it is still above its competition. CEO Sundar Pichai said that the digital transformation is underway for large corporations. He envisions the effects of the work from home to last beyond the pandemic, which should bolster the demand for its Google Workspace product line.

Competitive Advantage

It’s no secret that Alphabet is crushing its competition. So much that it has attracted the scrutiny of the DOJ on October 20th for its alleged monopolistic practices. We will talk more about it in the risk section of this article. In the meantime, here’s a recap of its competitive advantages using the five Porter forces and the perceived moat for each (+++ best and — worst):

1. Bargaining power of buyers (+++):

Alphabet is benefiting from the network effect. Online marketers have limited options to advertise because the majority of the traffic is going through their operations, which de facto makes it the best advertising choice.

2. Bargaining power of suppliers (++)

With the exception of its exclusive partnership with Apple (AAPL) for the inclusion of its search on iOS devices, suppliers are highly dependent on the company’s policies and procedures. Therefore, they hold no negotiation power.

3. Threat of new entrants (+)

There is little to no barrier to entry in the business that a new player can easily come up with a better product/feature in its segments in the upcoming years. Alphabet relies on its top-notch business intelligence to react accordingly.

4. Threat of substitutes (+++)

Other products do exist, like DuckDuckGo’s search for example. Yet end-users keep coming back, despite privacy concerns. This is because they find the product helpful, they trust the experience, and are reluctant to change.

5. Rivalry between players (-)

Alphabet is facing tough competition. Other big techs are on the constant lookout for new disruptive technologies. Its culture shift from its free and open thinking mindset towards innovation is a long-term growth concern.

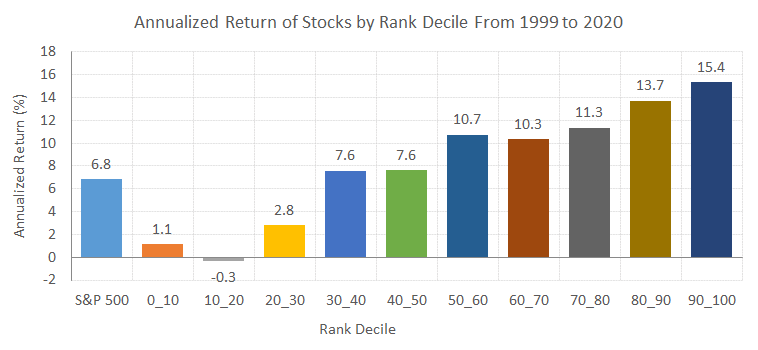

High Ranking

Alphabet has been ranking steadily in the first decile of our ranking system since June 2019. Our ranking is made of 10 quality, value, and momentum factors. For more details, calculations and definitions are available in the US Growth Strategy presentation of our website. Our ranking is obtained by weighing the grade of each factor and normalizing the result to a percentile.

Alphabet’s individual rank as of November 16th, 2020:

| Ranking (%) | Quality (35%) | Value (40%) | Momentum (25%) |

| 92.7 | 78.4 | 75.8 | 95.2 |

In other words, we do 35% * 78.4 + 40% * 75.8 + 25% * 95.2 which equals 81.6. This result is then normalized relative to all the other stocks of the universe. This explains why Alphabet can still pull off a higher rank than what it would intuitively seem to. Now, to better understand why Alphabet is ranked 92.7, let’s delve into each factor and discuss relevant metrics.

