Summary

- Despite the bear market, our Tactical Sector Rotation Strategy, which works on identifying the shift in business cycles based on the LEI and Fed rate, generated positive returns.

- The Strategy outperformed the market in 2022 increasing by 2.6%, while the S&P 500 dropped by 18.1%.

- Skyrocketing inflation pushed the Fed to tighten its policy aggressively and increase rates at a very rapid pace.

- After a year of macroeconomic and geopolitical shocks, the challenges may persist in 2023. However, a new business cycle may emerge as the Fed pauses its tightening monetary policy.

Introduction

During 2022, several factors were driving financial markets and exacerbating volatility and uncertainty, such as global inflation, supply chain disruptions, and the Russia-Ukraine war. However, the Fed’s aggressive policy to combat the country’s 40-year-high inflation pushed stocks into a bear market, and the year ended with a higher probability of a recession in early 2023.

In the meantime, our Tactical Sector Rotation strategy, which invests in ETFs from various GICs Level 1 sectors according to the different stages of the economic business cycle, has identified two shifts for 2022. As such, our portfolio outperformed the market last year, increasing by 2.6%, while the SPDR S&P 500 Trust ETF (SPY) dropped by 18.1%.

The strategy is a rule-based investment methodology that has produced above-average annual returns when backtested. For more information on the strategy’s approach, see our previous articles: “This Sector Rotation Strategy Made 17% Each Year Since 1991” and “This Sector Rotation Strategy Has Delivered Each Year Since 1991 (Part 2),”. We outline and describe how the model predicts the economic cycle shift and the associated sectors for each phase.

Inflation, Interest Rates, and Geopolitical Risks

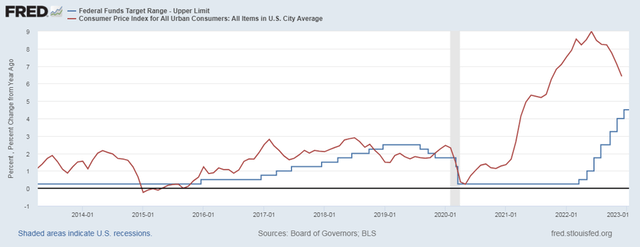

In November 2021, the Fed stated that rates would be raised to lower inflation to a 2% target. The tightening cycle began in March 2022 with seven consecutive rate hikes, of which four were significant 0.75% raises, bringing the Federal Funds Target rate to 4.50%. As illustrated in the chart below, inflation continued to rise as the conflict between Russia and Ukraine turned into a war, adding another factor to the already disrupted global supply chains and causing oil prices to rise above $100 per barrel for an extended period.

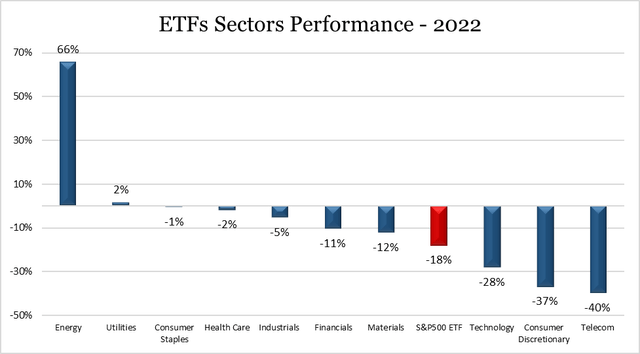

Analysts expected the Fed to take a more dovish stance during the year’s second half; however, Chairman Jerome Powell reiterated in several speeches and press conferences that rate hikes were necessary and would continue at least through early 2023. This unusually aggressive policy weighed on valuations as borrowing costs rose dramatically and inflation did not drop at the predicted rate, causing increased uncertainty and volatility. As a result, despite occasional short-term rebounds, stocks entered a bear market in June that lasted until the end of 2022. The SP&500 TR fell 18.1%, while macroeconomic factors weighed more heavily on cyclical sectors than on defensive ones, and energy closed the year with an astounding 66% total return. The graph below displays the performance of major sectors:

