Summary

- Hologic’s continuous organic revenue growth bolstered investor’s confidence in the company’s future;

- Strength in Hologic’s COVID-related product are a catalyst for its international expansion strategy;

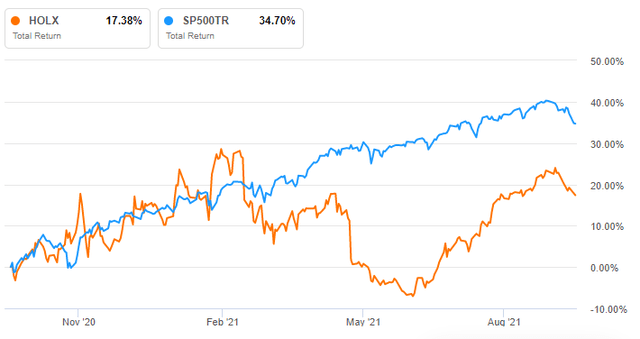

- Despite a solid financial performance, the company’s stock underperformed the market in 2021.

Introduction

Hologic (HOLX) is one of the leading medical appliances & equipment companies focusing on women’s health. It is engaged in the development, manufacturing, and supply of different diagnostics and medical devices. In Q3 2021, Hologic exceeded guidance on both top and bottom lines. Revenue reached $1.17 billion, surging 41.9% year-over-year, driven by a strong rebound across its business segments. Also, its GAAP EPS came at $1.04 in the quarter, increasing by 96.2% compared to last year’s figure ($0.53). In 2021, Hologic’s stock fluctuated between $60 and $83, underperforming the market, and is currently trading near $77 per share.

Source: Seeking Alpha

Business Segments

Hologic’s business is divided into four segments: Diagnostics, Breast Health, GYN Surgical, and Skeletal Health:

- Diagnostics (66% of total revenues): Covers a wide range of diagnostic products used to screen and diagnose human diseases.

- Breast Health (24% of total revenues): Portfolio of products and solutions for breast cancer care: radiology, pathology, and surgery.

- GYN Surgical (8% of total revenues): Solutions for women’s gynecologic conditions affecting their uterine health and well-being.

- Skeletal Health (2% of total revenues): Products used in evaluating bone density and performing body composition assessments.

In the table below, we summarized the year-over-year growth in revenues for each segment. We can notice that the core business segments of Hologic are still growing compared to pre-pandemic levels:

| Segment | Q3-2021 Y/Y growth compared to Q3-2020 | Q3-2021 Y/Y growth compared to Q3-2019 |

| Diagnostics | 25% | 118% |

| Breast Health | 56% | 7% |

| GYN Surgical | 148% | 14% |

| Skeletal Health | 70% | -70% |

Source: Hologic

It is noted that Hologic completed the Medical Aesthetics segment sale on the first day of the second quarter of FY 2020 (December 30, 2019).

Competitive Advantage

Hologic focuses on innovation to drive its growth and differentiate its products. We use Porter’s five forces framework to evaluate its current strategic position within its industry.

Threat of New Entrants (Low)

New entrants in the medical appliances & equipment industry need to spend considerable amounts on physical infrastructure and R&D. Furthermore, they are less likely to enter a highly regulated industry and compete with established players like Hologic.

Bargaining Power of Suppliers (High)

Due to cost and quality, Hologic relies on a limited number of suppliers for certain critical raw materials used in manufacturing its products. Accordingly, it is exposed to increased risks such as production delays, manufacturing disruptions, and supply shortages.

Bargaining Power of Buyers (High)

Hologic has a relatively small customer base which might put pressure on the company’s long-term profitability. The company does not have any customer representing more than 10% of its revenues. However, this is not the case per segment. For example, the two largest customers of the Diagnostics segment accounted for 23.4% of the segment’s revenue in the fiscal year 2020. As a result, the loss of any key customer could significantly reduce the segment’s revenues and profitability.

Threat from Substitute Products (Low)

Substitute products are available in the market and can present a threat for any company in the industry. However, some of Hologic’s products are large equipment that are well differentiated from its competitors. Hologic is also a product-oriented company. In FY2020, nearly 15% of its revenues were generated from services and 85% from its products sale. As long as the company fulfills its customer needs and upgrades its products accordingly, the impact of substitute products remains low.

