November 2024 was a dynamic month for markets, shaped by post-election shifts and evolving economic conditions. Donald Trump’s re-election and a Republican congressional sweep set the stage for significant policy changes, with markets rallying on expectations of tax cuts, deregulation, and new trade measures. This drove major indices, including the S&P 500, Nasdaq, and Dow Jones, to new highs.

The Canadian stock market maintained positive momentum in November, with the S&P/TSX Composite Index climbing to a new all-time high. Gains were led by the energy and materials sectors, supported by rising commodity prices. However, the market faced some headwinds as concerns over potential U.S. tariffs on Canadian goods introduced an element of uncertainty.

International markets exhibited mixed results. European stocks faced challenges due to political uncertainties and potential U.S. tariffs, with the euro experiencing its worst monthly performance since early 2022, losing over 3%. Conversely, emerging markets like China showed resilience despite tariff concerns.

| Index | Oct-2024 | Nov-2024 |

| S&P 500 Total Return | -0.91% | 5.87% |

| S&P/TSX Total Return | 0.85% | 6.37% |

Canada

The Canadian stock market sustained its upward momentum in November, with the S&P/TSX Composite Index rising 6.37%. Inflation steadied near the Bank of Canada’s 2% target, offering relief to households and businesses, while retail sales posted steady gains. Despite these encouraging signs, the Canadian dollar slipped to a 4.5-year low against the U.S. dollar, underscoring persistent global uncertainties. As the year draws to a close, the economic outlook remains cautiously optimistic, with expectations of further rate cuts aimed at bolstering growth amid ongoing challenges. Here’s a closer look at the key economic indicators:

GDP Growth: Canada’s economy expanded at an annualized rate of 1% in the third quarter, below the Bank of Canada’s forecast of 1.5%. This growth was supported by consumer spending and government expenditures, while declines in business investments and exports posed challenges. The GDP per capita decreased by 0.4%, marking the sixth consecutive quarterly decline, indicating potential concerns about living standards.

Retail Sales: Retail sales increased by 0.4% month-over-month in October, marking the fourth consecutive monthly rise. This growth was primarily driven by a 3.5% increase in motor vehicle and parts dealers, indicating a rebound in consumer demand in the automotive sector. However, core retail sales, which exclude gasoline and motor vehicle sales, declined by 0.4%, suggesting that consumers remained cautious in other spending areas.

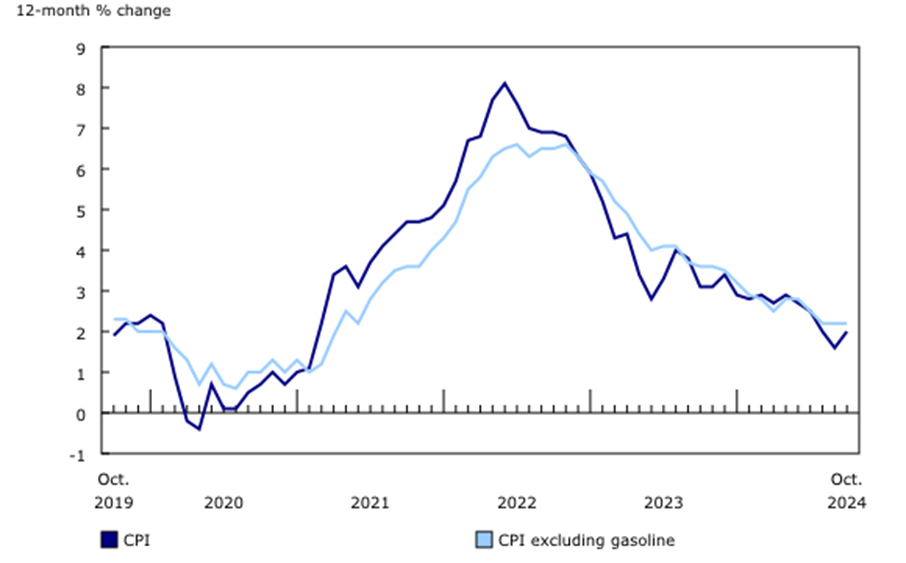

Inflation Trends: The Consumer Price Index (CPI) rose by 2.0% year-over-year in October, up from a 1.6% increase in September. This uptick was partly due to gasoline prices falling less in October compared to September. Excluding gasoline, the CPI increased by 2.2%, consistent with the previous two months.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and service prices

Employment: In October 2024, Canada’s unemployment rate held steady at 6.5%, reflecting little change in overall employment with a modest gain of 15,000 jobs (+0.1%). Youth employment saw a notable uptick.

