In January 2025, U.S. financial markets exhibited resilience amid geopolitical uncertainties and economic shifts. Investor sentiment was buoyed by expectations of deregulation and favorable conditions for dealmaking under President Donald Trump’s administration. However, concerns over potential trade tensions, particularly with China, introduced volatility, leading to mixed performances among major tech companies. The emergence of China’s AI startup, DeepSeek, impacted tech stocks like Nvidia, contributing to market fluctuations.

In Canada, the S&P/TSX Composite Index experienced modest gains, supported by rising metal prices and positive corporate earnings reports. The technology sector, notably led by Shopify, played a significant role in this upward movement. Despite these positive developments, the market remained cautious ahead of anticipated U.S. trade tariffs, which could impact Canada’s economy. The Bank of Canada’s decision to cut interest rates further added to the complex economic landscape, as investors closely monitored the potential effects of these policy changes.

Internationally, European markets showed strong performance bolstered by robust earnings reports and the European Central Bank’s decision to cut interest rates, which enhanced investor confidence. However, the looming threat of U.S. tariffs introduced a degree of uncertainty, as international markets braced for potential economic disruptions.

| Index | Dec-2024 | Jan-2025 |

| S&P 500 Total Return | -2.38% | 2.78% |

| S&P/TSX Total Return | -3.27% | 3.48% |

Canada

Canadian markets started 2025 on a positive note, with the S&P/TSX Total Return Index rising by 3.48%. However, as we look deeper into the economic landscape, various sectors are showing mixed signals. Despite some optimism in retail and labor markets, challenges persist, notably in GDP growth, inflation trends, and the ongoing risks posed by potential trade disruptions. With concerns about a possible U.S. tariff conflict and its impact on Canadian economic stability, policymakers will need to navigate these uncertainties in the coming months. Here’s a closer look at key economic indicators for Canada as we enter the new year.

GDP Growth: Canada’s real GDP fell by 0.2% in November, primarily due to a 1.6% decline in mining, oil, and gas, along with strikes and mild weather affecting utilities. However, retail activity in December is expected to boost GDP, with an estimated growth of 0.2%. Overall, Q4 GDP is projected at 0.4%, in line with the Bank of Canada’s expectations. While November’s softness was driven by temporary factors, the focus now shifts to the ongoing risks from potential tariffs, which will likely be the key concern for policymakers in the near term.

Retail Sales: Canadian retail sales were flat in November, with declines in most sectors, notably building materials and food and beverage. Autos and gas stations saw modest gains, but overall, sales excluding these categories fell. Provincial sales were mixed, with most showing declines. In volume terms, sales dropped by 0.4%, though December is expected to show a strong rebound. The slowdown in November is likely due to timing factors like Black Friday and the start of tax holidays.

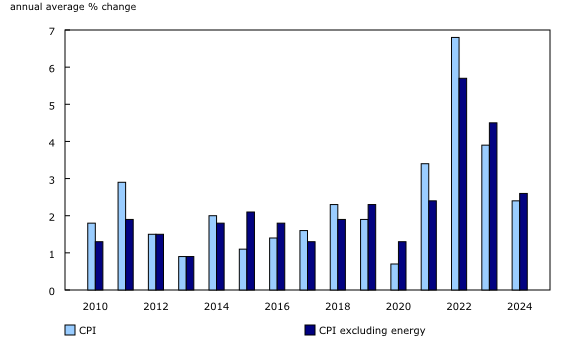

Inflation Trends: Canadian consumer prices fell by 0.4% in December, primarily due to seasonal factors, bringing the headline inflation rate to 1.8%. However, when adjusted for seasonality, prices rose by 0.2% month-over-month, and core inflation showed concerning signs with recent three-month trends picking up. While tax-related cuts in areas like food and alcohol temporarily lowered inflation, underlying inflation excluding sales taxes increased to 2.2%.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and CPI excluding energy

Monetary Policy: The Bank of Canada reduced its key policy rate by 25 basis points to 3% in January 2025. The central bank has expressed concerns about the potential economic damage from a trade conflict with the United States and is adopting a cautious approach to monetary policy. Bank of Canada governor warned that a tariff war with the US would ‘badly hurt’ economic activity in Canada.

Labor Market: Canadian employment rose by 90,900 in December, marking the largest increase in nearly two years and bringing the unemployment rate down to 6.8%. Full-time employment increased by 57,500, and hours worked also grew. The gains were broad-based across sectors, with Alberta and Quebec seeing notable job increases. Wage growth slowed to 3.8% year-over-year, the lowest since May 2022. Despite strong employment gains, the youth unemployment rate rose, and concerns about potential U.S. tariffs loom for 2025.

Currency Exchange Rate and Trade Risks: The Canadian dollar has experienced volatility, depreciating to a 22-year low against the U.S. dollar amid tariff threats. The loonie’s performance remains closely tied to developments in trade relations and global economic conditions, as the U.S. administration has threatened to impose a 25% tariff on all Canadian imports, which could lead to retaliatory measures from Canada. Such a trade conflict could reduce Canadian growth by 2.5% in the first year and another 1.5% in the second, according to the Bank of Canada.

Housing Market: Canada’s housing market showed mixed conditions in late 2024. Ontario struggled with falling prices and excess supply, while other regions saw strong price growth. Nationally, existing home sales were up 19.2% from a year ago, though December experienced a 5.8% drop in sales. Inventory levels were stable, and national prices rose slightly.

United States

In January 2025, U.S. markets demonstrated resilience, with the S&P 500 Total Return Index rising by 2.78%, despite increased volatility. This positive performance occurred amid President Donald Trump’s implementation of new tariffs on imports from Canada, Mexico, and China, aiming to address trade imbalances and national security concerns.

