Summary

- Do not underestimate the collective power of /r/wallstreetbets Redditors. With more than three million users, they are controlling the narrative of Gamestop (GME) against hedge funds, at least for now.

- As long as those investors stay united to make this short squeeze successful and the short interest remains high, their investment thesis is intact. The stock can surge to unchartered territories.

- The law of gravity stipulated by Newton still applies in this case: What goes up must come down. A collapse is expected at any time. Trade at your own risk, especially at these current levels.

- In the last two decades, avoiding companies with a high short interest was a winning investment strategy, except in the previous twelve months, where the dynamic seems to have reversed.

The Story

A few clients asked our opinion on Gamestop (GME) and how to interpret the short-interest ratio. Today, the company’s stock closed at $347 per share, which is a 7,600% 52-week return. From a quantitative perspective, Gamestop’s intrinsic value is without a doubt a fraction of its current price.

However, as Benjamin Graham once said: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” Right now, Gamestop shares are worth what someone is willing to pay for them. Today, it is $347, but tomorrow it could be $1000$ or even $40, nobody knows.

What the hell is going on? More than three million retail investors banded together on the Reddit forum r/wallstreetbets to short squeeze large hedge funds who piled a tremendous short interest of 140% on the stock. It is a tug of war between main street and wall street unfolding under our eyes.

Shorting this failing brick and mortar video game retailer was a winning trade until the stars aligned for a reversal. First, Ryan Cohen of Chewy, a successful $40 billion company, joined the company in August. Second, next-generation consoles were released last November, a vast tailwind for Gamestop.

Amateur investors noticed this highly unusual short interest abberation and crafted a simple yet brilliant investment thesis. In theory, with enough buying power, they could force hedge funds with billions of AUM to cover their massive short positions and make the stock metaphorically rocket to the moon.

This idea had already proven to work in 2008. At that time, Volkswagen (VWAGY) was viewed as a candidate for bankruptcy. Near the bear market low, Porsche orchestrated short squeeze that caused Volkswagen to briefly become the world’s most valuable company, creating $30 billion losses for short-sellers.

With Gamestop, the situation similar but the actors are different. Millennials are channeling their greed and anger toward baby boomers in a coordinated attack against the establishment. Many use their stimulus aid, short term savings, and credit cards to buy Gamestop options or stocks without caring if the trade backfires.

Although there might still be significant upside potential left, especially Friday with the exercising of options at 3pm, the price of Gamestop is inevitably going to collapse. It is not a matter of if but when. It might sooner than later with brokerage firms restricting trade on the stock and the forum getting shut down.

Short Interest Ratio

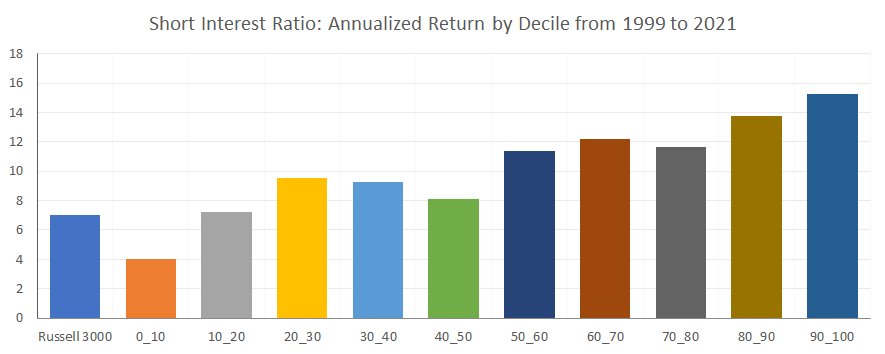

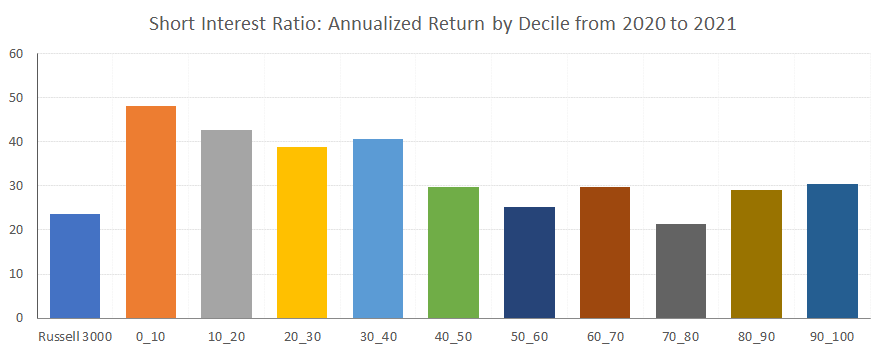

Regarding the short-interest ratio, we use it as a buy rule in some of our model portfolio strategies to exclude stocks with ongoing controversies. The backtest of that metric over the last twenty years has shown that investing in companies with a low short interest ratio is quite profitable, as shown below.

However, it’s the first year in the last two decades where companies with the highest short interest ratio are the ones generating the highest returns. The social phenomenon behind /r/walstreetbets discussions coupled with historically all-time low-interest rates and the easy monetary policy is probably why.

Conclusion

If there is one certainty, Gamestop will appear in the finance textbooks as one of the most incredible market stories of our lifetime. In a funny way, it is challenging the hypothesis that investors act rationally and that markets are efficient. For now, it is best watch the short squeeze unfold, while eating popcorn.