Summary

- Driven by the strong demand for semiconductor equipment, NVMI exhibits a solid track record of profitability and growth.

- The firm’s revenues and EPS grew at a double-digit rate overall of 2021; the trend is expected to continue in the upcoming quarters.

- We added Nova to our holdings early November as our rankings signaled that it is a quality company trading at an attractive price.

Introduction

Nova Measuring Instruments Ltd. (NVMI) is designing, developing, manufacturing, and distributing process and control systems used in the production of semiconductors. It also supports several aspects of the integrated circuit manufacturing industry.

NVMI delivered exceptional earnings in the third quarter of the fiscal year 2021, beating analysts’ expectations and reaching record-high levels. Revenue during the quarter soared 62.2% year-over-year, and GAAP-EPS was $1.02, crossing the $1 threshold for the first time. These great operating results indicate that NVMI could efficiently meet its clients’ needs despite supply chain disruptions. As a result, its stock surged 115% over the last year and is currently trading near its all-time high levels.

Strong Operating Performance

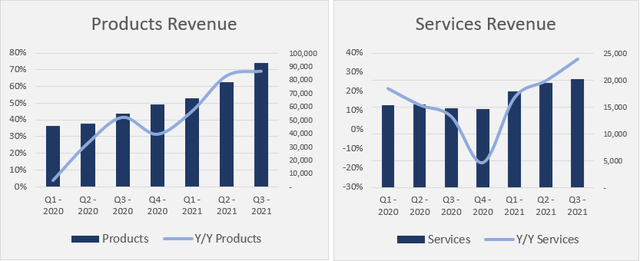

NVMI’s revenue is spread across two main streams: products, which contributed to roughly 77.7% of total revenues in 2020, and services, which accounted for approximately 22.3%. Both segments are growing at double-digit figures, but the products segment is growing at a faster pace. This growth was attributed to greater demand for the company’s offerings across all product lines, forcing NVMI to boost its production capacity and plan to open two new facilities.

The company’s products segment provides a variety of models targeting chemical mechanical polishing equipment and metrology systems for monitoring thin film measurement. Those devices assist semiconductor manufacturers in their production cycle while enhancing efficiency and avoiding costly maintenance.

The market for NVMI’s products is driven by semiconductor manufacturers’ capital expenditures, which are also impacted by the global demand for semiconductor devices incorporated into tech devices. Currently, the market is expected to keep rising, especially with the deployment of 5G networks, AI, and machine learning, in addition to the need for upgrading global infrastructure. On the other hand, the surge in the services segment is driven by the increasing rate of customers installing NVMI’s systems.

Outlook and Guidance

NVMI has a strong track record of outpacing analysts’ expectations on both the top and bottom lines. This outstanding performance demonstrates the company’s ability to operate efficiently even in uncertain and volatile business environments. Following its most recent earnings call, management forecasted revenue for the current fiscal year to surpass $412 million, representing more than 50% year-over-year growth.

For 2022, although management does not provide guidance for more than one quarter ahead, they anticipate that the positive momentum will continue in the first half of next year, driven by the growing demand for NVMI’s innovative portfolio.

Competitive Advantage

We analyzed NVMI’s current strategic position based on Porter’s five forces framework. As a result, the firm is relatively well-positioned to uncover new sources of competitive advantage, particularly with the spike in demand for semiconductor products.

Threat of new entrants (Low)

Currently, there are few prominent market participants in the semiconductor industry. Thus, it is hard for newly established companies to enter the market and compete due to the high capital investment required in machinery and heavy equipment.

Bargaining Power of Suppliers (Medium)

The company’s suppliers did not encounter any significant disruption or termination. However, it relies on a small number of suppliers, and potential difficulties faced by any of them might negatively impact its manufacturing process.

Bargaining Power of Buyers (High)

NVMI’s sales are highly concentrated among a limited number of large customers. For example, 72% of the company’s revenues were generated from only five customers in the fiscal year of 2020. The loss of any customer could significantly reduce revenues. As a result, the company has invested in its online platform by opening new sales channels, increasing its market share and better knowing its customers’ needs.

