Summary

- Enphase Energy’s growth will likely continue at its strong pace, supported by a favorable macro environment to fight climate change.

- The firm intends to introduce new products in a near future that are expected to expand its serviceable addressable market.

- The stock price is not overvalued considering the growth opportunities in the market, justifying its premium valuation.

Introduction

Enphase Energy (ENPH) is a leader in the solar microinverter industry. It is specialized in designing, developing, and manufacturing solar microinverters used to convert the direct current produced by solar panels into an alternating current. Its products also include software for monitoring, AC battery storage systems, and other accessories. The company sells to different type of clients such as solar distributors, large installers, and equipment manufacturers. It also targets individual homeowners through its online store.

Enphase Energy’s stock price increased nearly 500% in 2020, outperforming growth stocks such as Moderna (443%) and Zoom Communications (390%), which benefited from the pandemic’s emergence. In 2021, the stock surged 50%, reflecting investors’ interest and optimism in the company’s prospects. The company’s high rank in our Factor-Based US Large Cap Equity ranking system led us to examine it further. As a result, we identified that the firm is a great investment opportunity, despite its rally over the recent period.

Robust Operations

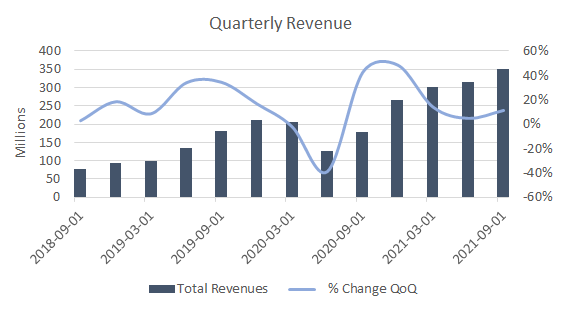

After being near bankruptcy in 2016, Enphase went into major restructuring in 2017 and acquired the microinverter business of SunPower (SPWR). As a result, Enphase’s revenue growth turned positive in 2018 while innovating new products. The chart below shows that the firm quickly recovered from COVID-19 and continued its quarter-to-quarter growth momentum.

Source: Enphase Energy

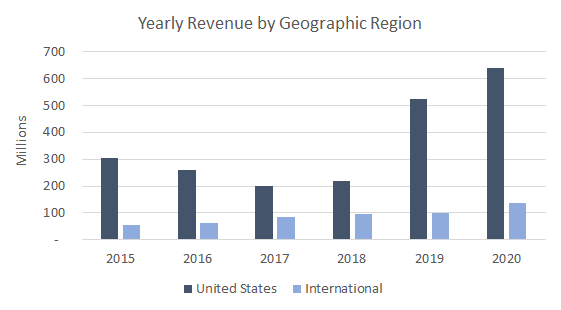

Enphase Energy’s business activity is not broken down by segment but by primary geographical market. The US is the firm’s primary market, constituting 82% of total revenue in 2020, while the international market accounted for only 18% of the revenue, despite a 36% growth in 2020.

Source: Enphase Energy

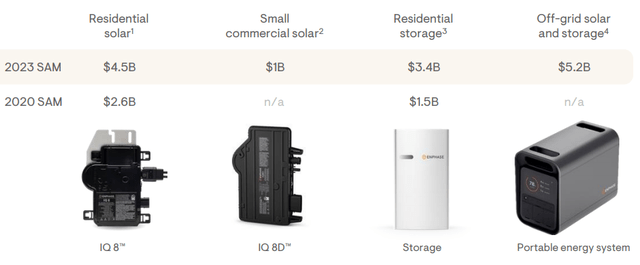

Enphase Energy is developing new products, enabling it to boost its growth in the upcoming period as it will start ramping up shipments in December. New products are expected to increase the serviceable available market (SAM) from $4.1 billion in 2020 to approximately $14.1 billion in 2023.

Source: Enphase Energy

Profitable Business

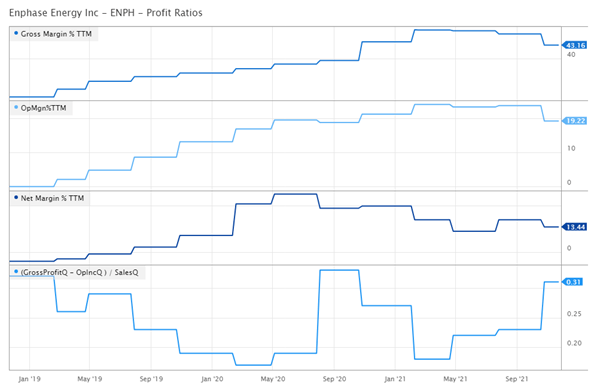

Enphase Energy is not only growing its revenue, but also its profitability. The gross profit margin expanded from 30% in the second quarter of 2018 to nearly 40% in the last quarter. Other profitability ratios experienced material improvement following the restructuring, which goes beyond its baseline financial model: 35% gross margin and 20% operating income.

