Well That Escalated Quickly

In early March, we wrote how the US was ill prepared to face the ongoing pandemic of COVID-19. Since then, the virus has widely spread to all US states and these major cities are now considered epicenters of the US pandemic: New York, Seattle, Detroit and New Orleans. In Canada, the propagation was less thanks to strict measures put in place at a provincial level due to the lack of decisiveness of the federal government. In this article, we will attempt to predict the end of the US coronavirus outbreak and its stock market impact.

Epidemiological Model

Using a modified version of the SIR Model for spread of disease, we are able to predict when the US coronavirus pandemic is going to end. The model considers two related sets of dependent variables:

The first set of dependent variables counts people in each group as a function of time:

S = the number of susceptible individuals;

I = the number of infected individuals;

R = the number of recovered individuals.

The second set of dependent variables are fractions of people in each of those three categories:

s (t) = the susceptible fraction of the population;

i (t) = the infected fraction of the population;

r (t) = the recovered fraction of the population.

US Pandemic Prediction

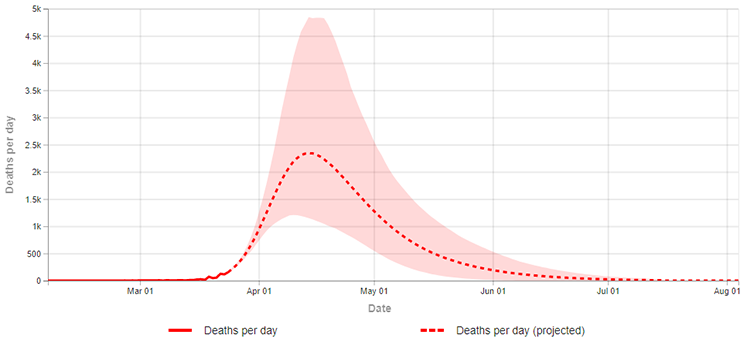

Chris Murray MD, a professor at the IHME (Institute for Health Metrics and Evaluation) computed the SIR Model with probable assumptions. His model suggests the peak of the pandemic to occur in the second week of April, around April 16th. On that day, he estimates the deaths per day to be a staggering 2,300! This is 4 times what we are seeing right now and much higher than the 900 deaths per day in Italy. This is unsurprising considering many US adults have comorbidities (42.4% suffer from obesity and 48.0% from cardiovascular diseases) and most didn’t take social distancing seriously during the spring break.

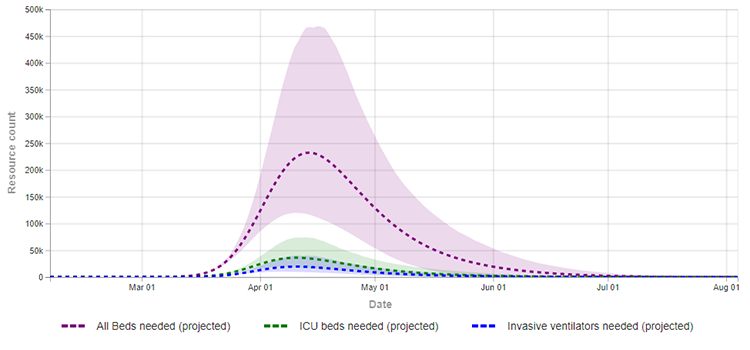

80% of the population becoming infected only develop mild symptoms similar to a bad flu. 20% exhibit symptoms requiring hospitalization (high fever, breathing difficulty and respiratory failure). At the peak of the crisis, 233K hospital beds are going to be needed, which represents a shortage of 49K beds. Moreover, 35K ICU beds are going to be required, which is an ICU bed shortage of 15K beds. The only positive news is that the number of invasive ventilators should be sufficient with recent efforts to ramp up production.

The shortage of hospital beds and ICU beds well exceeds the current capacity of hospitals across the country. This forecast may help the US government devise strategies to mitigate the gap. For example, US municipalities will most likely have to convert hotels and stadiums into makeshift How To Cook Chicken In Bulk – Bodybuilding Meal Preparation best shoulder exercises for mass cumulative fatigue – the real secret of fast muscle growth – relative strength advantage hospitals to fill the excess demand. According to the author, assumptions of his forecast already take into account the implementation of social distancing measures in all US states, in order to provide a conservative prediction.

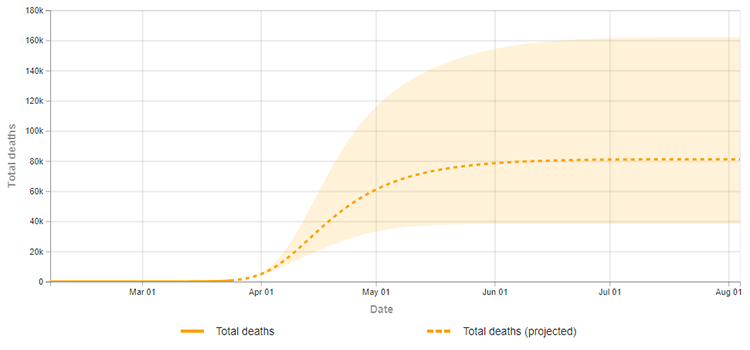

The conclusion of his analysis is that there will be a total of 80K deaths (95% confidence between 40K and 160K) over the next 4 months. He believes the curve will flatten by the summer. Between June 30th and July 7th, US deaths are estimated to drop below 20 deaths per day, which is the equivalent of the current situation in China. However, as the epidemic gets under control in the northern hemisphere, it is possible the epidemic will keep ravaging the southern hemisphere in South America and Africa.

Economic & Market Outlook

With this being said, the impact on the US GDP should be felt for a period of 4 months: March to June. Even if the initial jobless claims numbers look impressive, most of the applicants will be back to work in July. As a result, a technical recession lasting two quarters is expected. This should be “it” when it comes to the impact of this first wave of COVID-19. North America and Europe will have a couple months to prepare for a second wave, if any. This should give some time for pharmaceuticals and biotechs to find a vaccine and eradicate the pandemic once for all. For these reasons, we believe stocks may rebound by year-end.

The Portfolio Management Team