December brought mixed economic signals and investor disappointment, especially after comments from Federal Reserve Chairman Jerome Powell. While the Fed announced a 25 basis point rate cut, the move was less aggressive than expected, dampening investor confidence. Powell’s focus on inflation control and a gradual approach to future rate cuts signaled that the Fed was not rushing to stimulate the economy further. His emphasis on persistent inflation, particularly in services, raised concerns about ongoing economic challenges. Stock markets fell nearly 3%, treasury yields surged, and the U.S. dollar reached a two-year high, reflecting the strength of U.S. monetary policy. At the same time, trade tensions and geopolitical risks weighed on sentiment as 2025 approached.

In Canada, key sectors such as housing, retail, and energy provided momentum, but persistent inflation and a weakening Canadian dollar created uncertainty for 2025. Real GDP growth slowed in 2024 due to weak business spending, but stabilization signs emerged as the housing market picked up, supported by lower borrowing costs. The Canadian dollar depreciated significantly, driven by the U.S. dollar’s strength and potential U.S. tariffs in January. Despite these challenges, the Bank of Canada’s cautious rate-cut strategy and improvements in labor markets and retail sales offer hope for more stable growth.

International markets also faced growing uncertainties in December. In Europe, concerns about slower economic growth persisted, with the euro weakening against the dollar as expectations of diverging rate paths for 2025 took hold. In Japan, a weakening yen boosted export-heavy industries, but industrial production showed weakness. Meanwhile, in China, ongoing stimulus measures showed mixed results, and trade tensions with the U.S. remained a key concern as 2025 approaches.

| Index | Nov-2024 | Dec-2024 |

| S&P 500 Total Return | 5.87% | -2.38% |

| S&P/TSX Total Return | 6.37% | -3.27% |

Canada

December 2024 was a challenging month for Canadian markets, as the S&P/TSX Total Return Index fell by 3.27%. While housing activity showed signs of recovery, with existing home sales rising and the housing market stabilizing, persistent inflation pressures and a depreciating Canadian dollar continued to raise concerns for the outlook heading into 2025. The Bank of Canada’s recent rate cut and gradual approach to further easing, alongside improving labor markets and retail sales, provide some optimism for more stable growth. However, risks remain, particularly with potential U.S. tariffs and a weakening currency that may further challenge economic stability. Here’s a closer look at the key economic indicators:

GDP Growth: Real GDP rose by 0.3% in October, slightly exceeding expectations and two ticks higher than the flash estimate. The mining, oil, and gas sectors were the main contributors, growing by 2.4%, contrary to earlier expectations of a negative impact. September GDP was revised up to 0.2%. November’s flash estimate reported a mild 0.1% contraction, marking the first negative print of the year, though this figure remains tentative. Growth is expected to improve to 2.0% in 2025 if tariffs are avoided.

Retail Sales: After strong retail sales in previous months, retail spending appears to have stalled at the start of Q4. Canadian retail sales rose by 0.6% in October, slightly softer than the flash estimate. Sales volumes were nearly unchanged (+0.05%), ending a three-month period of solid gains. The softness in retail sales, along with rising goods prices, suggests potential challenges ahead for consumer spending.