Source: Factor-Based

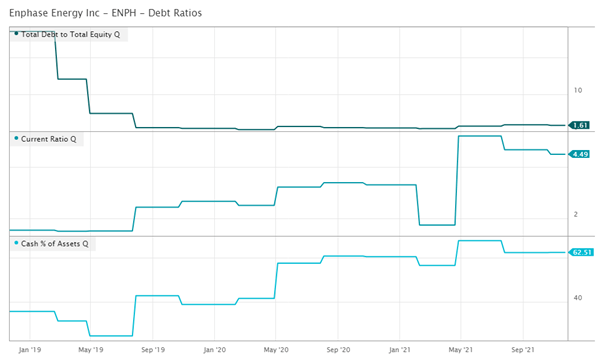

On the balance sheet side, liquidity and solvency ratios have improved, allowing the company greater flexibility in implementing new initiatives and leading to potentially more robust cash flows in the upcoming period.

Source: Factor-Based

Solar Energy Industry

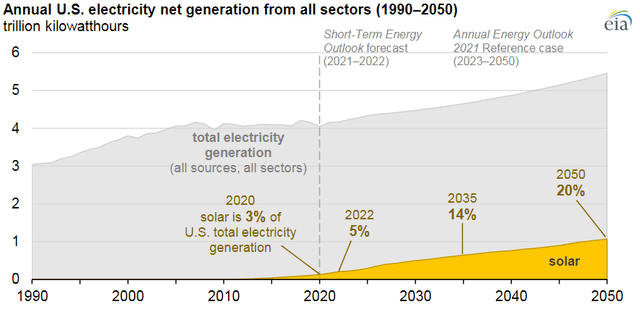

According to the US Energy Information Administration (EIA) studies, solar power accounted for 3% of US electricity generation last year. It is expected to reach 4% in 2021 and 5% in 2022. In the long run, solar generation will reach 20% of the consolidated US electricity production in 2050.

Source: US Energy Information Administration

Solar companies are obviously the primary beneficiaries in the renewable energy sector. Therefore, we need to assess Enphase Energy’s current market position and how it can benefit from this tremendous growth in the market. As such, we will use Porter’s five forces framework to briefly discuss how some external factors might impact the company’s development strategy.

Threat of new entrants (Low)

Since Enphase Energy is continuously innovating its products and services and expanding its SAM, new entrants won’t present a major threat to its growth. They might put some pressure on the pricing strategy and decrease the margins; however, the company is beyond its targets.

Bargaining Power of Suppliers (Medium)

Manufacturing of some products is outsourced to partners, and the company relies on various unaffiliated firms to provide specific components utilized in the production process. However, for some key components (like ASICs and lithium-ion batteries), the company still depends on a limited number of suppliers, which might pose a risk to the supply chain process.

Bargaining Power of Buyers (High)

The company’s sales are highly concentrated in the US market. Furthermore, in 2020, 29% of total revenues were generated from a single customer, implying a relatively high concentration risk. Therefore, the loss of any large customer could significantly impact the company’s growth.

Threat from Substitute Products (Low)

Enphase Energy has a built-in system redundancy that eliminates failure risk in PV generation and energy storage products. Also, the cloud-based monitoring solutions provide an unmatched service for cost-effective remote maintenance. The combination of these features is currently unavailable in the market, providing the company with significant competitive differentiation compared to other companies and traditional inverter technologies.

Rivalry among the existing players (Medium)

The solar industry is highly competitive, and the competition is expected to increase as renewable energy is more requested in ESG-friendly environments. Competitors are actively introducing new products to the market, which could negatively impact Enphase’s business outlook. However, since the whole market is expected to grow, internal competition might not be a major concern as long as Enphase can innovate its products.

Ranking

Based on our multi-factor ranking system, Enphase Energy is an intriguing investment opportunity. It is among the top-ranked companies in our Factor-Based US Large Cap Equity Strategy, with a rank of 87.4.

| Ranking (%) | Quality (35%) | Value (30%) | Momentum (35%) |

| 87.37 | 63.06 | 69.19 | 75.19 |

Source: Factor-Based

The ranking model is based on nine metrics classified in three factor categories: quality, value, and momentum. We assign a weight to each factor, then normalize the final rank to a certain percentile to get the final rank. A detailed presentation with explanations is available in the US Large Cap Equity section of our website. We will now take a closer look at some of the factors that led Enphase Energy to a high rank in our universe.