Sector Rotation Performance

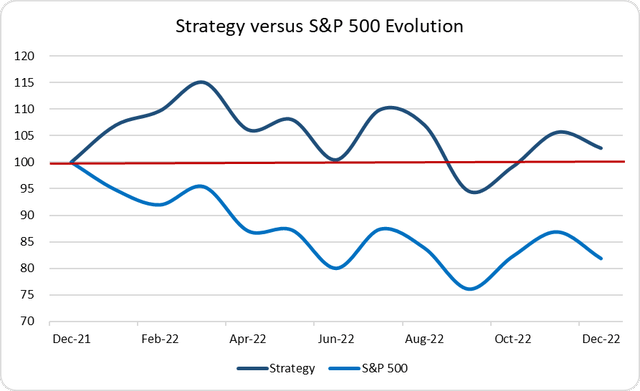

In 2022, our investment model suggested two shifts, and according to the strategy, each phase has a corresponding set of sectors that are expected to outperform. To assess the efficiency of the strategy’s suggested business cycle shifts, we may examine the evolution of the model portfolio throughout this period.

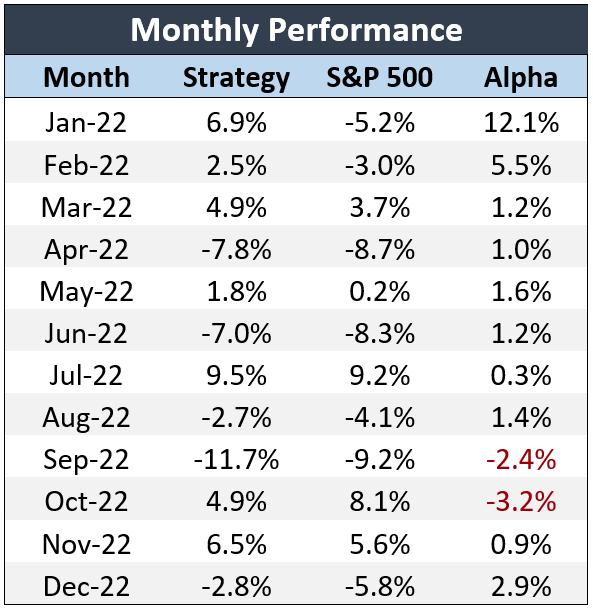

Assuming the same amount was invested in an ETF portfolio that replicated market performance and another in the corresponding ETFs as suggested by the investment strategy, the sector rotation portfolio would have outperformed the market throughout 2022, growing by 2.6% while the market portfolio drastically declined by 18.1%. As a result, the strategy generated a 20.7% excess return while protecting capital. Furthermore, when we look at the strategy’s monthly performance last year, we see that it outperformed the market in 10 of the 12 months.

As mentioned earlier, the strategy changed its holdings twice during 2022, and the main factors contributing to the outperformance of the chosen sector combination are the following:

The “Early Phase” (January and February): The portfolio holdings were divided into three ETFs as the year 2021 ended: Energy, Financials, and Industrials, as suggested by our strategy last year. During the first quarter of 2022, Eastern Europe evolved into a war zone due to Russia’s invasion of Ukraine. Energy drove the portfolio’s performance as Russia is a major energy and commodity exporter, and the economic implications of the invasion of Ukraine weighed on the markets, pushing commodity prices to extremely high levels. On the other hand, investors started pricing in the impact of the interest rate hikes expected to boost the financial sector’s earnings.

The “Rebound Phase” (between March and November): Before the end of the first quarter, the strategy indicated a shift to the rebound phase, and the portfolio holdings shifted to Info Tech and Utilities sectors. As shown in the above table, the strategy outperformed during 5 out of the 7 months of this business cycle. Utilities stocks are considered low-risk investments, and investors tend to shift their holdings to safer sectors during uncertain investment environments. Moreover, during that period, the Info Tech sector experienced several short rallies. For instance, the earnings season was positively received by investors because major companies could operate efficiently during challenging business conditions. Moreover, investors appeared to be accounting for worse scenarios and lower guidance.