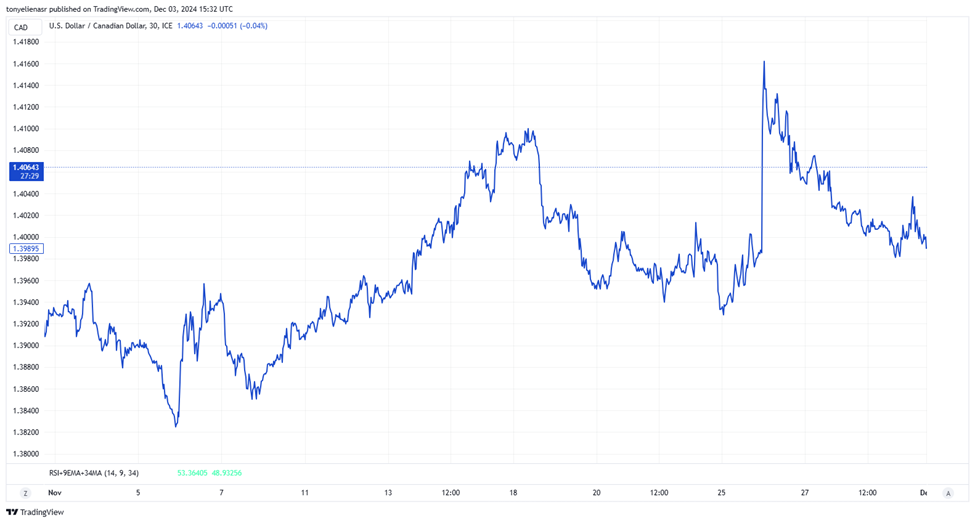

Currency Exchange Rate: The Canadian dollar weakened, reaching a 4.5-year low against the U.S. dollar, trading at approximately 1.3985 CAD per USD. This depreciation was influenced by stronger U.S. economic data and rising global risk aversion due to geopolitical tensions, which increased demand for the U.S. dollar as a safe-haven currency.

USD/CAD Performance November 2024

United States

In November, U.S. stock markets delivered strong gains, with the S&P 500 Total Return Index climbing 5.87% and breaking past the 6,000 mark. This rally was driven by robust investor optimism surrounding President-elect Donald Trump’s anticipated pro-business agenda. Expectations of corporate tax cuts and regulatory rollbacks buoyed sentiment across sectors. Tesla stood out as a key performer, with its stock surging 38% over the month, adding significant momentum to the broader market. Economic indicators presented a mixed but overall positive picture, as the labor market demonstrated resilience despite recent disruptions, and the services sector continued to expand steadily. Here’s a breakdown of key indicators by category:

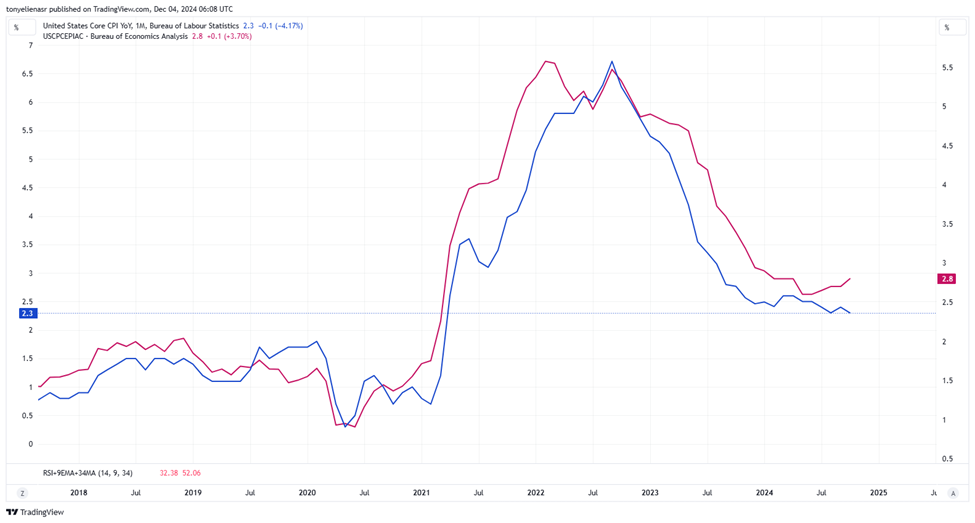

Inflation: Headline CPI rose 0.2% month-over-month, pushing year-over-year inflation to 2.6%, above the Federal Reserve’s 2.0% target. Core CPI increased to 3.3% year-over-year, reflecting persistent pressures, particularly in housing and services. Shelter inflation drove over half of the monthly CPI increase while rising prices in used cars, airfares, and medical care services also contributed. Moderating sectors, such as gasoline, apparel, and food, provided some balance.

