September is typically a challenging month for equities, but this year, markets have defied expectations. Aggressive rate cuts by central banks and easing inflationary pressures have created a more favorable economic backdrop. Major central banks, including the US Federal Reserve and the Bank of Canada, have shifted towards monetary easing, moving away from inflation concerns and focusing on sustaining economic growth. This pivot has fueled equity market rallies, with both the S&P 500 and S&P/TSX reaching new highs.

As the US Presidential election approaches, market volatility is likely to increase, a pattern seen in previous election cycles. Historically, volatility rises in the weeks leading up to elections and tends to subside afterward. Meanwhile, the Fed and BoC are expected to continue their rate-cutting paths, with the BoC potentially delivering a 50 bps cut in October and the Fed likely following suit by year-end. Global growth remains steady, with the OECD projecting 3.2% growth for 2024, though certain regions, such as China, are showing signs of economic weakness.

| Index | Aug-2024 | Sep-2024 |

| S&P 500 Total Return | 2.43% | 2.14% |

| S&P/TSX Total Return | 1.22% | 3.15% |

Canada

The Canadian stock market sustained its upward momentum in September, with the S&P/TSX Composite Index delivering a monthly total return of 3.15%. While inflation has returned to the Bank of Canada’s 2% target, concerns persist around signs of a slowing economy, particularly on a per capita basis, with declines in productivity, business investment, consumer spending, and hiring. Key economic indicators influencing the outlook include:

Economic Growth: July GDP grew by 0.2%, with retail, wholesale, and manufacturing sectors up, but construction and manufacturing showed declines. Q3 growth is on track for a modest growth well below the BoC’s 2.8% projection.

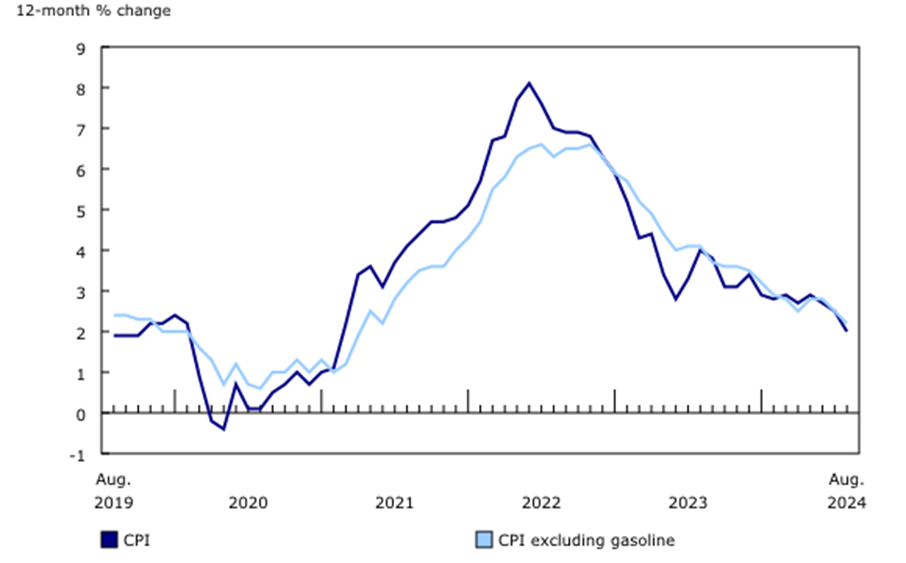

Inflation: Inflation fell to 2% in August, down from the 8.1% peak in 2022. Core inflation measures suggest further progress toward the BoC’s target, with CPI-median and CPI-trim reaching 2.3% and 2.4%, respectively. However, concerns remain about inflation falling too fast if economic weakness persists.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and service prices

Unemployment: The unemployment rate rose to 6.6%, with 1.5 million Canadians unemployed last month, driven by a softening labor market, especially among youth and newcomers. Job vacancies have fallen to 2019 levels, and slack is building in various sectors.

Interest Rates: The BoC has cut its overnight target rate by 25bps to 4.25%, with expectations for continued rate cuts. Depending on GDP and inflation data, a more aggressive 50bps cut may be considered in the near term.

Housing Market: Despite early rate cuts, the housing market remains subdued, with stable sales and flat prices in most regions. Further easing, especially with mortgage rates dropping below 4%, could help stimulate demand, particularly in high-priced markets like Ontario and B.C.