Quality

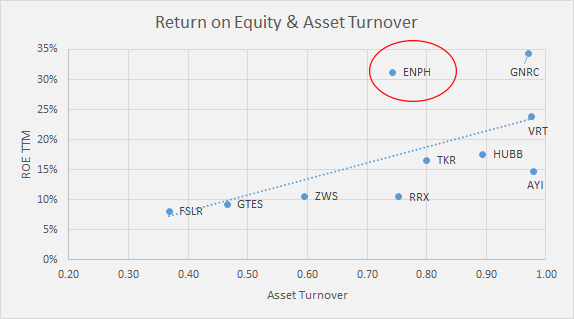

Return on Equity (ROE) and asset turnover ratio are two quality metrics we look at. When plotting the asset turnover ratio against the ROE of the top 10 companies in the Electrical Equipment and Power Systems industry, ENPH is above-average, implying higher quality than its peers.

Source: Factor-Based

Value

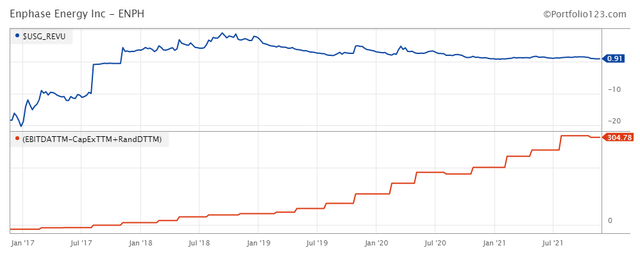

REVU is an excellent metric for identifying undervalued companies. It has (EBITDA – CAPEX + R&D) as the numerator and Enterprise Value as the denominator. This ratio experienced a substantial increase following the restructuring of 2017 and is currently at stable levels. Nevertheless, if we check the numerator on a standalone basis, it is continuously increasing, implying that Enphase can still grow its adjusted EBITDA.

Source: Factor-Based

Momentum

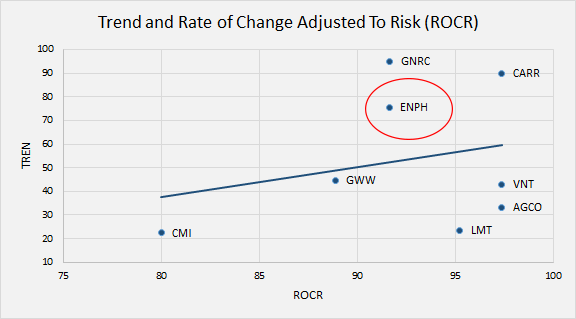

As for momentum factors, the price slope is used to identify stocks with a medium-term uptrend. The factor is the 63-Day VMA (Volume Weighted Moving Average) divided by the 252-Day VMA. Another momentum factor is the rate of change adjusted to risk (ROCR), which identifies if the company’s industry is performing better than other industries.

In the chart below, we plotted both factors for highly ranked companies in the industrial sector. Enphase Energy has an attractive price momentum profile relative to its peers that allows the stock to appreciate further.

Source: Factor-Based

Source: Factor-Based

Additionally, as shown below, Enphase Energy lies in the lower half of a rising dynamic trend channel, which is a potential entry point.

Source: TradingView

Underlying Risks

Although Enphase Energy has a bright outlook per our analysis so far, it is exposed to different risks and challenges:

- As mentioned earlier, the company is over-dependent on the US market, which constitutes 82% of its 2020 revenues;

- The company’s accounts receivable (AR) might be subject to a credit concentration risk. In 2020, one client accounted for nearly 36% of total AR. In 2019, three customers accounted for 59% of total AR.

- The company is currently trading at relatively high valuation ratios compared to the industry (forward PE of 110, TTM P/S of 26.8, and EV/Sales TTM of 28.26). Trading at high valuation ratios makes the stock sensitive to earnings surprises at each quarter release.

Conclusion

The global shift toward greener energy sources is a long-term trend, driven by government incentives, business compliance with ESG standards, and global awareness. Enphase Energy appears to be well-positioned for the upcoming growth in the solar energy industry. The firm has a leading position in this thriving US market, with new innovative products presenting a potential growth catalyst for the upcoming period. Moreover, its business model proved to be efficient and delivered outstanding financial and operational results during the last three years. Finally, based on our Factor-Based ranking model, the company is an attractive investment opportunity.