Summary

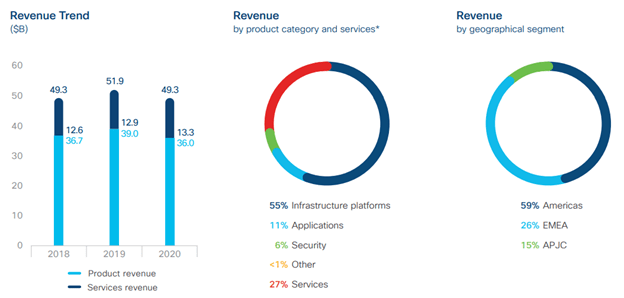

- Cisco Systems is a multinational leader in networking & communication devices that redefined technology to do business. Its annual revenues reached $49.3 billion during the fiscal year 2020.

- Since the beginning of 2021, the company’s stock has surged 24.0% on a total return basis compared to 17.2% for the S&P 500 TR.

- We believe Cisco’s valuation presents investors with attractive upside potential as its quality, value, and momentum metrics are still indicating that the company is a good investment.

Introduction

Cisco Systems is one of the leading global companies providing IT, networking, and cybersecurity solutions. The company is well-positioned to reap the benefits of the strong demand for security and networking solutions.

The coronavirus emergence led to a drastic upgrade in all companies’ IT infrastructure and massive growth for secure online services. Webex, Cisco’s video conferencing software, was one of the business solutions that had widespread adoption by businesses and educational institutions.

Cisco registered quarterly revenue of $12.80 billion during the third quarter of FY 2021 representing a 6.8% year-over-year growth, indicating a broad strength across its major business segments. Moreover, Cisco’s quarterly EPS surged 5.0% on a GAAP basis to $0.68 per share.

Segments

Cisco changed the structure of its reporting segments in 2018 and divided its revenue stream into five segments: infrastructure platforms, applications, security, other products, and services.

Source: Cisco annual report 2020

Competitive Advantage

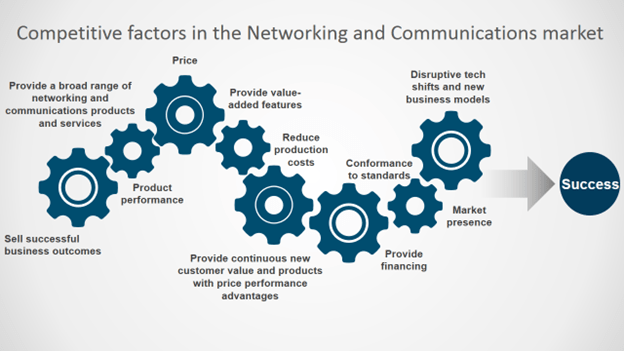

As Cisco continues to expand globally, it faces global competition in different geographic regions and across its various business segments. In addition, price-focused competition is expected to be the next primary concern in the market as participants aim to retain clients and increase their market share. In their annual filings, Cisco summarized the principal competitive factors in the markets in which it operates that are key for its growth in the future. We summarized those factors in the chart below.

Source: Cisco annual report 2020

The brand name “Cisco” is powerful; however, we need to review Cisco’s strategic position within the networking and communications industry to assess its competitive advantage. We will use Porter’s five forces as a framework to discuss briefly the company’s potential opportunities and how external factors might impact its development strategy.

Threat of New Entrants (Low)

New entrants into networking and communication devices should have huge research and development costs and massive infrastructure to provide similar services and compete with large corporations that are well established. Start-ups with innovative ideas might represent a threat for Cisco; however, key market players tend to acquire those start-ups in their early stages of operations. Cisco has an active M&A history and was able to evolve with technological changes and be among the companies to define the industry standards.

Bargaining Power of Suppliers (High)

Cisco does not own or operate all its manufacturing facilities and is reliant on an extended supply chain. Any problem experienced by its suppliers can harm its business through increased costs or delays in providing services to its clients. The growth and ability to meet customer demands depend on Cisco’s suppliers’ timely deliveries of parts or services. The company has experienced shortages in the past, which jeopardized the manufacturing process. Furthermore, sudden demand is likely to create significant pressures on Cisco and its supply chain components.

