Summary

- Adobe offers a compelling product mix, unmatched by other competitors.

- The company enjoys many competitive advantages and consistently record double-digit growth and increased margins.

- Adobe’s quality and value factors put the company on our buy radar recently.

- As businesses adopt digital solutions and more people work remotely, this stock is an excellent pick for investors and offers high growth opportunities.

Introduction

Adobe (ADBE), founded in 1982, is one of the most well-known companies in the software development industry. The company became the digital design space leader with a diverse portfolio, allowing different users to design and deliver exceptional digital content.

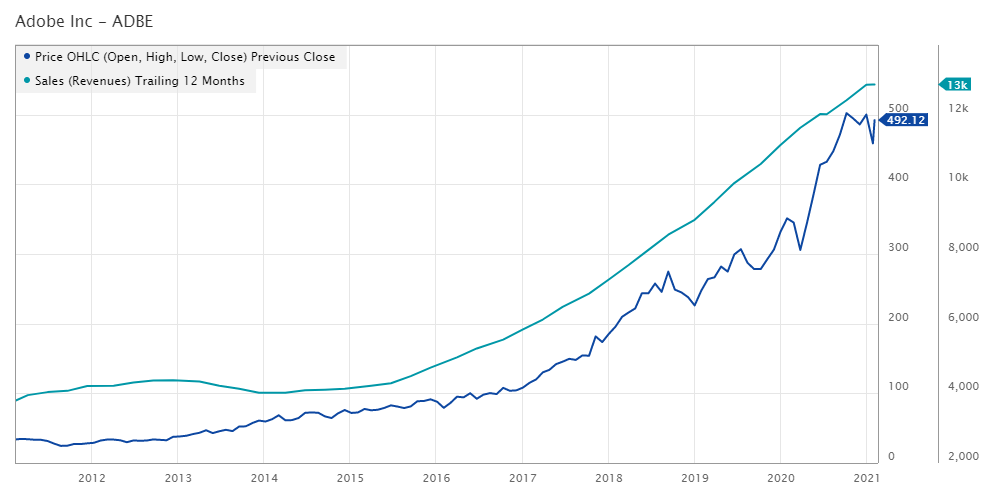

Adobe registered record quarterly revenues of $3.42 billion during the fourth quarter of 2020, representing a 14% year-over-year growth. Moreover, Adobe’s annual revenue of 2020 reached a record level of $12.87 billion (15% year-over-year growth).

Key Segments

Adobe’s business is divided into three reporting segments: Digital Media, Digital Experience, and Publishing and Advertising.

Digital Media (72% of total revenues) :

This segment includes subscriptions to Adobe Creative Cloud (Photoshop, Illustrator, Adobe XD, etc.) and Adobe Document Cloud (Adobe Acrobat, Adobe Sign, and Adobe Scan). These cloud-based services and products have a critical role in the current business environment, where millions of users interact with documents every day across the globe.

Digital Media segment revenue reached $9.23 Billion (20% year-over-year growth) during 2020. Also, a 20% year-over-year was registered over the last quarter.

Digital Experience (24% of total revenues) :

Adobe Experience Cloud helps companies deliver exceptional experiences to their customers by providing real-time data and insights and delivering customized content. It provides the following set of solutions: Customer Data and Insights, Content and Commerce, Customer Journey Management and Work Management. These tools help companies boost their business performance throughout the customer journey.

After reclassifying Advertising Cloud to “Publishing and Advertising” segment, Digital Experience segment revenue registered $3.20 Billion in 2020, growing by 12%. Last quarter, this segment recorded a 10% year-over-year growth.

Publishing and Advertising (4% of total revenues) :

Publishing and Advertising is a new segment created last quarter which combines the Publishing segment with Advertising Cloud (previously included in the Digital Experience segment). This segment addresses authoring and publishing needs and includes platforms like Advertising Cloud, eLearning, web conferencing.

2021 Guidance

Adobe’s management outlined several promising growth opportunities in its Financial Analyst Meeting of December 10th. Revenues are expected to reach $15.15 Billion in FY21, representing a growth of18% year-over-year. As shown in the chart below, Adobe’s revenues were steadily increasing since 2016, while its stock price has benefited from an exponential uptrend.

For the first quarter of 2021, a 21% year-over-year increase in revenues is expected. This increase includes one additional week in FY21, which falls in the first quarter and is expected to generate $240 million.

On a strategic level, Adobe’s CEO Shantanu Narayen announced that its total addressable market (TAM) has expanded to approximately $147 billion by 2023 due to ongoing innovations. Historically, any TAM expansion has been a solid leading indicator of future growth.

On the other hand, the current $8 billion stock repurchase program is expected to be exhausted in the first half of 2021. However, a new $15 billion repurchase program was recently approved.

Competitive Advantage

Adobe enjoys several competitive advantages. Its extensive customer base, its global brand and software’s ubiquity, and its dedicated employees are all factors contributing to the company’s success and economic moat.

To evaluate Adobe’s strategic position within the Application Software industry, we will discuss briefly, based on Porter’s five forces, the company’s position in its environment and explore its potential opportunities in the Tech sector.

