Global economies are navigating a phase of moderated inflation following aggressive monetary tightening by central banks, with many now pivoting towards rate cuts as inflation approaches their targets. In the U.S., inflation has eased, strengthening the Federal Reserve’s confidence that it is gradually aligning with the 2.0% goal. However, concerns linger over the sustainability of economic growth as the labor market weakens and consumer spending begins to outpace income growth, raising risks of long-term economic strain.

Meanwhile, Canada presents a more mixed economic picture. Strength in sectors like government spending and housing starts is tempered by growing challenges in the labor market and widening trade imbalances. While inflationary pressures have eased, the slowdown in economic growth raises questions about the durability of recent gains. Additionally, a widening current account deficit and declining foreign direct investment highlight deeper structural issues, increasing the likelihood of further interest rate cuts should economic momentum continue to soften.

| Index | July-2024 | July-2024 |

| S&P 500 Total Return | 1.22% | 2.43% |

| S&P/TSX Total Return | 5.87% | 1.22% |

Canada

The Canadian stock market continued its upward momentum in August, with the S&P/TSX Composite Index delivering a monthly total return of 1.22%. Canada’s economy grew at an annual rate of 2.1% in Q2, slightly exceeding expectations, driven primarily by strong government spending. However, when adjusted for population growth, the overall economic expansion remains modest. Despite the Q2 growth, signs of a slowdown emerged over the summer, with flat growth recorded in both June and July, raising concerns about the country’s ability to meet the Bank of Canada’s Q3 growth target of 2.8%.

Labor Market: The Canadian labor market struggled in June, with nonfarm payrolls falling by 47,300, erasing previous gains. Public sector growth, led by health care, education, and public administration, rose by 3.3%, but overall employment would have declined by 0.4% without it. Private sector employment remains sluggish, growing just 0.6%, the slowest pace since 2016 outside of the pandemic. Job vacancies dropped by 191,000, bringing the vacancy rate back to pre-pandemic levels of 3.1%.

Economic Growth: Canada’s economy grew by 2.1% annually in Q2, driven largely by government spending. However, when adjusted for population growth, this expansion appears modest. Consumer spending rose by 0.6%, while housing investment fell by 7.3%.

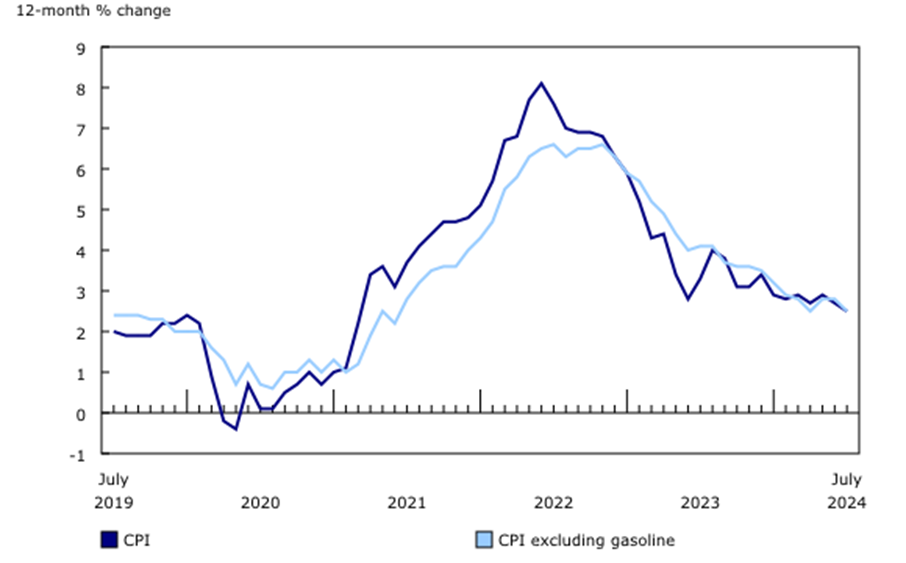

Inflation: Inflation remained steady in July, with the Consumer Price Index (CPI) rising by 0.4% month-over-month and 2.5% year-over-year. Core inflation metrics showed minimal increases, with annual rates at their lowest since April 2021.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and service prices

Trade and Investment: Canada’s current account deficit widened to $8.5 billion in Q2, driven by a goods trade deficit. Foreign direct investment (FDI) rebounded to $38.5 billion after a Q1 decline, but Canadian direct investment abroad fell to $21.2 billion, reflecting challenges in maintaining business investment momentum.

Housing Market: The housing market showed resilience in July, with housing starts rising to 279.5k annually, the highest since June 2023. Urban single-family starts held steady at 43.8k, while multi-unit starts surged to near-record levels of 217k.

United States

In August, equity markets demonstrated resilience despite early volatility, with the S&P 500 Total Return Index finishing the month up 2.43%. The month began with sharp market declines, triggered by a weaker-than-expected nonfarm payrolls report and an unexpected rate hike by the Bank of Japan. However, strong economic data and optimism about inflation, particularly with Core PCE inflation holding steady at 0.16%, helped fuel the rebound. Moreover, the Federal Reserve’s comments at the Jackson Hole Symposium hinted at potential rate cuts, further boosting market sentiment.