Bargaining Power of Buyers (Low)

Cisco’s customers include businesses of all sizes, public institutions, governments, and service providers; they often seek help in their information technology (IT) solutions to drive positive business outcomes. When it comes to software infrastructure and security solutions, customers want to buy the best offerings available, but they rarely change their service provider once chosen. Moreover, Cisco has a broad base of widespread customers globally, and the company does not rely on a particular type of clientele.

Threat of Substitutes (Moderate)

Cisco operates in a market characterized by continuous technological innovations and rapid change. As a result, industry profitability is under constant pressure due to continuous new products or services being launched to meet customer needs differently. The threat of substitute products or services is high if those substitutes can offer added value to customers at low switching costs. However, software and security infrastructure have relatively higher switching costs, decreasing this threat if the pricing strategy is similar.

Rivalry Arnold Schwarzenegger Bodybuilding Training Motivation – No Pain No Gain | 2018 sustanon 250 injection the best nutrition tips for muscle growth Among Competitors (Moderate)

The industry in which Cisco operates is growing every year, and the competitors are few and mainly large. Cisco continues to innovate its products and services to stay ahead of its competitors. The companies in the industry are very active on the merger and acquisition side, driven by innovation for growth. Cisco is focusing on its customers’ needs to have more differentiated services and raise switching costs by developing long-term customer relationships.

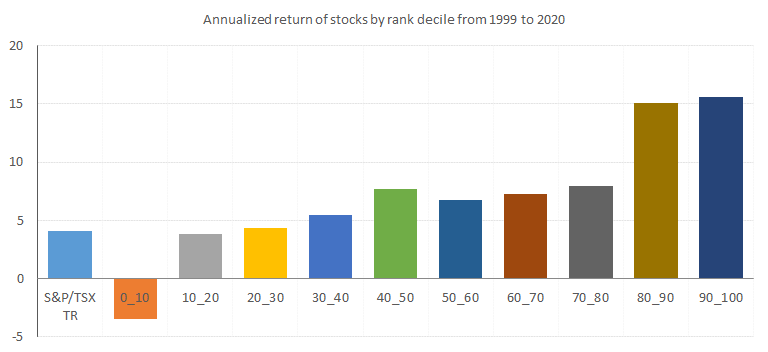

Ranking

Cisco is among the first decile stocks in our Factor-Based US Large Cap Equity Strategy, with a rank of 94.6. Therefore, it is a buy opportunity as per our ranking system based on 12 factors distributed across quality, value, and momentum. The table below shows Cisco’s rank for each factor.

| Ranking (%) | Quality (35%) | Value (30%) | Momentum (35%) |

| 94.6 | 56.1 | 95.9 | 89.1 |

Source: Factor-Based

The final ranking is obtained by weighting the grade of each factor and normalizing it to a percentile. Full definitions of metrics used are available on our website in the Factor-Based US Large Equity Strategy presentation. Now, let’s look into why Cisco has a high rank, analyze some of these factors, and evaluate the company’s relevant metrics.

Quality

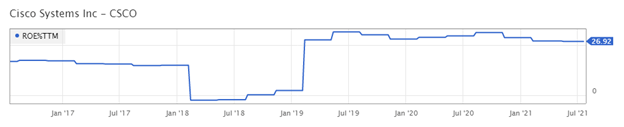

The quality factor captures the profitability of the company. The Return on Equity is among one of the quality metrics we consider. It examines a company’s profitability from the equity holders’ perspective. Cisco’s ROE increased significantly in 2019 and maintained a relatively high level. It is now at 26.9%, trailing twelve months.

Source: Factor-Based

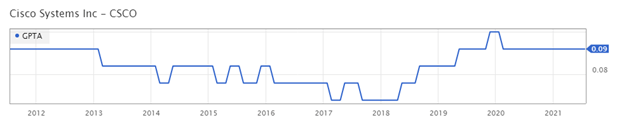

The Gross Profitability ratio is another metric to assess quality. This metric is measured as the gross profit of the company divided by its total assets. As shown in the chart below, this ratio improved significantly during recent years, implying that it could increase its profitability relative to its assets base.

Cisco’s gross profit was $31.2 billion over the last twelve trailing months compared to $29.7 billion in 2015. Moreover, its total assets decreased 17% over this period.

