In October, the US equities experienced notable volatility, with the S&P 500 declining nearly 1% for the month. A significant sell-off in tech stocks primarily drove this downturn, as major companies like Microsoft (MSFT) and Meta (META) reported earnings that fell short of market expectations. Additionally, investor sentiment was influenced by rising bond yields and uncertainties surrounding the upcoming US presidential election.

Meanwhile, Canadian equities saw a slight increase, though the S&P/TSX Composite Index faced its challenges. The energy and materials sectors, which make up a substantial portion of the index, were particularly affected by fluctuating commodity prices and global demand concerns. Despite these headwinds, sectors like consumer staples and healthcare showed resilience, helping to offset broader market declines.

Internationally, markets showed mixed performances. European indices were pressured by geopolitical tensions and economic data pointing to slower growth. In contrast, some Asian markets demonstrated relative strength, supported by favorable economic indicators and favorable policy measures.

| Index | Sep-2024 | Oct-2024 |

| S&P 500 Total Return | 2.14% | -0.91% |

| S&P/TSX Total Return | 3.15% | 0.85% |

Canada

The Canadian stock market maintained its upward momentum in October, with the S&P/TSX Composite Index posting a modest gain of 0.85%. Despite positive employment growth and gains in select sectors, GDP growth remained sluggish, inflation eased, and the Bank of Canada’s (BoC) aggressive rate cuts signaled concerns over economic momentum. Here’s a closer look at the key economic indicators:

GDP Growth: August GDP was flat, while July saw a slight upward revision to +0.1%. For Q3, growth is estimated to be around 1%, falling short of the Bank of Canada’s target of 1.5%; however, a modest rebound of +0.3% is anticipated for September. Looking ahead, the economy is projected to grow by 1.1% in 2024, with an improvement to 1.8% in 2025, suggesting a gradual recovery marked by economic slack.

Retail Sales: Retail sales increased by 0.4% in August but fell short of the preliminary estimate. Autos led gains (+3.5%), while gas station sales dropped (-2.7%). Excluding autos and gas, sales fell by 0.4%.

Interest Rate Cuts: The BoC cut the overnight rate by 50 bps to 3.75%, the fourth consecutive cut, totaling 125 bps. This aggressive approach is unmatched by other major central banks. The BoC signaled a dovish stance, emphasizing future rate moves would depend on incoming data, with potential 25 bps cuts ahead.

Inflation: September CPI dropped 0.4%, bringing annual inflation down to 1.6%, the first dip below 2% since February 2021. The decline was driven by a significant drop in gasoline prices (-7.1%). Core inflation measures held steady, with a median of 2.3%, and trimmed at 2.4%. The BoC’s Q3 core CPI averaged 2.4%, slightly below its 2.5% projection.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and service prices

Employment: September saw a robust rise of 46,700 jobs, with the unemployment rate decreasing to 6.5%. Full-time employment surged by 112,000, and private sector payrolls increased by 61,200. However, hours worked fell by 0.4%, and the participation rate hit its lowest level since the late 1990s at 64.9%.

United States

In October, the S&P 500 Total Return Index declined by 0.91%, marking its first monthly drop since April. This downturn was influenced by rising bond yields and uncertainties surrounding the upcoming presidential election. Economic data for the month presented a mixed picture: consumer spending remained robust, while manufacturing and housing sectors faced challenges. Inflation trends showed signs of cooling, and labor market indicators were mixed, with only 12,000 jobs added in October, the lowest since 2020. These factors are likely to influence the Federal Reserve’s upcoming policy decisions. Here’s a breakdown of key indicators by category:

