July was marked by significant volatility in the US markets. In the first half of the month, an unexpected decline in June’s consumer prices boosted the market. However, a major sell-off in tech stocks occurred later as earnings reports revealed conservative EPS guidance ahead. Despite this turbulence, stocks rallied by the end of July, closing the month on a positive note, and government bond yields fell after the Federal Reserve decided to keep interest rates unchanged while signaling potential rate cuts in the coming months.

On the other hand, the Canadian economy continued on its interest rate-cutting cycle, with the Bank of Canada lowering the policy rate to 4.50%. Future rate cuts will depend on economic data, but the central bank has shifted its focus to concerns about inflation falling below target, indicating more cuts are likely. This dovish stance reflects worries about potential economic weakness and aligns with expectations for the policy rate to reach 4.00% by year’s end.

| Index | June-2024 | July-2024 |

| S&P 500 Total Return | 3.59% | 1.22% |

| S&P/TSX Total Return | -1.42% | 5.87% |

Canada

In July, the Canadian stock market demonstrated strong performance, with the S&P/TSX Composite Index achieving a monthly total return of 5.87%, surpassing the 23,000 mark for the first time. This gain contributes to a broader positive trend, as the index has increased by approximately 12.28% year-to-date. Despite a slowdown in growth during the second quarter, the Canadian economy continued its expansion. Statistics Canada reported a 0.2% rise in real GDP for May. While the Bank of Canada has been closely monitoring the economy for signs of a slowdown to control inflation, it projects an acceleration in economic growth for the third quarter, even as inflationary pressures begin to ease. Several economic indicators released in July provided insights into the underlying health of the Canadian economy:

Gross Domestic Product (GDP): Canada’s real GDP increased by 0.2% in May, exceeding initial estimates. According to Statistics Canada, preliminary data for June suggests a modest gain of 0.1%, leading to an estimated Q2 growth of 0.5%, or just over a 2% annualized rate.

Employment: The unemployment rate rose to 6.4% in June, with Canada’s economy losing a net 1,400 jobs, all in full-time positions. This was below analysts’ expectations, who had anticipated a gain of 22,500 jobs and an unemployment rate of 6.3%. Despite the softer labor market, average hourly wages saw a year-over-year increase of 5.4%, indicating robust wage growth.

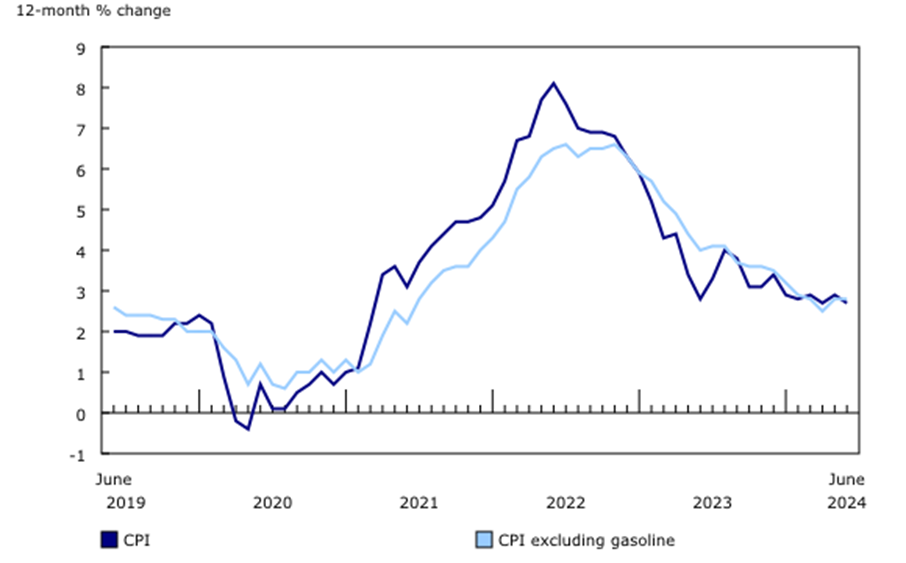

Inflation: Canada’s economy continues to soften, with annual consumer inflation slowing to 2.7% in June, down from 2.9% in May. This cooling of the inflation rate was more significant than expected, primarily due to slower growth in gas prices. Meanwhile, the average of the Bank of Canada’s preferred “core” inflation measures held steady at 2.8%, indicating that underlying price pressures remained relatively stable.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and service prices