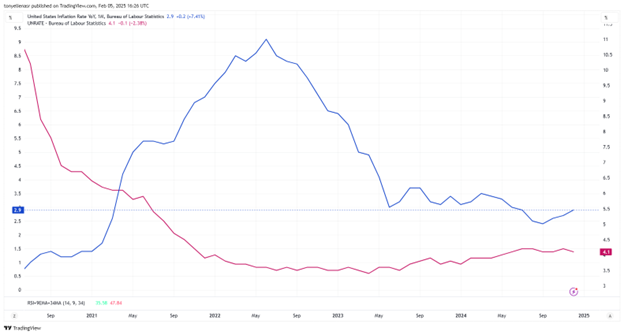

Inflation: Core PCE inflation remained steady at 2.8% in November, while short-term core prices slowed slightly to around 2.5%. Core CPI also moderated, stabilizing in the low 3% range, signaling that inflationary pressures are easing. However, headline inflation rose by 0.3%, pushing the annual rate to 2.6%. While inflation has shown some signs of slowing, the Fed remains cautious, noting that inflation remains “somewhat elevated.”

GDP Growth: U.S. economic growth in Q4 2024 was 2.3%, slightly below expectations, with strong consumer spending driving much of the growth. Real consumer spending surged at a 4.2% annualized rate, outperforming forecasts and marking the largest increase in nearly two years. Despite this, investment and exports showed weakness, which slightly dampened the overall economic performance. Full-year GDP growth for 2024 came in at 2.8%, a solid pace that was just below 2023’s 2.9%, indicating continued expansion above long-term potential.

Consumer Spending: Real consumer spending grew at a robust 4.2% annualized pace, outperforming expectations (3.4%). Spending on durable goods surged 12.1%, non-durable goods increased by 3.8%, and services spending rose 3.1%. On the other hand, personal spending rose by 0.7%, surpassing expectations, following a revised 0.6% increase in November.

Labor Market: The labor market continued to show strength, with nonfarm payrolls rising by 256k in December, far surpassing expectations. The unemployment rate dropped to 4.1%, driven by a sharp increase in household employment. The labor force remains robust, with average hourly earnings growing by 0.3%, suggesting steady income growth. However, manufacturing faced challenges, losing 13k jobs, while sectors like education, healthcare, and leisure posted strong gains.

Monetary Policy: The FOMC kept the fed funds rate at 4.25%-4.50%, as expected. The statement noted inflation “remains somewhat elevated,” reflecting ongoing concerns. The unemployment rate was described as “stabilized at a low level,” signaling a strong labor market. The Fed sees risks to both employment and inflation as “roughly in balance” and will continue to assess data before any further rate changes. The decision was unanimous, unlike the previous meeting with a dissenting vote. The March meeting may also result in a pause, depending on economic data. Chair Powell emphasized that rate cuts will depend on “real progress on inflation” or weakening in the labor market. The outlook remains uncertain due to potential changes in trade, fiscal, and regulatory policies.

Housing Market: Existing home sales rose 2.2% in December, and the housing market saw a solid 5.8% increase in Q4 2024, showing resilience despite inventory challenges. Median home prices increased by 6% year-over-year, driven by limited supply, with the number of homes available for sale remaining tight, indicating ongoing strong demand.

Source: bea.gov

International

In January 2025, the looming threat of tariffs potentially imposed by President Trump cast uncertainty over global markets. Investors closely monitored the scale of these tariffs and the responses from world leaders, with trade risks and geopolitical tensions continuing to influence market sentiment and expectations.

Europe: The eurozone economy stalled in Q4 2024, with GDP growth flat at 0.7% for the year. Germany and France contracted, while Spain saw 0.8% GDP growth. Inflation rates for January varied, with France at 1.8%, Germany at 2.8%, and Spain at 2.9%. The ECB cut its deposit rate by 0.25% to 2.75%, citing progress in disinflation. ECB President Christine Lagarde confirmed the decision was unanimous but refrained from indicating how long the rate cuts would continue, emphasizing that policy remains “restrictive.” Additionally, the Riksbank in Sweden lowered its interest rate to 2.25%, marking the sixth cut. While the bank indicated further rate cuts are unlikely in the short term, it remains prepared to act if inflation or economic conditions change.

Japan: Domestic stocks faced pressure from the Bank of Japan’s (BoJ) hawkish stance, as it raised interest rates for the third time within a year and revised its inflation forecasts upward during its January 23–24 meeting. BoJ officials indicated they will continue to raise rates if economic conditions align with their forecasts. As such, expectations of further rate hikes strengthened the yen, bringing it to around JPY 154 against the U.S. dollar. The yield on the 10-year Japanese government bond remained stable but at a 14-year high. On the inflation front, the Tokyo-area core consumer price index for January rose 2.5% year-over-year, matching expectations and slightly up from 2.4% in December. This data supports a hawkish BoJ outlook, although weak economic growth remains a concern, suggesting a gradual pace for future rate hikes.

China: Government data revealed that China’s economy started 2025 on weak footing. The official manufacturing PMI unexpectedly dropped to 49.1 in January, while the nonmanufacturing PMI fell to 50.2, indicating slower growth in construction and services. Although January’s manufacturing PMI typically softens due to the Lunar New Year holiday, other data pointed to continued economic weakness. Profits at large industrial companies declined by 3.3% in 2024, marking the third consecutive year of falling profits, driven by deflationary pressures and a prolonged real estate downturn affecting domestic demand.

EURUSD GBPUSD USDJPY Performance – January 2025

The Portfolio Management Team