Global markets experienced increased volatility in April 2025 due to growing trade tensions and uncertain policies. Investors’ sentiment was shaken by President Trump’s unexpected announcement of substantial tariffs on a broad range of imports from major countries. This raised concerns about a significant global trade war, with affected countries suggesting retaliatory measures. However, market pressure subsided after a few days as the administration revised its position, offering a 90-day delay in enforcing tariffs for countries that did not retaliate and exempting certain electronic goods.

Looking forward, ongoing trade disputes and tariff implications are expected to continue weighing on economic growth, with potential risks of recession if conditions persist. Monitoring developments in trade policies, inflation trends, and consumer sentiment will be critical in shaping the economic landscape in the coming months.

| Index | Mar-2025 | Apr-2025 |

| S&P 500 Total Return | -5.63% | -0.68% |

| S&P/TSX Total Return | -1.51% | -0.10% |

Canada

Canadian equities traded sideways in April, with the S&P/TSX Total Return dropping 0.10%. While March activity showed tentative signs of resilience, sectors like manufacturing and wholesale trade, which are closely tied to cross-border commerce, appeared vulnerable.

- GDP: Canadian real GDP fell by 0.2% in February, followed by a 0.1% rebound in March (flash estimate). On the other hand, for the first quarter, the economy expanded by 0.4% (1.5% annualized), its slowest pace in over a year.

- Retail Sales: February sales dropped 0.4%, with notable declines in autos (-2.6%) and furniture (-2.9%), while food and beverage spending rose 2.8%.

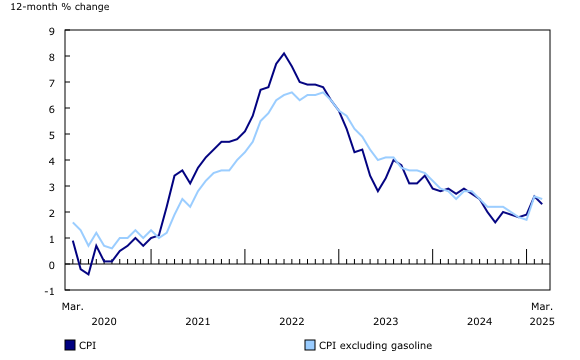

- Inflation: Headline CPI eased to 2.3% year-over-year in March. Core inflation remained sticky, with median inflation at 2.9% and trim inflation at 2.8%.

- Housing Market: Existing home sales fell 4.8% in March, marking the fourth straight monthly decline. The national benchmark price declined 1.0% month-over-month, while new listings rose 3.0%. Housing starts also dropped to 214,000 annualized units, the weakest reading since 2019.

- Consumer Confidence: Sentiment showed a modest recovery in April after hitting multi-decade lows in March, though uncertainty remains elevated.

- Manufacturing: A flash estimate showed a 1.9% decline in March, signaling tariff-related weakness, especially in wholesale and trade-sensitive sectors.

- Monetary Policy: The Bank of Canada held its policy rate at 2.75% during its April meeting, amid deep divisions on the path forward. Some policymakers favored a rate cut, citing financial fragility and weakening growth. Others preferred to pause, citing lingering inflation risks and a lack of clarity on the full impact of tariffs.

Source: Statistics Canada. 12-month change in the Consumer Price Index (CPI) and CPI excluding energy

United States

US equity markets experienced notable fluctuations in April. The S&P 500 Total Return Index declined by 0.7% for the month, with the most significant pressures occurring in the first half amid broad market sell-offs. Economic data pointed to a broader slowdown: services activity weakened, consumer sentiment dropped to pandemic-era lows, and business confidence took a hit.

Monetary Policy: The Federal Reserve maintained its cautious stance in April, keeping the federal funds rate steady at 4.25% to 4.50%. Despite President Trump’s pressure for rate cuts, Chair Jerome Powell emphasized the need for clear evidence of economic deterioration or sustained disinflation before adjusting rates.

GDP: The US economy contracted by 0.3% annually in Q1 2025, compared to 2.4% growth during the fourth quarter of 2024. This decline was primarily due to a surge in imports ahead of new tariffs, leading to a record trade deficit.

Consumer Spending: Growth slowed to 1.8% in Q1, down from 4.0% in Q4 2024, indicating cautious consumer behavior amid economic uncertainties.