Monetary Policy: The Bank of Canada cut its benchmark interest rate by 25 basis points to 4.5%, with Governor Tiff Macklem indicating that further reductions may be necessary to stimulate the economy. This widely anticipated move comes as inflation cools and the economy shows signs of weakness. Macklem expressed confidence that measures to bring inflation back to the 2% target by the second half of 2025 are in place despite a revised forecast lowering 2024 GDP growth to 1.2% from 1.5%.

United States

The US stock market had mixed results in July 2024, with the S&P 500 Total Return increasing by 1.22%. The month began strong, driven by historical seasonal strength and positive investor sentiment. However, volatility in the latter part of the month, particularly within the technology sector, caused a slight pullback. The Federal Reserve maintained the federal funds rate at 5.25% to 5.50% and highlighted ongoing progress in reducing inflation. In addition, they signaled that they will continue quantitative tightening at $60 billion per month for the remainder of the year.

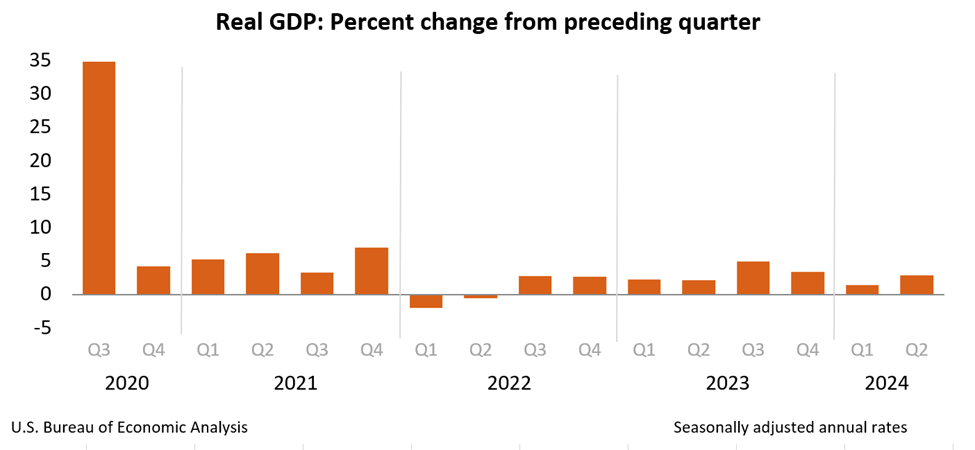

Gross Domestic Product (GDP): The initial estimate for Q2 GDP growth showed a 2.8% annualized increase, well above the first quarter’s 1.4%. This robust performance was driven by consumer and business spending, government expenditure, and a substantial inventory build. However, the headline figure may overstate the economy’s strength due to the inventory contribution.

Source: bea.gov

Retail Sales: June retail sales were unexpectedly strong, with only a minor 0.02% decrease, defying forecasts of a 0.3% drop, while May sales were revised upward to a 0.3% increase. Excluding auto and gasoline sales, which fell significantly, retail sales rose by a healthy 0.8%, reflecting robust consumer spending. The retail sales control group, crucial for GDP forecasting, increased by 0.9%.

Housing: June saw a 3.0% (month-on-month) rebound in housing starts, driven by lower mortgage rates. Building permits rose by 3.4% in June after falling 2.8% in May, indicating future growth in homebuilding despite a year-on-year decline in total permits.

Industrial Production: Industrial production rose by 0.6% in June, surpassing expectations and marking the strongest back-to-back gains since late 2021. Utilities output increased by 2.8%, manufacturing by 0.4%, and mining by 0.3%. The annual growth rate climbed to 1.6%, the highest since November 2022, with capacity utilization reaching 78.8%.