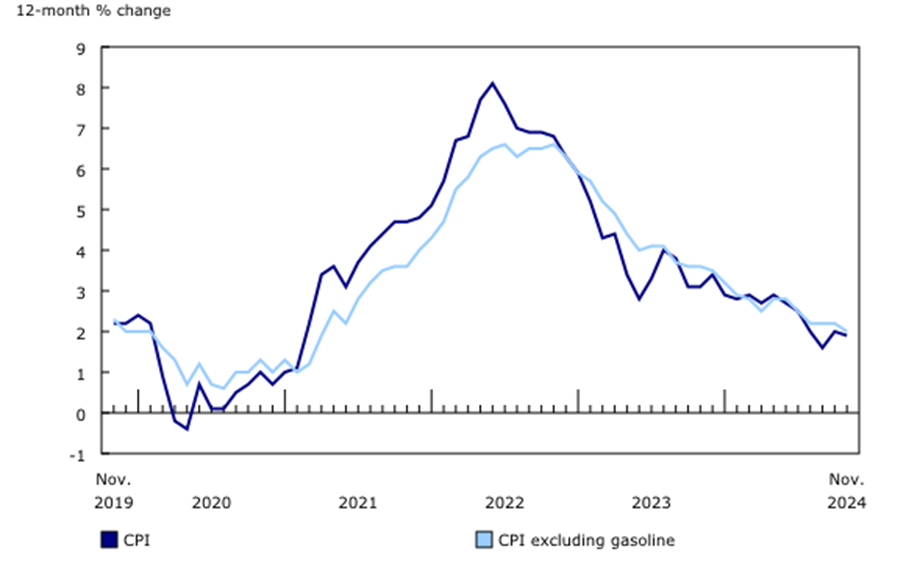

Inflation Trends: CPI inflation dropped to 1.9% in November 2024 from 3.1% in November 2023, largely due to lower fuel costs and a weaker loonie. The Bank of Canada’s two key measures of core inflation, trim (2.7%) and median (2.6%) remained steady and above the Bank’s 2% target, signaling persistent inflation pressures in some sectors, especially services.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and service prices

Labor Market: Canada added 329,300 jobs by November, but the unemployment rate rose to 6.8%, the highest in nearly eight years, as job growth couldn’t keep pace with labor force growth. The jobless rate is expected to peak at 7.0% and decline modestly later in 2025 as the economy stabilizes and labor market conditions improve.

Monetary Policy: The central bank’s aggressive easing campaign has helped reduce debt service costs and facilitated mortgage refinancing at lower rates. The Bank of Canada cut rates by 50 basis points in December and has signaled a gradual approach moving forward. The policy rate is expected to decline further to 2.5% by September 2025, provided tariffs do not disrupt the economy. The cautious rate cuts and monetary policy stance aim to support economic stability while keeping inflation under control.

Housing Market: The housing market has shown signs of recovery, with existing home sales rising and market conditions improving. It is expected to continue stabilizing through 2025 as lower borrowing costs and rising home prices support growth. The Bank of Canada’s rate cuts and easing stress tests have helped fuel the rebound, though ongoing affordability concerns could weigh on the pace of growth.

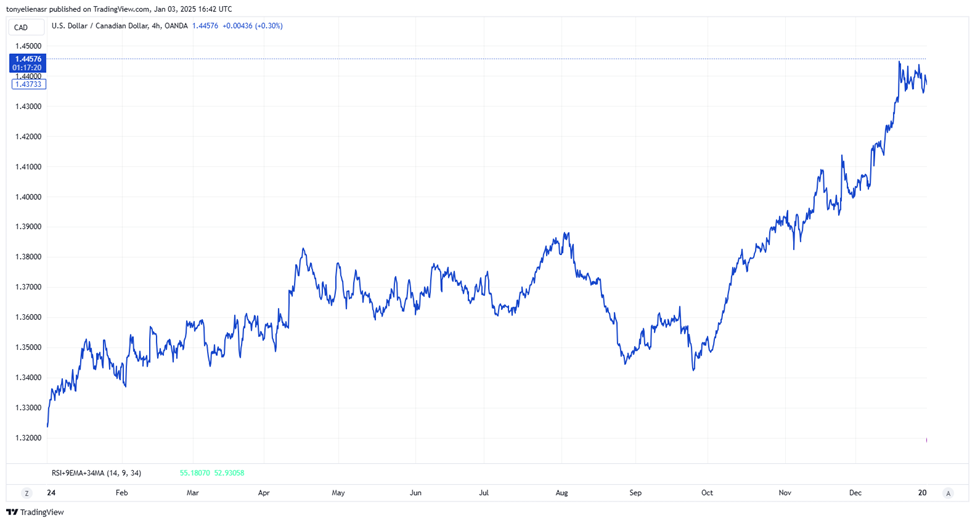

Currency Exchange Rate and Trade Risks: The Canadian dollar depreciated by 7.9% in 2024 to a 20-year low of 69.5 cents USD, largely driven by the strength of the U.S. dollar. The potential imposition of U.S. tariffs on Canadian exports remains a significant risk. A 25% duty on all Canadian goods could trigger a sharp slowdown in the economy, further complicating efforts to drive growth and stability. Retaliatory tariffs would increase costs for businesses and consumers, further undermining the Canadian economy’s outlook.

