Objectives

- Target long term capital appreciation among US Sector ETFs.

- Consistently deliver performance over the S&P 500 Total Return Index.

- Maximize tax efficiency by having a low portfolio turnover ratio.

Suitability

You have a reasonable investment time horizon (over 5 years) and a medium to high risk tolerance. Consider this strategy if you are seeking an equity strategy that is not focused on tracking an index, but is instead focused on generating alpha in any market environment.

Strategy

In seeking to pursue its investment objective, the portfolio is designed to opportunistically provide exposure to US Sectors throughout the business cycle by investing in 2-3 Select Sector SPDR ETFs. This strategy is based on a proprietary multi-factor quantitative model.

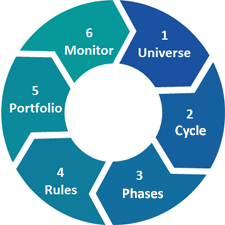

Investment Process

|

|

Free Membership

- Register to create your account.

- You will gain partial content access.

- No credit card required at this step.

Rebalancing Calendar

- The date varies from one month to another but is usually the third Friday of the month.

(Conference Board Release Dates)

Portfolio Manager

Francois Soto, CFA, MBA, FRM, CIM

With more than 15 years of experience in the financial services industry, Francois brings extensive background and innovation in the field of quantitative finance to the firm. He holds both a BBA and MBA from HEC Montreal.

- P: (514) 700-1989

- E: info@factorbased.com