Competitive Rivalry (Moderate)

The markets in which Hologic operates are highly competitive. All players want their market share, mainly driven by the rapid technological innovations in medical research. As a result, any new product introduction by industry participants can pressure the demand and the prices of Hologic’s products. However, the company is spending significant amounts of money on R&D to upgrade its current portfolio and stay ahead of competitors by innovating new medical products.

Business Outlook

The company is expanding its presence internationally. This growth has been mainly driven by strategic acquisition activity in recent years. Moreover, since two-thirds of COVID-related test revenues were generated outside the U.S., management expects to benefit from this global footprint, cross-sell its core business products and gain additional market share in the coming years.

For the fourth quarter, management expects a decline in revenues compared to last year’s inflated figure due to massive COVID-related test sales the previous year. However, it is expected to grow significantly above pre-pandemic levels and in line with its strategic plan.

[…] Based on our recent strategic planning process, we are confident that organic revenue can grow 5% to 7% through our fiscal 2025, excluding sales of COVID assays as well as the related ancillaries and instruments.

Stephen MacMillan – Chairman, President and Chief Executive Officer

Rankings

Hologic is an attractive investment opportunity based on our multi-factor ranking system. It ranks among the first decile stocks in our Factor-Based US Growth Equity Strategy with a grade of 94.5.

| Ranking (%) | Quality (35%) | Value (30%) | Momentum (35%) |

| 94.5 | 86.3 | 94.6 | 53.7 |

Our ranking system is based on nine metrics distributed across quality, value, and momentum factors, where each factor is assigned a certain weight. Then, the final rank is calculated by normalizing to a percentile. For more details and explanations, please check the Factor-Based US Large Cap Equity Strategy presentation on our website. Now, let’s check these factors and discuss how they contributed to a high rank for Hologic in our universe.

Quality

Our ranking system includes the following quality metrics to assess the company’s profitability: Return on Equity and Gross Profitability. First, the twelve trailing months ROE has been steadily improving since 2019 and reached a record level of 66.42%. Moreover, the ROE is better than its peers, like Bio-Rad Laboratories (BIO) and DexCom (DXCM), whose ROE ratios are 42.70% and 31.66%, respectively.

Second, the Gross Profitability ratio, measured as Gross Profits / Total Assets, is another quality metric. The ratio increased significantly during the last year, continuing its upward trend and confirming its increased profitability.

Value

We use a ratio called REVU to assess how much EBITDA is being generated for every unit of Enterprise Value after adjusting for R&D. The ratio is calculated as (EBITDA – CAPEX + R&D) divided by Enterprise Value which has increased sharply since the beginning of 2021, implying greater efficiency in generating profits.

As shown in the chart below, we paired those quality with value metrics by plotting the REVU ratio (y-axis) against the ROE (x-axis) of other companies in the healthcare sector with high ranks. Hologic has a better overall positioning showing a reasonable valuation, with good potential for appreciation.

Momentum

Regarding momentum, we use the price slope to identify stocks experiencing a medium-term uptrend. Despite the decreasing trend earlier this year, the ratio started to increase and is currently at 1.02. It is calculated as the 63-Day VMA (Volume Weighted Moving Average) by the 252-Day VMA. As shown below, HOLX lies in the lower part of a rising trend which is a good buy level.

Despite an attractive rank, a stellar growth trend, and a promising business outlook, Hologic is exposed to various risks and challenges:

Investment Risks

- Research and Development: Hologic needs to continuously spend on its R&D activity to gain market shares and stay ahead of its competitors.

- Goodwill concerns: The goodwill amount on Hologic’s balance sheet increased from $2.5 billion in 2018 to $3.3 billion recently due to a high number of acquisitions. The high goodwill amount might be a potential threat for the company in case of any impairment.

- COVID-19 revenue uncertainty: As per management, a significant part of the company’s revenue growth was attributed to the sale of COVID assay tests and related ancillaries. Once the pandemic is gone, Hologic’s revenues will be expected to decrease.

Conclusion

During the pandemic, Hologic was able to show resilient operations and grow faster than expected. The company successfully diversified its operations for a post-pandemic return to normalcy. Also, Hologic ranks among the first decile in our ranking system. Companies in the first decile tend to outperform the S&P 500 TR historically. Furthermore, after thoroughly analyzing our underlying factors, HOLX is considered an attractive investment opportunity.