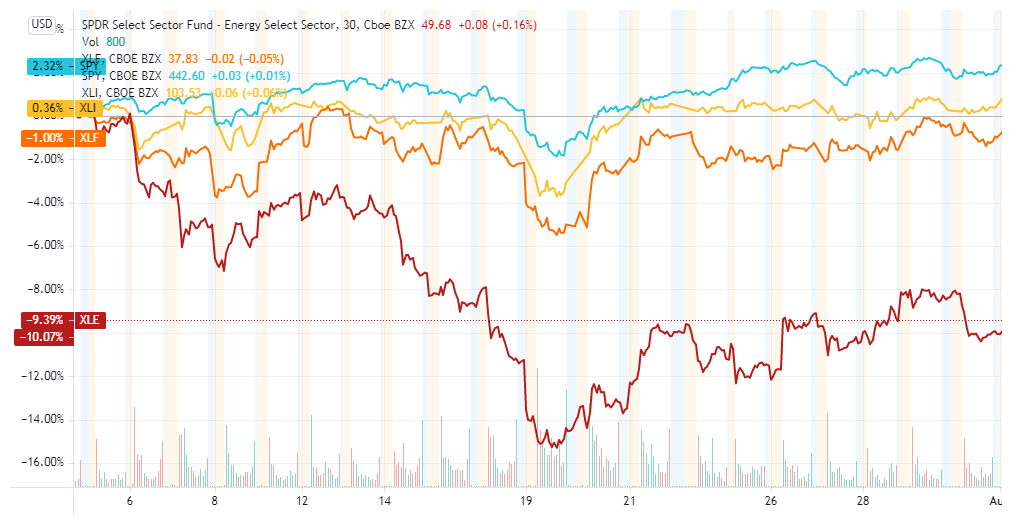

Financials, energy, and industrials are currently the favored sectors in our Factor-Based Tactical Sector Rotation Strategy. Those sectors were chosen by looking at the business cycle, measured by the year-over-year change of the Leading Economic Indicator. Unfortunately, all three sectors underperformed the market in July for several reasons: inflation, lower commodity prices, and delta variant emergence. In this ad-hoc report, we will explain the performance of each sector and why they are still attractive investments at this time.

Financials

The main headwind for financials is the Fed’s response to the threat of inflation. Various emerging market central banks already began raising their short rates. In the US, inflation is well above the Fed’s 2.0% target, and employment indicators suggest that the labor market could make “substantial progress” over the next year. Nevertheless, Fed’s Chairman Jerome Powell reasserted his intention to stay patient in assessing the timing of tapering its quantitative easing asset purchase program.

Long-term US Treasury rates continued to decline on the prospect that inflation may be transitory. The 10-year US Treasury yield reached 1.24% at the end of July, decreasing over 30% from the high level achieved (1.78%) in March. Financials suffered because they typically have higher profit margins on mortgage and loans when the long interest rates are higher. However, the yield curve still has a lot of room to steepen (see chart below), which means that theorically long interest rates could still go higher. If that’s the case, Financials are most likely going to outperform again.

Energy

Energy stocks declined 8.3% in July, posting their first negative monthly return since October 2020. Several factors were responsible for this outcome:

- Falling commodity prices;

- OPEC+ tensions regarding supply quotas;

- Risks of the new COVID-19 wave caused by the delta variant;

Biden administration’s call for lower oil prices has put more pressure on crude oil prices. Also, the US dollar has rallied, which diminished the risk/return tradeoff for some investors.

However, favorable tailwinds could put the energy sector back on track towards higher levels once some risks are mitigated. Valuations are still attractive relative to other sectors despite the increase in stock prices since October 2020. Moreover, oil inventories have declined recently, and the global economy is still recovering, which implies that oil demand might outstrip supply leading to higher oil prices again.

Additionally, energy companies are reinventing their operating models at high speed to cope with the changing business environment, resulting in new ventures and opportunities.

Industrials

While the industrial sector was also a strong performer earlier this year, it also underperformed in July. This is because the industrial sector outperformed when manufacturing was growing at a fast pace. However, The Institute for Supply Management’s PMI® came at 59.5 in July, showing that the economy is still expanding, but below June’s figure of 60.6 (a reading above 60 suggests that the manufacturing activity is strong).

The main components of the manufacturing PMI slowed in July:

| % Change July | % Change June | |

| Manufacturing PMI | -1.10% | -0.60% |

| New orders | -1.10% | -1.00% |

| Production | -2.40% | 2.30% |

Despite the slightly lower activity, the industrial sector is still operating at its strongest level in years. Following last year’s lockdowns, the sector had to put up with supply shortages as demand surged faster than expected. Historically, the industrial sector outperformed the market during recovery and expansion. Therefore, as long as growth is picking up, the sector is expected to present an attractive investment opportunity for investors.

Conclusion

Since the global economy is still recovering from last year’s business disruptions, we believe that the three sectors: energy, financials, and industrial are attractive investment opportunities despite the recent monthly underperformance. The market is still recovering and in an uptrend, although the delta variant poses some risks. Fed Chair Powell noted that each new wave of COVID had a minor effect on economic activity for various reasons, including vaccination. Looking ahead, investors should keep an eye on employment numbers, oil and commodity prices, and manufacturing activity.