Source: Factor-Based

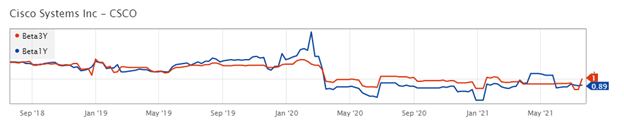

Long-term beta is another quality metric used to measure the company’s systematic risk compared to the market. It could arguably be classified as a low volatility metric, but truth be told that companies exhibiting low volatility have more stable fundamentals and predictable earnings. Cisco’s beta decreased during the recent period implying lower volatility for the stock compared to the market.

Value

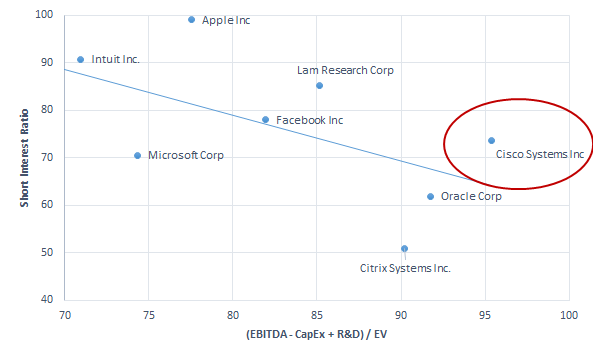

The Short Interest Ratio is one of our valuation metrics measuring the number of days it takes to cover the short interest in the company’s stock. Cisco’s SIR is currently 2.04.

Another value metric is the ratio of EBITDA – Capex + R&D / Enterprise Value. Usually, growth companies consider R&D as an investment rather than an expense. Therefore, this ratio evaluates the amount of EBITDA being generated for every 1 unit of EV (after adjusting R&D and capital expenditures).

Compared to other top-ranked tech companies, Cisco has a high rank on both metrics, as shown in the chart below.

Source: Factor-Based

Momentum

Normalized Average True Range is used as a momentum factor to identify whether the company is experiencing unusual short-term volatility. Cisco’s rank of 93.8 is among the highest ranks compared to its peers in the tech sector.

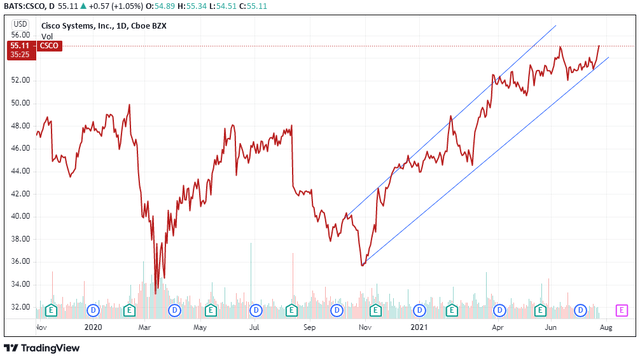

As depicted in the below chart, Cisco’s stock price increased by 50% since November 2020 after the economy started recovering from the pandemic crisis. Moreover, the price has been rising within a precise range, reaching levels beyond $55 recently.

Source: TradingView

Investment Risks

Cisco is exposed to various risks despite its substantial competitive advantage and sound profitability. Below are the main challenges that might affect its bottom line negatively:

- Acquisitions: With the intent to increase revenues and market share, Cisco continues to acquire companies with potential synergies or innovations. The acquisition activity increases integration risks and might negatively impact the company’s balance sheet through a high level of intangible assets and goodwill and a more significant debt burden.

- Research & Development: Cisco has to work continuously on updating and innovating its products and services. Thus, a substantial level of research and development costs is expected to stay on its income statement.

- Weak supply chain: As discussed earlier, Cisco products availability is reliant on its supply chain and the efficiency of its suppliers. Delayed orders might harm the company’s reputation.

Final Thoughts

Cisco’s performance is benefiting from the economic recovery and the growing demand for infrastructure and networking services. The company has a bright outlook as the trend to implement digital networks for educational and business operations is still emerging, in addition to e-commerce opportunities.

Cisco is expected to continue this growth pace. However, supply chain constraints may weigh on the company’s performance. The industry is continuously changing, and consumers always want the latest updates, and Cisco has the required competitive advantage to fill those needs.

Companies in the first decile of our ranking have historically outperformed the S&P 500 TR by 8.6% each year, as shown above. Are you looking for a model portfolio strategy with stocks like this one? CSCO is a position in our Factor-Based US Large Cap Equity Strategy since June 2019. Our Strategy holds 25 quality companies trading at an attractive price.