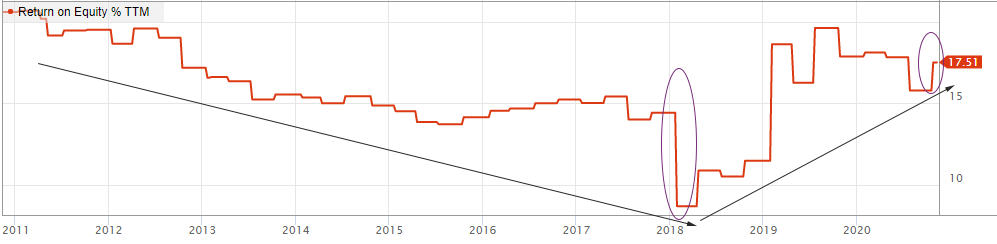

Quality

From our experience, the most relevant quality metrics are those assessing profitability because they quantify a company’s competitive advantage. On the chart below, the Return on Equity Trailing Twelve Months has been under pressure from 2011 to 2019. The drop in 2018 was caused by a one-time $9.9 billion hit from the federal Tax Cuts and Jobs Act. Since then, Alphabet has successfully reversed the trend by increasing its market share, especially with Google Cloud. The smaller drop in 2020 is tied to the COVID-19 pandemic but we can see the upward trend resuming in the last quarter.

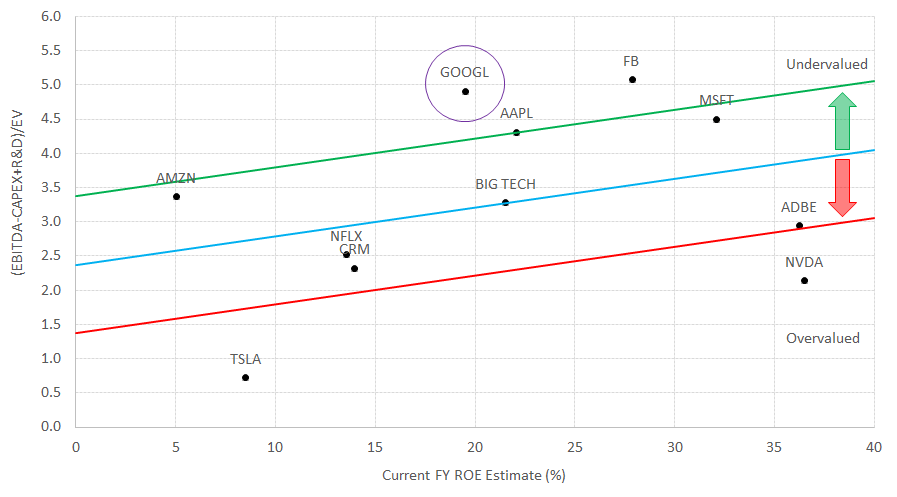

Value

Regarding valuation, we backtested hundreds of value metrics over the last 20 years. Some are simple ratios such as Price / Sales while others are more complex such as Economic Value Added (NYSE:EVA) ratios. Based on our findings, we found the (EBITDA – CAPEX + R&D) divided by Enterprise Value to be a great metric for valuing stocks part of our US Growth universe.

Our QARP (Quality At Reasonable Price) approach makes us pair quality with value. For screening purposes, we use a scatter plot to identify potential opportunities. On the chart below, The X-axis is the Current Fiscal Year Return of Equity Estimate while the Y-axis is our (EBITDA – CAPEX + R&D) / EV metric. Please note the BIG TECH point is the average of its peers.

The chart above shows how Alphabet stacks up against its peers. We drew a regression line with upper and lower boundaries. Theoretically, the higher the Current FY ROE Estimate, the higher the valuation. We can see how how the “smaller” big techs such as Netflix (NFLX), SalesForce (CRM), Tesla (TSLA), Adobe (ADBE), and Nvidia (NVDA) are overvalued to different degrees. Out of all those stocks, Alphabet (GOOGL) is the one with the most reasonable valuation level, which leaves room for further price appreciation.