USD/CAD Performance November 2024

Outlook for 2025: The Canadian economy faces a complex landscape in 2025. While there are positive signs in housing and labor markets, persistent inflationary pressures and the risk of trade disruptions pose challenges. The Bank of Canada’s cautious approach to interest rates, coupled with potential external risks, will likely influence economic growth. Despite these uncertainties, a moderate recovery is anticipated if tariffs are avoided, with GDP growth expected to improve to 2.0% in 2025.

United States

Although the U.S. economy performed strongly throughout 2024, December saw a significant decline in the S&P 500 Total Return, down 2.38%. Despite positive GDP growth and notable progress in reducing core inflation, challenges persist, including a slight rise in unemployment, a cautious Federal Reserve, and ongoing inflationary pressures. As we move into 2025, key questions remain regarding the trajectory of inflation, the potential for a recession, and the broader economic impact of global risks, including trade tensions. Here’s a breakdown of key indicators by category:

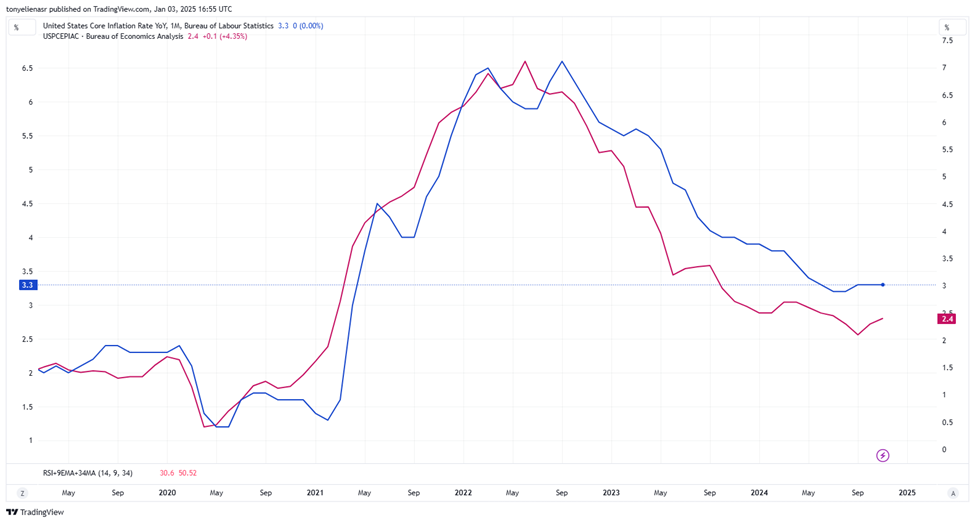

Inflation: Inflation showed notable progress in 2024, with core PCE inflation dropping from 6.14% in January to 1.39% in November. However, inflationary pressures remain, especially in the services sector. The Federal Reserve’s caution on rate cuts, responding to persistent inflation, reflects ongoing concerns. Core PCE inflation for November remained at 2.8%, and inflation in non-market services continues to be volatile. The Fed’s projections indicate that core inflation is unlikely to return to the 2% target until 2027, marking a delayed return to stable price growth.

Source: bea.gov

GDP Growth: The U.S. economy grew by 2.83% in Q3 2024, marking a strong overall performance for the year. However, the growth rate is expected to moderate slightly in 2025, with projections of 2.3% GDP growth. The economy is benefiting from strong nonresidential investment, government spending, and exports, while consumer spending remains robust. However, risks from geopolitical tensions and trade policy shifts could temper growth, making 2025 a year of moderate economic expansion.

Consumer Spending: Consumer spending remained a key driver of the economy, rising 0.4% in November and showing a solid 2.9% year-over-year increase. Strong retail performance has supported economic stability, and personal income grew by 5.3% over the past year. However, with inflation pressures still lingering, especially in housing and services, there is uncertainty over whether consumer spending will continue its robust pace in 2025. Higher costs and persistent inflation may eventually impact consumer behavior, especially in discretionary spending categories.