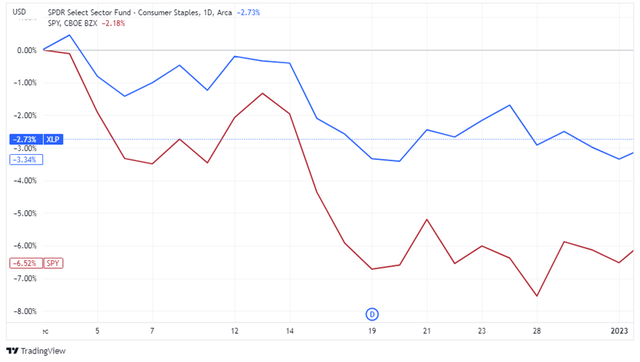

The “Decline Phase” (December): The aggressive monetary policy tightening started showing its impact on the economy during the last few months of 2022. The LEI showed a consistent decline over several months, indicating that the economy is entering the decline phase. Persistently high inflation, increasing interest rates, and deteriorating economic indicators translated into lower earnings reports by the end of 2022. Several firms started setting lower growth expectations for 2023 amid escalating business threats. Furthermore, despite the potential negative impacts, Fed members’ determination to keep raising rates until inflation returns to normal levels fueled recession fears. As a result, investors continued to favor defensive sectors, and Staples outperformed over this period.

Recession threats are not over yet

As inflation is still considerably far from the Fed’s target rate and further rate hikes are expected to be announced in the upcoming period before a potential pause in rates, the U.S. and global economies might face a moderate recession through the summer of 2023. As a result, defensive sectors are projected to outperform the market. In particular, based on the backtesting conducted while implementing the sector rotation strategy, we concluded that the consumer staples sector held up well during this period.

A new business cycle after a recession

Several analysts believe a recession will occur in the first half of 2023. The Fed’s rate hikes will result in weaker economic fundamentals, which might drive unemployment higher and cause a decline in corporate earnings. However, a policy shift by the Fed is required to avoid a deep and prolonged recession as the impact of interest rate hikes becomes more pronounced. Accordingly, a pause in hikes is expected.

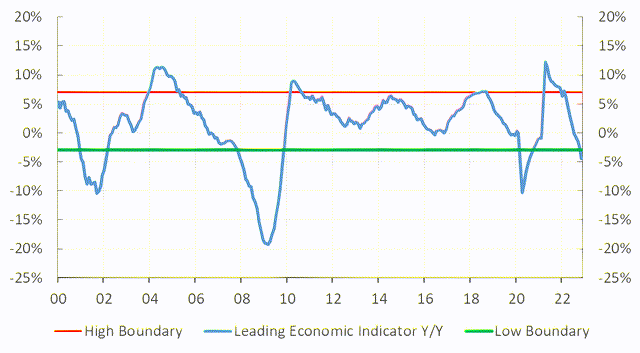

To estimate the shift in the business cycle, we use the year-over-year change in the LEI indicator, together with variables relating to the Fed Fund Rate. Accordingly, we estimate that the model will indicate a business cycle shift into a new phase in the coming months as the Fed stops interest rate hikes and the LEI turns from its downward trend. Therefore, new sectors are projected to emerge in the coming months with a potential recovery.

Conclusion

The economic business cycle will remain one of the primary drivers when making investment decisions. However, it is challenging to forecast the timing of the business cycle shifts, which is crucial to outperforming and delivering excess returns. Our sector rotation strategy, driven by the yearly change in LEI, proved so far to be an efficient way of gauging the shift in economic phases. The rebalancing decisions taken last year helped us achieve above-average returns and end 2022 positively.

The challenges of 2022 are still there, with high inflation, rising rates, and geopolitical tensions weighing on the broader economy. Still, a new business cycle is predicted to emerge as 2023 progresses. Investors may benefit from our sector rotation strategy’s investing model by taking a forward-looking approach to the next business cycle and gaining investment insights and ideas for 2023 and beyond.