Summary

- Despite intense competition in Indonesia’s mobile sector and significant capital expenditure, Telkom remains the leader in telecommunications in Indonesia.

- Telekomunikasi Indonesia is well-positioned to take advantage of the 5G rollout in Indonesia, which might boost its revenues and profitability in the future.

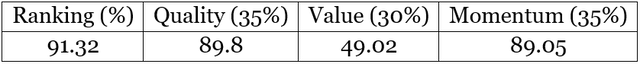

- The company has a high rank among quality, value, and momentum factors, indicating that it is a good investment opportunity supported by a large consumer base and solid fundamentals.

Introduction

PT Telekomunikasi Indonesia, or Telkom, is a multinational Indonesian company providing telecommunications and network services. Since the beginning of 2022, Telkom’s stock has surged by 12%. Its revenue increased 4.9% in the fiscal year 2021, while its EPS reached a record-high level at 249.94 IDR. These outstanding results show that Telkom maintained its dominance in the Indonesian market while growing its revenues and posting higher profits.

Telkom has a high rank in our Factor-Based International Equity ranking system. After reviewing the company’s factors and its underlying financials, we concluded that the firm is an attractive investment opportunity.

Business Segments

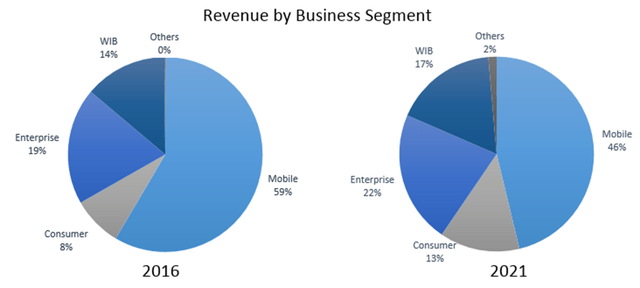

The Indonesian government owns approximately 52.1% of Telekomunikasi Indonesia which is headquartered in Bandung, and operates through four primary reportable segments:

- Mobile (46% of total revenues): provides mobile voice, SMS, value-added services, and mobile broadband;

- Consumer (13% of total revenues): offers Indihome, a bundled service of fixed wireline, pay-TV, and internet, as well as other related consumer digital services;

- Enterprise (22% of revenues): Offers ICT and digital platform services dedicated to corporates and institutions. Such services include satellite, IT services, digital advertising, e-health, managed ATMs, and many other corporate services;

- Wholesale and International Business (17% of revenues): Provides interconnection services like wholesale voice, IP transit, and connectivity. It also offers mobile virtual network operating services, call center services, and tower infrastructure services to other licensed operators and institutions.

Additionally, Telkom classifies revenues generated from other services, such as digital platforms, digital content, and e-commerce, in addition to property management services under a caption called “Others” (2% of total revenues).

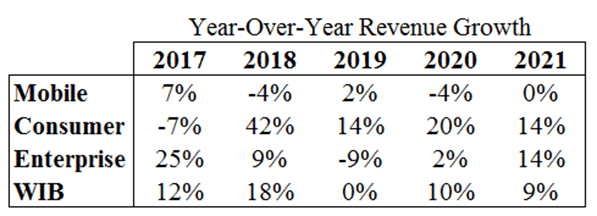

As shown in the above chart, the mobile segment constituted 59% of Telkom’s consolidated revenues, whereas, in 2021, this part represented only 46% of total revenues. The mobile segment faces fierce competition in terms of pricing and growing its market share. However, the other segments (consumer, enterprise, and WIB) were able to grow following the emergence of COVID-19 which led to a massive adoption of digital services. As shown below, the mobile segment’s growth was flat during 2021, while the other segments were growing at higher rates during recent years.

Outlook

The company aims to provide innovative services and is heavily investing in capital expenditures to strengthen the network infrastructure and improve its digital ecosystem. During the last year, the amount of Capex represented 25% of revenues on average, and is expected to remain at the same level during the upcoming period.

As per management, most of the investment made earlier was applied to the 4G deployment and expanding the capacity and coverage of the network. However, on the 5G spectrum side, the company is preparing the necessary documents to bid once the government announces the process, an opportunity that might lead to a boost in revenues across different segments.

Competitive Advantage

As mentioned earlier, Telkom focuses on providing innovative services to drive growth and differentiate its offerings. We used Porter’s five forces framework to assess its current strategic position within its industry.

Competitive Rivalry (High)

Telkom faces competition at different levels of its business. In the mobile segment, competition and data pricing are the main threats that the firm is dealing with and are limiting the growth in revenues for this segment. Nevertheless, Telkom managed to maintain its market share by keeping its packages affordable. This makes the rivalry among existing companies a strong force within the telecommunications industry.

Threat of Substitutes (Medium)

A few substitutes that offer high-quality services at prices similar to Telkom are available. Still, as per management, Telkom is looking to offer customized packages to existing customers in order to ensure renewals due to the high risk of switching. Such measures ensure that the company’s market share is sustained.

To strengthen its ability to offer differentiated digital services, Telkom entered into a partnership with Microsoft Indonesia last August to accelerate the digital transformation process and ensure digital sovereignty in Indonesia. Additionally, Telkom works on cross-selling its core business products to gain additional market share in the future and make switching to other competitors harder for its customers.

Threat of New Entrants (Low)

Many factors make the entry of a new player into the telecommunications industry difficult. On top of the extensive capital requirements needed to set up the business, ongoing research and development costs should be incurred to be able to compete efficiently and offer innovative services. On the other hand, strict licensing and government policies prior to operations make it even harder for new entrants to consider this industry.