Labor Market: The U.S. labor market continued to show resilience, with 329,300 jobs added by November. However, the unemployment rate rose slightly to 4.2%, reflecting a mismatch between job growth and the expanding labor force. Job growth could slow in 2025 as the labor market begins to tighten, with the unemployment rate projected to stabilize around 4.3%. Despite this, the job market remains healthy overall, supported by strong consumer demand and a recovering economy.

Monetary Policy: The Federal Reserve’s monetary policy in 2024 was marked by caution. In December, it cut the federal funds rate by 25 basis points to 4.25%-4.50%. The Fed has indicated a more gradual approach to rate cuts moving into 2025, with the policy rate expected to remain at a higher level for longer. The Fed’s primary focus remains inflation control, though uncertainties in inflation trends and the potential for future fiscal policies under the new administration could shape future monetary decisions.

Outlook: The U.S. economy faces a mixed outlook for 2025. While moderate GDP growth of 2.3% is expected, inflationary pressures and the risks of trade tensions and geopolitical conflicts pose challenges. The Federal Reserve’s cautious approach to rate cuts, combined with ongoing inflationary pressures, suggests a year of slower growth. Consumer spending and the labor market will remain key to the economy’s performance, but external risks, such as protectionist policies and trade wars, could impact economic stability. As the Fed’s actions and inflation trends unfold, 2025 will likely be a year of both recovery and uncertainty.

International

In December 2024, global economies faced mixed signals as inflation pressures remained persistent in many regions while growth showed signs of slowing. From political instability in Europe to mixed economic data in Japan and China, the global outlook for 2025 remains uncertain, with trade risks and geopolitical tensions continuing to shape market expectations.

Europe: In Europe, the Harmonised Index of Consumer Prices (HICP) for the Euro area rose to 2.3% year-over-year in November, up from 2.0% in October, signaling a rise in consumer prices. While ECB President Christine Lagarde noted that inflation is approaching the 2% target, she expressed caution due to persistent inflationary pressures in services. In France, President Macron appointed a new cabinet following the collapse of the previous government, highlighting ongoing political instability as the country grapples with its fiscal deficit. Meanwhile, in the UK, the Office for National Statistics revised third-quarter economic growth to 0.0% from 0.1%, signaling a stagnating economy and raising concerns about economic momentum, particularly amid planned tax increases to address budgetary challenges. Against this backdrop, the euro remained weak against the U.S. dollar in December, with markets anticipating diverging monetary policy paths between Europe and the U.S.

Japan: In Japan, inflation continued to build in December, with the Tokyo-area Consumer Price Index (CPI) rising 3% year-over-year, up from 2.6% in November. The core CPI also increased to 2.4%, reflecting sustained price growth and ongoing inflationary pressures. Meanwhile, economic activity showed mixed signals, with industrial production falling by 2.3% in November, a sharp contrast to the 2.8% rise in October, while retail sales saw strong growth, increasing 1.8% in November compared to just 0.1% in October. The Bank of Japan (BoJ) remains cautious in its monetary policy, suggesting that further interest rate hikes could be necessary if economic conditions improve, though the timing and pace of any adjustments will depend on the evolution of economic activity and inflation.

China: In China, industrial profits fell by 7.3% year-over-year in November, marking the fourth consecutive monthly decline, though the pace of decline slowed compared to October’s 10% drop. This highlights ongoing pressures on corporate earnings amid a challenging economic environment. To address these issues, the People’s Bank of China (PBoC) injected RMB 300 billion into the banking system through its medium-term lending facility, while maintaining the lending rate at 2%. Despite these efforts, concerns persist over the effectiveness of these measures due to a significant net liquidity withdrawal. In response to the economic slowdown, China plans to sell a record RMB 3 trillion in special Treasury bonds in 2025 to boost consumption, support innovation-driven sectors, and alleviate economic strain. However, the success of these stimulus measures remains uncertain, especially as China faces potential trade tensions with the U.S. in 2025.

EURUSD GBPUSD USDJPY Performance – December 2024

The Portfolio Management Team