Our US Large Cap Equity Strategy has been underperforming the S&P 500 TR over the last two years. The underperformance coincides with two significant events:

1. Inclusion of a qualitative overlay in 2021

2. Change of the US ranking system in 2021

In this interim research report, we open the hood and see what went wrong and how to rectify the situation because the level of underperformance is unsustainable.

1. Inclusion of a qualitative overlay in 2021

Those who have been clients with us since 2017 will remember that we initially followed our multi-factor strategies on a quantitative auto-pilot. With the Trump administration in power back then, the notion of industry risk came into play, notably in the healthcare sector.

This has caused some stocks in health insurance, pharmacies, and drug makers to be high in our ranking system. We automatically bought those recommended by the strategy and ended up underperforming. As a result, we added a qualitative overlay or some discretionary power in stock picking.

For example, between a stock rated 99.9% or 98.5%, if we judged the highest ranked stock at 99.9% carried industry risk or was a poor fit with the portfolio, we allowed ourselves to skip it and consider the next company, and so on until would find the next replacement.

In doing so, we still followed the quantitative model philosophy: buy highly ranked stocks. Theoretically, there is not much statistical difference at the percentile level but more at the decile level. However, the strategy, in any case, remains concentrated with 25 stocks.

2. Change of the US ranking system since 2021

We updated the ranking system of the US Large Cap Equity Strategy in 2021 as we proceeded to move from S&P Global to Factset. It was needed because stocks were reclassified in other industries, and line items for many factors were just calculated differently.

After a few weeks of backtesting our collection of 2,100 factors on Factset, we made a new ranking system that appeared to be robust. We communicated to all of our clients the proposed changes. We deployed it with the qualitative overlay mentioned previously.

Since those two changes, we have had two years of underperformance. It is interesting to note the automated version of the US Large Cap Equity Strategy did two years of outperformance (Exhibit B). The qualitative overlay seems to be responsible for the difference.

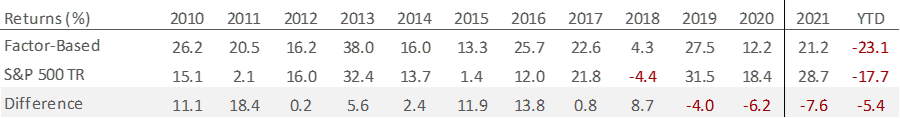

Exhibit A: Old ranking 2010-2020 and new ranking with qualitative overlay 2021-2022

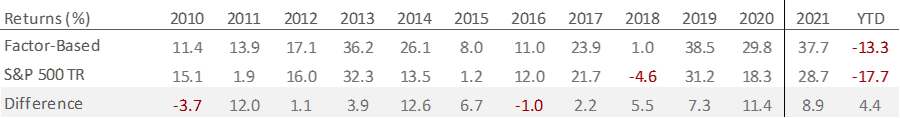

Exhibit B: New ranking 2010-2022 automated stock picking

The good news is that the updated US Large Cap Equity Strategy ranking on Factset with automated stock picking made in 2021 has delivered good results over the last two years. The bad news is that the qualitative overlay seems responsible for the underperformance of the previous two years.

The automated stock picking did well despite a change from a low to a high inflation regime. We recently backtested all the 2,100 factors again to include data from the last two years, and the factors we chose to use in the new 2021 ranking system are surprisingly still fairly optimal.

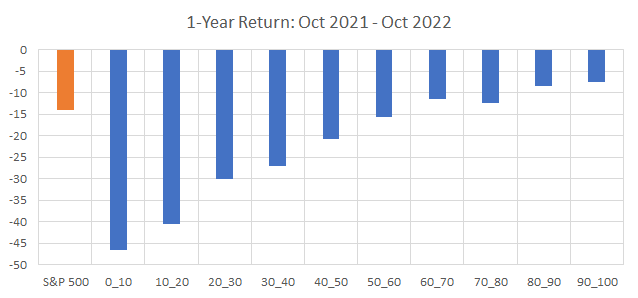

In the chart below, we see the ranking system was still able to sort the losers from the winners for each decile in the high inflationary period we saw over the last year’s bear market. Remember, each decile contains 50 stocks (10% of the S&P 500), so it’s well diversified.

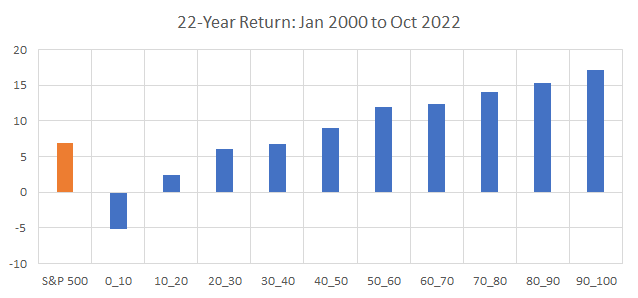

The following chart is our ranking system, applied over the last 22 years, on all the available data on Factset. As you can see, the slope across deciles is still holding despite adding the data from the last two years, which makes us believe that the ranking system is still doing a good job.

Conclusion

Based on our findings, the qualitative overlay seems responsible for the bulk of the underperformance of the last two years because the ranking system still works. As a solution, we plan to revert to the fully automated version and limit discretionary decisions to only exceptional cases.

We believe political / industry risks to be limited for the next two years as the Democratic Party remains in power. It’s not for nothing; they have been called “upholders of the status quo.” Therefore, fewer chances highly ranked stocks will be traps carrying such risks.

For the upcoming rebalance of the US strategies in December, we have decided to merge both US strategies into a new US Large Cap Equity Strategy (possibly rename it US Equity) with the same ranking system designed in 2021 and with the original methodology.

For our existing clients in either of those strategies, we advise proceeding with a portfolio reconstitution. We will give you the stocks and weights that mirror the snapshot of the newly updated US Equity strategy, and we suggest rebalancing accordingly.

As a result, we expect a high December portfolio turnover for clients in any of our two US strategies. Significant changes are needed to address the situation and position ourselves for outperformance in 2023. If you have any questions, feel free to let us know.

The Portfolio Management Team