Threat from Substitute Products (Low)

NVMI’s unique portfolio adds a competitive edge to the company. However, the process of switching between suppliers is time-consuming for Nova customers. Additionally, they need substantial investment to evaluate, test, select and integrate the new capital equipment into their production line. Nevertheless, the company needs to continuously innovate its product portfolio since customers always look for better products.

Rivalry among the existing players (High)

The semiconductor industry has been consolidating. Many merger and acquisition activities have occurred. This M&A activity allows NVMI’s competitors to have a better market position due to more product offerings and synergies. If NVMI fails to adapt to technological innovations quickly, it may lose ground to its competitors.

Ranking

According to our multifactor ranking system, Nova is an appealing investment opportunity. It is the highest-ranked stock that we already own in our Factor-Based International Equity Strategy, with a rank of 99.9, as seen below:

| Ranking (%) | Quality (35%) | Value (30%) | Momentum (35%) |

| 99.9 | 80.77 | 88.69 | 92.03 |

Source: Factor-Based

The ranking is based on ten factors spread across quality, value, and momentum. We normalize the final rank to a percentile after assigning a weight for each factor. Let’s discuss the factors contributing to Nova’s high rank and compare it with its peers.

Quality

Among the quality metrics included in our ranking system is the earnings quality indicator (EPSQ). This ratio is used to analyze the quality of the company’s financial statements and assess if it is manipulating its accruals. It divides the difference between the operating cash flow and earnings by the firm’s total assets. Since mid-2019, NVMI’s earnings quality ratio has been growing, reflecting improved financial statement quality amid a period of higher profitability. The ratio’s increase was mainly driven by the cash generation capacity of the company, where the twelve-month trailing operating cash flow more than doubled between 2019 and now.

Value

One of our value metrics is a ratio dividing discounted free cash flow by the company’s Enterprise Value (EV). The DCF model is based on a five-year projection of free cash flows and discounting them using the long-term average growth rate.

Market capitalization is another simple yet effective metric in our ranking methodology that accounts for the size effect of the firm. Again, smaller companies usually tend to outperform over the long run, mainly due to greater growth potential.

As shown in the chart below, when plotting the rank of the DCF/EV ratio against the market cap rank of the major companies in the semiconductor industry, NVMI has a better overall positioning, indicating higher value than its competitors.

Momentum

Positive momentum patterns are visible in market prices and analysts’ estimates adjustments. Our analyst revisions metric compared today’s EPS mean for the current fiscal year to its value four weeks ago. Nova’s analyst revisions factor increased, implying that earnings are gaining momentum due to higher expected growth.

It is clear from the chart above that the company has been regaining strong momentum since May. Additionally, both factors exhibited again higher values earlier this month which resulted in a remarkable increase in Nova’s stock price.

Investment Risks

Although NVMI has an appealing rank in our factor-based system, it is vulnerable to several risks and challenges:

High cash conversion cycle

Days inventory is high compared to peers, indicating that NVMI is not forecasting demand accurately, resulting in more inventory and greater handling costs, and inventory obsolescence.

Low capital expenditures

NVMI’s Capex-to-Revenue is lower than all its competitors. The ratio suggests that others are more aggressively reinvesting their earnings back into their production and boosting productivity and efficiency. Low investment might weaken its performance if its competitors could translate their higher investment into a greater market share.

Cyclicality of the business environment

The cyclical nature of NVMI’s market raises the risk of sustaining a high growth rate in revenues. Despite being more stable over recent periods, the industry has experienced steep upturns and downturns in the last decade. Furthermore, it is difficult for management to predict the length or timing of any potential downturn. However, the chronic shortage of chips may dampen the cyclicality of the industry in the medium-term.

Conclusion

Nova Measuring Instruments has been consistently posting solid results over the previous quarters. Revenue and EPS are still growing at a double-digit rate, pushing management to increase guidance for the next period. Moreover, NVMI has strong quality, value, and momentum factors contributing to a high ranking in our International Equity Strategy ranking system.

This factor combination was the key to identifying attractive investment opportunities delivering consistent investment returns. On November 1st, Nova was added to the holdings of our Factor-Based International Equity Strategy. Despite its latest rally in November, the company should be closely monitored in case investors are willing to initiate or add new positions.