Bargaining Power of Buyers (Medium)

Buyers’ income level is a major determinant of their consumption. As such, increased inflation will put more pressure on the company’s pricing strategy as transferring the higher costs to customers might impact the demand for products and services. However, the recent pandemic period proved that telecommunication services are essential in people’s lives.

Bargaining Power of Suppliers (Low)

The company owns more than 28,000 towers across Indonesia and provides various IT services that are developed and maintained in-house, making the threat of suppliers low. Additionally, the products or services that the suppliers provide in terms of radio frequency usage and leasing lines are standardized.

Ranking

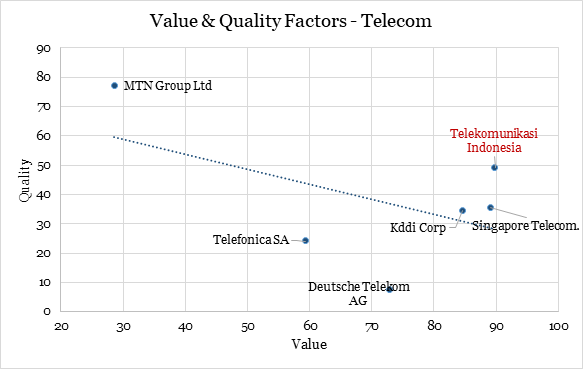

Based on our multifactor ranking system, Telkom is among the first decile stocks, having a rank of 91.3. The ranking system is based on nine factors spread over quality, value, and momentum. We assign a specific weight to each factor and normalize the final rank to a percentile. The below table summarizes the three types of factors:

Now, let’s discuss why Telkom has a high rank compared to its peers and analyze some of these factors.

Quality

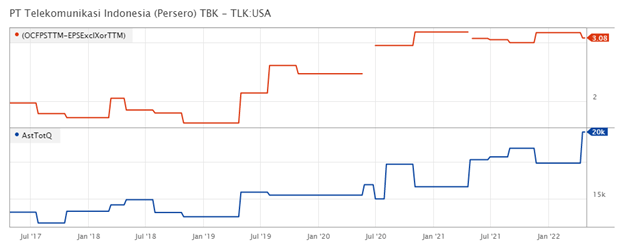

Factors classified under quality capture the profitability of the company. The earnings quality indicator (EPSQ) is among those factors used to analyze the financial statements’ quality and assess the possibility of accrual manipulation. It divides the difference between the operating cash flow and earnings by the company’s total assets. Both metrics have constantly been growing over the last three years, indicating that the company is growing at regular rates on its balance sheet and income statement.

Value

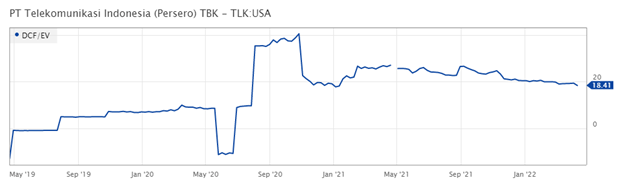

Among the value metrics used, a ratio dividing the discounted free cash flow by the Enterprise Value (EV). A five-year projection of the company’s free cash flows is simulated, and the long-term average growth rate is used as the discounting rate to calculate the discounted free cash flow value.

As shown in the above chart, the ratio increased substantially following the pandemic’s emergence as the need for telecommunication services peaked, and it is currently stable, at a relatively higher level than in the period before the pandemic.

Momentum

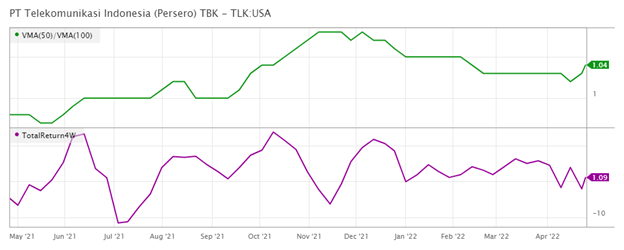

We use the rate of change in the company’s stock price over the last month to assess the short-term price momentum of the stock. As a medium-term price indicator, we utilize a price trend factor, a ratio dividing the 50-Day Volume Weighted Average by the 100-Day Volume Weighted Average. Both factors are above their average levels and show an upward trend.

Peers Comparison

As shown in the chart below, when plotting the value ranks against the quality ranks, Telkom has a better position than other multinational telecom companies.

Investment Risks

Although Telkom has a high rank and a sustainable business model, it is exposed to various risks.

- The high inflation environment is a major threat to the company on the demand side and on the cost side as well. Demand might be negatively affected as customers reduce their consumption, and further pressure will affect profitability margins as operating costs increase;

- The 5G roll-out in Indonesia might be postponed due to government or legal requirements threatening the company’s planned expansion;

- Intense competition in the mobile segment might limit the company’s revenue growth;

Conclusion

In conclusion, Telekomunikasi Indonesia worked on a strategy to maintain its market share while focusing on high-quality services that are less price-sensitive. Management confirmed that in some segments, like mobile, it is facing aggressive competition, limiting the upside potential of revenues. However, Telkom can retain its market leadership and expand its network coverage further as the 5G roll-out is launched. Moreover, the company is well-positioned in the telecommunications industry and can easily scale and improve its business services to drive growth in the upcoming period.

Finally, according to our Factor-Based ranking model, we conclude that Telkom is an attractive international investment opportunity. Telkom is a position in our Factor-Based International Equity Strategy since February 2022.