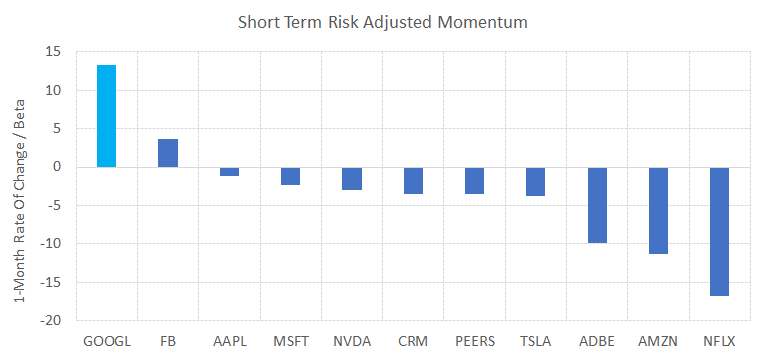

Momentum

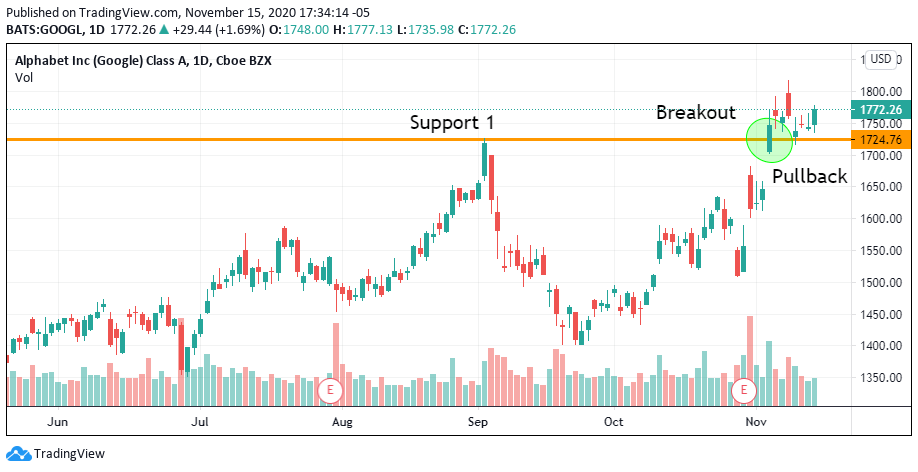

We have seen 3 market regimes this year: 1) the pandemic complacency (January to February), 2) the pandemic / early vaccine R&D (March to October), and 3) the pandemic / late vaccine R&D (November). Let’s assess momentum since the third regime began with a risk-adjusted 1-Month Rate of Change metric. We observe below that Alphabet (GOOGL) and Facebook (FB) are clear winners since the U.S. election while all other big techs tanked. Why?

Pfizer and Moderna announced vaccines that are 90% and 94.5% effective respectively against COVID-19 in its latest clinical data. As a result, investors sold big tech darlings and chased discounted cyclicals. Unlike its peers, online marketing platforms are rallying as SMEs are expected to increase their advertising efforts in the hope that vaccines will lead to a grand reopening.

More pharmaceuticals are expected to release their promising Phase 3 clinical trial data in the upcoming weeks. If those also have a positive outcome, the cyclicals outperformance is just beginning. For this reason, we believe the recent accumulation between $1715 and $1815 per share to be a good entry point to initiate a position or accumulate before the next leg up.

Underlying Risks

In its complaint, the Justice Department is accusing Alphabet of monopolistic practices detrimental to consumers and competitors. Although a trial might be a distraction from day-to-day operations, we believe the litigation risks are not much of a concern, at least for now, for the following reasons:

- The U.S. antitrust lawsuit has bipartisan support and should be carried by the Biden Administration. However, investors find solace that Biden’s thought process is more predictable than Trump’s unstable temper.

- Democrats have more pressing issues to deal with in 2021, such as the transition of power and beating the pandemic just to name a few. Other political issues such as this one might be kicked down the road.

- The investigation is sector-wide and will target more companies than just Alphabet. Management stated they will keep a constructive approach. They will defend their case while being flexible and adapt accordingly.

- Alphabet might be forced to spin-off its different business units in a couple of years. If that’s the case, investors believe more value might be unlocked that way and are increasingly more comfortable with the idea.

Final Thoughts

Companies in the first decile of our ranking have historically outperformed the S&P 500 by 8.6% each year as shown below. Alphabet’s latest consolidation seems like a great opportunity to seize with limited downside risk.

Looking for a model portfolio strategy with stocks like this one? GOOGL is a position in our Factor-Based US Growth Equity Strategy since March 9th, 2020. Our Strategy holds 20 quality companies trading at an attractive price.