Durable Goods Orders: Orders jumped 9.2% in March, driven by transportation equipment, notably a surge in Boeing orders and a 2.3% rise in autos, which were both boosted by tariff front-running.

Housing Market: Existing home sales dropped 5.9% in March, the steepest decline since November 2022, amid high mortgage rates and poor affordability. Additionally, housing starts fell 11.4% in March to 1.32 million annualized units.

Labor Market: The labor market is still demonstrating resilience with 177,000 jobs added in April. Moreover, the unemployment rate stood at 4.2%, surpassing analyst expectations and easing market concerns sparked by earlier negative GDP data.

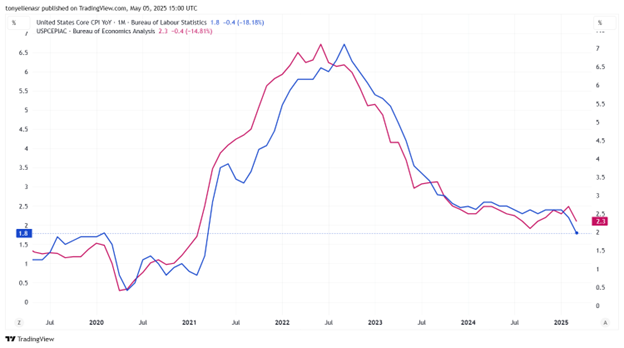

Inflation trends were encouraging, with the Consumer Price Index (CPI) falling 0.1% in March, marking the first monthly decline since May 2020. On a yearly basis, inflation eased to 2.4%, down from 2.8% in February. However, inflation expectations surged, with the one-year outlook rising to 6.7%, rising above the 5% reading in March.

Monetary Policy: The Federal Reserve maintained its cautious stance in April, keeping the federal funds rate steady at 4.25% to 4.50%. Despite President Trump’s pressure for rate cuts, Chair Jerome Powell emphasized the need for clear evidence of economic deterioration or sustained disinflation before adjusting rates.

Source: bea.gov

International

Europe: European markets saw mixed signals in April. While Eurozone GDP for the first quarter grew by 0.4%, the Purchasing Managers’ Index (PMI) showed weakening momentum of 50.1, and services slipped into contraction. Similar to other markets, the US tariffs and ongoing geopolitical tensions weighed on confidence, pushing the economic sentiment index and the consumer sentiment to decline. In the UK, economic momentum also deteriorated. The composite PMI fell to 48.2, and house prices declined as buyer demand softened. Furthermore, business confidence dropped sharply amid tariff concerns and rising employment costs.

Japan: Notably, Japanese equities outperformed as both the Nikkei 225 and the TOPIX index posted gains during April, supported by a weaker yen and improved service-sector activity. The flash all-industry PMI increased to 51.1, driven by a rebound in services, while manufacturing remained in contraction territory, highlighting ongoing vulnerability to export headwinds, especially from US trade measures. On the monetary front, the Bank of Japan kept rates steady at 0.50% and downgraded its growth and inflation forecasts, citing “extremely high uncertainty” surrounding global policy dynamics.

China: The escalating trade tensions weighed on the Chinese markets as the US ramped up tariffs on most Chinese goods to 145% in early April, prompting immediate retaliation from Beijing. Despite the headline conflict, the latter half of the month brought some relief, as China signaled openness to renewed dialogue and exempted certain US imports from tariffs. In terms of economic data, April’s PMI data was disappointing. Manufacturing activity fell back into contraction at 49.0, while non-manufacturing eased to 50.4. However, the GDP for the first quarter came in strong at 5.4% year-over-year.

Commodities: In April, gold surged to a record high of $3,500 per ounce, driven by escalating geopolitical tensions. However, as trade tensions showed signs of easing and US economic data improved, gold prices corrected to around $3,250 by month’s end. Conversely, oil prices experienced a significant decline, with Brent down 15% and WTI falling 18%, the biggest monthly percentage declines since November 2021. This downturn was attributed to OPEC+’s decision to increase output by 411,000 barrels per day starting in June, coupled with rising global recession fears and weakening demand.

EURUSD GBPUSD USDJPY Performance – April 2025

The Portfolio Management Team