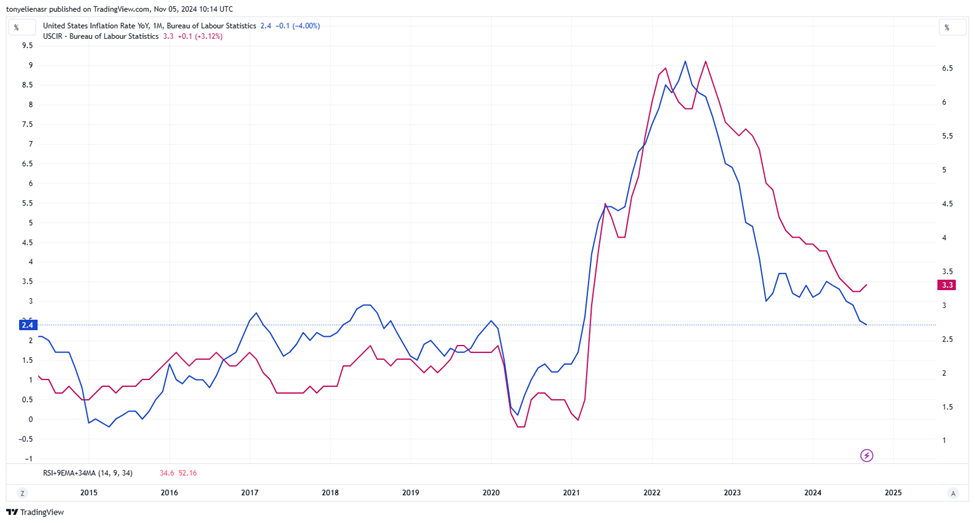

Inflation The PCE Price Index rose by 0.2% in October, bringing the annual rate down to 2.1%, which is close to the Federal Reserve’s target. Core inflation increased by 0.25%, maintaining a 3-month annualized rate of 2.3% and an annual rate steady at 2.7%. Supercore services, which exclude energy and housing, rose by 0.3%, lifting the 3-month pace to 2.9% and keeping the annual rate at 3.2%. Prices paid by manufacturers also rose to 54.8, suggesting moderate inflationary pressures but still below the 2021 peak.

Source: bea.gov

Labor Market The labor market showed mixed results in October. Nonfarm payrolls added only 12,000 jobs, significantly below expectations due to disruptions from hurricanes and strikes. The employment index rose to 44.4 but remained under 50, indicating contraction, with manufacturing jobs declining by 46,000. Weather-related impacts were substantial, affecting 512,000 workers, well above the historical average of 56,000. Job gains from the previous two months were revised downward by 112,000, reducing the 3-month average to 104,000. The unemployment rate held steady at 4.1%, while wages rose by 0.4% month-over-month and 4.0% year-over-year, signaling continued wage growth. However, the labor force shrank by 220,000, leading to a dip in the participation rate to 62.6%.

Consumer Spending Consumer spending remained a strong component of economic growth. Retail sales increased by 0.4% in September, the best monthly performance since July, with control group sales up 0.7%. Q3 GDP growth was reported at an annualized 2.8%, slightly below Q2’s 3.0%, supported by consumer and government expenditures but offset by a surge in imports.

Manufacturing and Production The manufacturing sector continued to face challenges. The ISM Manufacturing PMI fell to 46.5, the lowest since summer 2023, marking nearly two years of contraction. Production dropped to 46.2, the largest decline since April 2021. Industrial production also fell by 0.3% in October, with manufacturing output down 0.4%, impacted by strikes and weather-related disruptions.

Housing and Construction The housing market showed continued weakness. Housing started to fall by 0.5% in September to an annualized rate of 1.354 million, influenced by high mortgage rates. Building permits dropped by 2.9% to 1.428 million, down nearly 6% year-over-year, indicating limited future construction activity.

Election Impact on Markets As the U.S. 2024 presidential election approaches, market participants are closely watching potential outcomes and their effects on economic policy. Historically, elections can create volatility as investors react to anticipated shifts in fiscal and regulatory policies. A Republican win could signal extensions of corporate tax cuts and deregulation, potentially boosting sectors like energy and finance but raising long-term deficit concerns. Conversely, a Democratic administration may focus on clean energy initiatives and healthcare reforms, impacting related sectors positively while increasing regulatory pressures on others.

International

In October 2024, international markets exhibited varied performances across regions:

Europe: Major European indices declined in October, influenced by concerns over potential Middle East conflicts, disappointing corporate earnings, and lowered expectations for European Central Bank interest rate cuts. Annual inflation in the euro area increased to 2.0% in October, up from 1.7% in September, aligning with the ECB’s target. This rise was attributed to a less significant drop in energy prices and higher costs for food and tobacco. Core inflation, which excludes volatile items like energy and food, remained steady at 2.7%. The eurozone economy grew by 0.4% in Q3 2024, doubling the 0.2% rate from Q2 and surpassing expectations. Germany narrowly avoided recession with 0.2% growth, while France and Spain also showed stronger-than-expected economic performance. In contrast, Italy’s economy stagnated during this period.

United Kingdom: The UK market followed broader European trends, with the FTSE 100 index declining. Investor sentiment was affected by concerns over economic growth and global market volatility. Further adding to the uncertainty, the UK budget announcement and fiscal policy decisions contributed to a cautious outlook. The UK’s annual inflation rate dropped to 1.7% in September 2024, down from 2.2% in August, marking its lowest level since 2021.

Japan: Japanese equities displayed resilience, with the Nikkei 225 index recording gains. The market was supported by weaker yen and positive corporate earnings. Japan’s core CPI growth rate rose in August compared to the previous month, while export values declined year-over-year for the first time in ten months as export prices softened due to yen appreciation.

China: Economic indicators in China pointed to signs of recovery, with factory activity expanding for the first time since April. The official manufacturing PMI rose to 50.1, indicating growth, while the nonmanufacturing PMI edged up to 50.2, partly fueled by increased spending during Golden Week. Additionally, value-added industrial output grew by 5.8% year-on-year in the first three quarters of 2024, reflecting steady industrial activity.

The Portfolio Management Team