Employment Costs: The Employment Cost Index for civilian workers rose by 0.9% in the second quarter, slightly below expectations. Wages and salaries increased by 0.9%, while benefit costs climbed by 1.0%. Total compensation costs are up 4.1% from a year ago, marking the smallest advance since the fourth quarter of 2021.

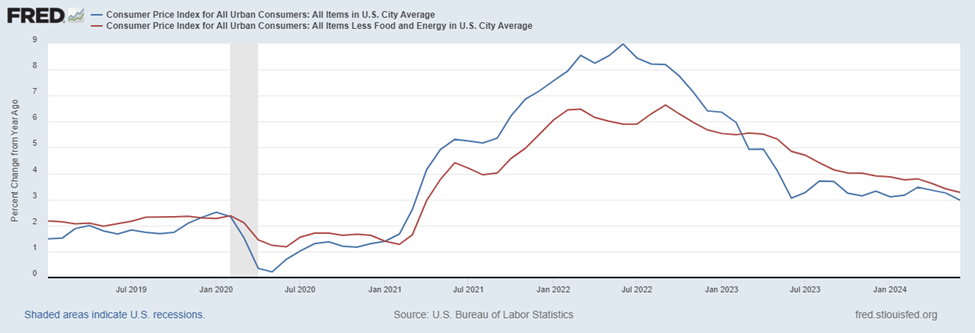

Inflation: In June, the inflation rate dipped by 0.1% from the previous month, bringing the annual rate to 3%, its lowest level in over three years. Core inflation, which excludes volatile food and energy prices, rose by just 0.1% monthly and 3.3% annually, marking the smallest annual increase since April 2021. This decline was driven by a significant drop in gasoline prices, which offset modest increases in food and shelter costs.

Inflation: In June, the inflation rate dipped by 0.1% from the previous month, bringing the annual rate to 3%, its lowest level in over three years. Core inflation, which excludes volatile food and energy prices, rose by just 0.1% monthly and 3.3% annually, marking the smallest annual increase since April 2021. This decline was driven by a significant drop in gasoline prices, which offset modest increases in food and shelter costs.

Source: U.S. Bureau of Labor Statistics

Monetary Policy: The Federal Reserve maintained its key interest rate at 5.25% to 5.50%, indicating some progress towards its 2% inflation target. Fed Chair Jerome Powell mentioned that a rate cut in September is possible if inflation data remains favorable. He emphasized the Fed’s apolitical stance, noting that upcoming elections do not influence policy decisions. Powell ruled out a 50 basis-point cut and highlighted close monitoring of the labor market for signs of a downturn.

International

Europe: n July, European stock markets experienced mixed results, with a late-month rally driven by positive quarterly earnings reports. Headline inflation in the eurozone unexpectedly rose to 2.6%, exceeding economists’ expectations, while core inflation, excluding volatile items, also increased to 2.9%. Services inflation slightly eased to 4% from 4.1% the previous month. This inflation rise occurred alongside a 0.3% growth in the euro zone’s GDP for the second quarter, surpassing forecasts despite a contraction in Germany’s economy. These developments have led investors to speculate on the European Central Bank’s potential interest rate cuts in September.

United Kingdom: The Bank of England introduced a new facility to stabilize the bond market, aiming to prevent volatility. Additionally, the UK government is set to announce the results of a public finances audit, which might reveal a substantial deficit, potentially leading to tax increases. Shop price inflation remained steady at 0.2%, the lowest rate since October 2021.

Japan: Japanese stock markets suffered notable losses in July, with significant declines in the Nikkei 225 and TOPIX indexes. The yen strengthened, negatively impacting exporters, as the government likely intervened in the forex market. Investors speculated about potential interest rate hikes and the tapering of the Bank of Japan’s bond purchases ahead of the central bank’s policy meeting. Inflation data showed a slight increase, supporting the possibility of a rate hike, though weak private consumption remains a constraint.

China: Chinese equities declined in July after the central bank’s unexpected rate cuts failed to boost confidence in the economic outlook. The People’s Bank of China reduced its medium-term lending facility and key short-term policy rates to stimulate growth. However, data indicating slowing retail sales, industrial production, and property investment underscored economic weakness.

The Portfolio Management Team