Retail Sales: Canadian retail sales rose 0.9% in July, with autos leading the way. Sales were up in seven of nine subsectors; however, spending growth remains modest relative to the country’s population surge.

United States

In September, equity markets reached new record highs, with the S&P 500 Total Return Index increasing by 2.14%, following the Federal Reserve’s aggressive 50bps rate cut. This substantial move aimed to balance inflation control with preventing significant labor market deterioration. The US economy has shown resilience, bolstered by robust consumer spending and solid GDP growth, despite challenges in manufacturing and housing. As the easing cycle continues, further rate cuts are expected into 2025 to support ongoing economic expansion, even amid mixed sectoral data.

Inflation: Core PCE remained steady at 0.16% in July, the third consecutive month below 0.2%. While overall PCE prices also rose by 0.16%, the three-month annualized core rate of 1.7% points to a continued cooling trend in inflation. CPI inflation rose by 0.2% month-over-month in July, while year-over-year inflation declined to 2.9%. Core CPI, excluding food and energy, remained steady at 0.2% month-over-month. The moderation in inflation supports the Fed’s progress toward its 2.0% target.

Source: bea.gov

PMI Data: The services PMI expanded to 55.4 in September, indicating continued growth, while the manufacturing PMI contracted to 47, its lowest in 15 months, signaling persistent challenges in the industrial sector. New orders rose slightly, but production remained in contraction at 49.8, pointing to weaker demand for factory goods.

Housing Market: Existing home sales dropped by 2.5% in August to 3.86 million annualized, the lowest since October 2023. New home sales, however, rose 9.8% YoY, boosted by falling mortgage rates, which dropped to a two-year low of 6.1%. Despite this, housing affordability remains a challenge due to high prices and tight supply.

Labor Market: Initial jobless claims fell to a four-month low, underscoring the labor market’s resilience. However, the manufacturing sector saw further employment declines, with the employment index dropping to 43.9.

Personal Spending: Personal spending rose 0.2% in August, following a strong 0.5% increase in July. Real spending edged up 0.1%, largely driven by services, with Q3 personal consumption on track for a 3% annualized gain.

International

In September, global markets received a boost following significant rate cuts by major central banks, improving investor sentiment. However, rising geopolitical tensions in the Middle East, particularly between Israel and Iran, have heightened fears of a broader regional conflict. This uncertainty has driven oil prices higher during the last few days due to the region’s critical role in global energy supply, increasing market volatility. The growing risk of military clashes has also pushed up gold prices as investors seek safe-haven assets, with potential ripple effects on global inflation and energy costs.

Europe: European markets rebounded, fueled by expectations of interest rate cuts amid slowing business activity and China’s newly introduced economic stimulus measures. Inflation rate In the Euro Area decreased to 2.20% in August from 2.60% in July of 2024. Additionally, PMI data pointed to a contraction, particularly in Germany, where declining new orders and ongoing struggles in manufacturing signaled potential economic headwinds. Both business and consumer confidence in Germany also weakened, highlighting future challenges. In contrast, the UK’s private sector continued its expansion for the 11th consecutive month. Meanwhile, the Riksbank in Sweden and the Swiss National Bank both lowered interest rates, citing easing inflation pressures.

Japan: Japan’s stock markets rose during September, fueled by optimism from China’s stimulus measures and dovish commentary from the Bank of Japan (BoJ), which weakened the yen. The announcement of a new prime minister also influenced market sentiment, as his monetary stance aligns with potential BoJ policy normalization. Moreover, the BoJ Governor indicated no immediate rush to raise rates further, allowing time to assess economic developments. On the economic front, Tokyo’s core CPI (2.00%) showed a slight slowdown in inflation due to energy subsidies, while PMI data reflected continued private sector expansion driven by services despite a contraction in manufacturing output.

China: Chinese stocks surged significantly following Beijing’s announcement of a broad stimulus package aimed at supporting the economy. The People’s Bank of China implemented several measures, including cutting the reserve requirement ratio by 50 basis points and lowering both the seven-day reverse repo rate and the medium-term lending facility rate. The package also included mortgage rate reductions and a decrease in the down payment ratio for second-home purchases. While these actions should boost near-term activity and improve market sentiment, some analysts believe the stimulus may not be sufficient to address China’s longer-term growth challenges.

The Portfolio Management Team