Source: bea.gov

GDP Growth: The second estimate for Q3 GDP confirmed a 2.8% annualized growth rate, supported by upward revisions in intellectual property spending. However, corporate profits showed weakness, with pre-tax profits falling by 0.3%, hinting at potential economic headwinds in 2025.

Manufacturing: Manufacturing activity showed improvement in November, though it remains a weak spot. The ISM Manufacturing PMI rose to 48.4, a 5-month high, but stayed in contraction territory. New orders expanded for the first time in eight months, while production and employment continued contracting at slower rates.

Labor Market: The labor market remains robust, with November nonfarm payrolls forecasted to increase by 180,000. Initial jobless claims fell to 213,000, reflecting continued strength in employment. Solid labor market conditions provide a foundation for consumer spending and economic stability as the year closes.

Consumer Income and Spending: Personal income rose by 0.6%, with disposable incomes surging by 0.7%. Personal spending increased by 0.4%, though real spending growth was modest at 0.1%. Higher savings (4.4%) and strong income gains position consumers for a healthy holiday shopping season despite high borrowing costs.

Housing and Construction: The housing market continues to grapple with affordability and high mortgage rates. Existing home sales increased by 3.4% in October, the largest rise since February, but remain near historic lows. Median selling prices climbed 4% year-over-year to $407,200, while tight supply continues to put upward pressure on prices. This sector remains “frozen,” as the Fed Chair described it, and requires significant policy adjustments to revive activity.

Federal Reserve Outlook: The November FOMC Minutes highlighted the Fed’s cautious stance. Policymakers emphasized gradual rate cuts due to a still-strong economy and elevated inflation. The neutral rate remains uncertain, and decisions will likely be taken meeting by meeting. As such, markets expect the Fed to proceed with a December rate cut, but future policy easing may depend on fiscal developments and inflation trends.

International

In November 2024, Donald Trump’s re-election as president of the United States, along with concerns over potential tariffs and policy shifts under his administration, exerted pressure on international markets.

Europe: In November 2024, Europe faced mounting economic challenges, marked by a significant 4% decline in the euro against the U.S. dollar, its steepest monthly drop since early 2022. The euro reached a low of $1.0418, driven by fears of U.S. trade tariffs, a weakening regional economy, and political instability in key member states. The Eurozone’s manufacturing PMI fell to 45.2, its 17th consecutive month below the neutral 50.0 mark, reflecting deepening contractions led by Germany and France. Despite falling energy costs, inflationary pressures have raised expectations for continued European Central Bank rate cuts to stimulate growth. Economic sentiment and employment expectations both declined, reflecting growing pessimism among businesses and consumers. On the other hand, the UK economy remained stagnant, with Q3 growth at just 0.1% and the manufacturing PMI slipping to 48.0, a nine-month low, as higher taxes and trade uncertainties further constrained output.

Japan: Tokyo’s core CPI increased to 2.2%, surpassing the Bank of Japan’s 2% target, driven by higher food and service prices. This has raised market expectations of a potential interest rate hike, with a 60% probability of the Bank of Japan increasing short-term rates from 0.25% at its next meeting. The yen strengthened past ¥150 against the U.S. dollar, reflecting these expectations. Meanwhile, the Japanese government approved a 39 trillion yen ($250 billion) economic stimulus package to boost incomes and address energy costs, digital innovation, and demographic challenges.

China: China’s economy demonstrated steady growth in the third quarter of 2024, with GDP expanding by 4.6% year-on-year, slightly below the 4.7% growth in Q2, as the country navigated global uncertainties and domestic restructuring. Inflation remained mild in October, with the Consumer Price Index rising 0.3% year-on-year and core CPI increasing 0.2%. In trade, China’s surplus widened in November, driven by stronger export demand ahead of anticipated U.S. tariffs, while weak imports highlighted soft domestic consumption.

EURUSD GBPUSD USDJPY Performance – November 2024

The Portfolio Management Team