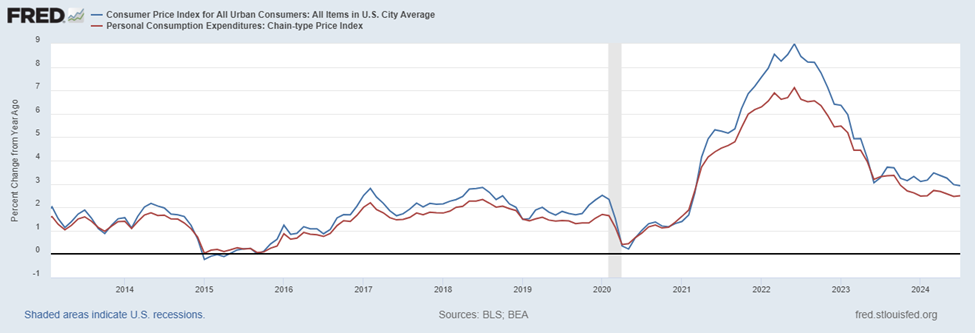

Inflation: Core PCE remained steady at 0.16% in July, the third consecutive month below 0.2%. While overall PCE prices also rose by 0.16%, the three-month annualized core rate of 1.7% points to a continued cooling trend in inflation. CPI inflation rose by 0.2% month-over-month in July, while year-over-year inflation declined to 2.9%. Core CPI, excluding food and energy, remained steady at 0.2% month-over-month. The moderation in inflation supports the Fed’s progress toward its 2.0% target.

Source: bea.gov

Durable Goods Orders: U.S. durable goods orders surged by 9.9% in July, recovering from a 6.9% decline in June. This rebound was largely driven by transportation equipment, particularly Boeing and defense aircraft orders. Excluding transportation, however, orders fell by 0.2%, with weakness in sectors such as communications and electrical equipment.

Labor Market: The U.S. job market is cooling faster than expected, with a preliminary revision indicating a loss of 818,000 nonfarm payroll jobs for the year ending in March 2024, the largest revision since 2009. This significant slowdown, averaging 68,000 jobs lost per month, suggests weakening labor market momentum and raises concerns about rising unemployment rates. However, productivity growth remains strong, with a 2.7% year-over-year increase in Q2, surpassing the long-term average.

Federal Reserve Outlook: The Fed held rates steady at its July meeting but signaled potential rate cuts in the future. Meeting minutes revealed that several participants are open to a 25-basis point cut, depending on upcoming data. With inflation moderating and labor market data weakening, a rate cut in September seems increasingly likely.

Retail Sales: Retail sales increased by 1.0% month-over-month in July, exceeding expectations. Motor vehicles, electronics, and grocery stores led the gains, while clothing and sporting goods saw declines. Despite strong growth, consumer spending is expected to moderate in the second half of the year.

Housing Market: Existing home sales rebounded by 1.3% in July, recovering part of the 5.1% drop from June. Single-family home sales led to this increase, while condo sales remained flat. Although the rebound is encouraging, high mortgage rates and low affordability have contributed to a 36-month decline in year-on-year sales.

International

In August, international markets experienced significant volatility. The month began with a sharp decline in global stock markets, prompted by weak U.S. economic data and an unexpected rate hike from the Bank of Japan. However, as the month unfolded, markets rebounded due to rising expectations of aggressive rate cuts by the Federal Reserve and other central banks. This positive shift was further reinforced by encouraging inflation reports from several regions, coupled with robust corporate earnings in the second quarter.

Europe: Eurozone inflation slowed to 2.2% in August, the lowest level in three years and nearing the ECB’s 2% target. This decline raised hopes for additional interest rate cuts from the European Central Bank. However, core inflation remained stubborn at 2.8%, prompting caution among some ECB policymakers who warned against cutting rates too soon due to persistent inflationary pressures, particularly in services. While overall eurozone economic sentiment improved slightly, Germany’s business climate deteriorated, with the Ifo index reflecting growing pessimism among companies.

Japan: Japan’s stock markets recovered by the end of August after a sharp sell-off earlier in the month. Renewed concerns about U.S. economic growth mainly drove the volatility and the unwinding of yen carry trades following the Bank of Japan’s (BoJ) surprise rate hike in late July. Inflation in Tokyo exceeded expectations, with the core CPI rising 2.4% year-over-year, reinforcing the BoJ’s hawkish stance. Governor Kazuo Ueda suggested that the central bank may raise rates again if economic conditions and inflation trends continue to meet projections.

China: Chinese stocks struggled in August as disappointing corporate earnings and economic data weighed on sentiment. Economists revised their 2024 growth forecasts for China as the property sector’s prolonged downturn and weak domestic demand persisted. Retail sales and fixed asset investment projections were trimmed, alongside a lowered inflation forecast of 0.5%, raising concerns that China may miss its 5% growth target for the year. In response to the weakened outlook, the People’s Bank of China injected liquidity into the banking system but left key lending rates unchanged, signaling the potential for further policy easing.

The Portfolio Management Team