Threat of New Entrants

Many young firms have successfully managed to enter into the applications software industry. Those startups bring innovation and put pressure on Adobe, mainly through lower pricing strategies. However, the company managed to build effective barriers by integrating personalized content, analytics, web experience management, cross-channel campaign management, and social capabilities on one platform. This bundle of products cannot be offered solely by newly established companies.

Bargaining Power of Suppliers

Switching costs between suppliers is low. Adobe develops its software internally, and in some instances, it acquires software developed by others. Suppliers provide standardized products used by Adobe’s employees, who add their creativity and innovation to reach the Adobe product mix. Accordingly, the only threat in this development phase is Adobe’s employees.

Bargaining Power of Buyers

Buyers always want to buy the best products at a low price. However, due to its large customer base and since some products are essential to its clients’ business operations, buyers are a low threat to Adobe’s market positioning. The company mainly uses its website as the primary channel to reach its customers.

Threat from Substitute Products

Product substitution is difficult in the software industry. Many users built their business models based on Adobe’s products and services, which are highly differentiated. Hence, substitution is time-consuming and not frequent in the industry.

Rivalry among the existing players

Competition in the industry takes an innovative aspect since it is still growing, and rivalry is more dedicated to new products to create new market opportunities. Adobe faced fierce competition efficiently with its comprehensive set of solutions putting the company years ahead of its rivals by securing a significant market share and maintaining its competitive edge.

Ranking

Adobe was flagged as a buying opportunity by our multi-factor ranking system last December. Its rank changed from 61% to 97% in December 2020 and then to 94% as of February 14th, 2021:

| Ranking (100%) | Quality (35%) | Value (30%) | Momentum (35%) |

| 93.7% | 65.8% | 76.0% | 90.9% |

Our ranking model is made of nine metrics distributed equally among quality, value, and momentum, where each factor is assigned a certain weight. The final rank is calculated by weighting the rating of each factor and then normalizing to a percentile. Let’s check some of these factors in-depth and see how they contributed to Adobe’s high rank.

Quality

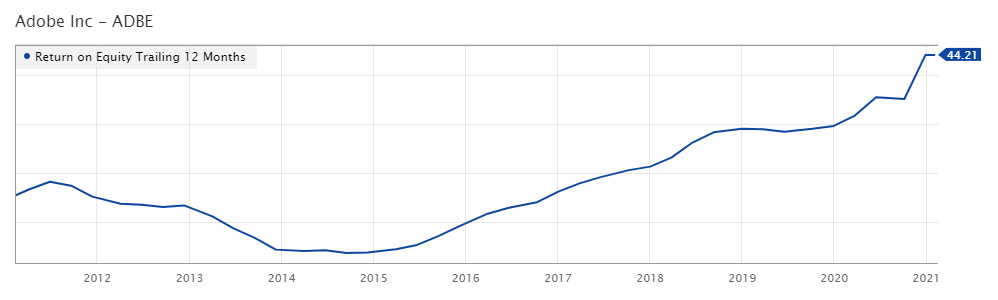

Profitability metrics often capture the quality factor. One of those metrics is the Return on Equity, which examines a company’s profitability from an equity investor’s perspective. Adobe’s ROE has been steadily increasing since 2015 and reached 44.2% for the twelve trailing months.

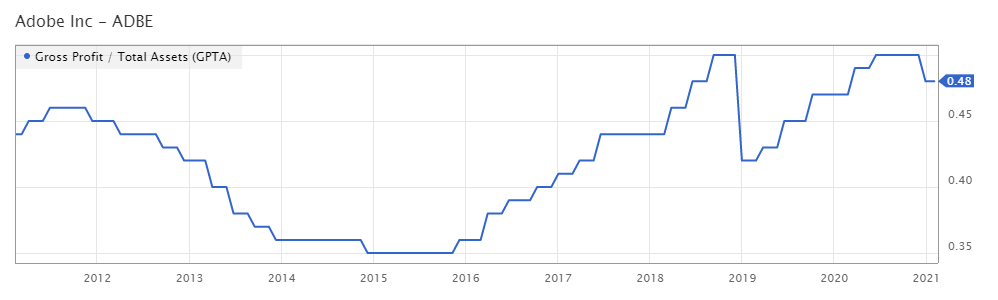

Another quality metric is the Gross Profitability ratio measured as Gross Profits / Total Assets. Adobe’s Gross Profitability ratio has been improving in recent years, despite a drop in 2018 caused by an increase in goodwill due to M&A activity concerning Marketo and TubeMogul. The ratio reversed in 2019 and continued its upward trend, reinforcing Adobe’s competitive advantage and difficulty for competitors to penetrate its business.

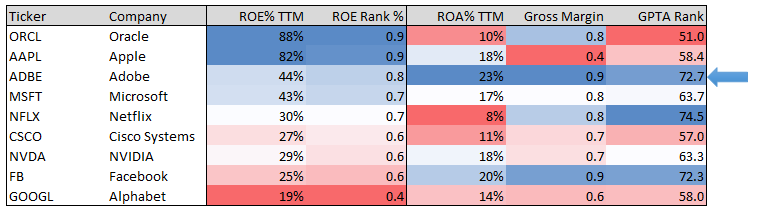

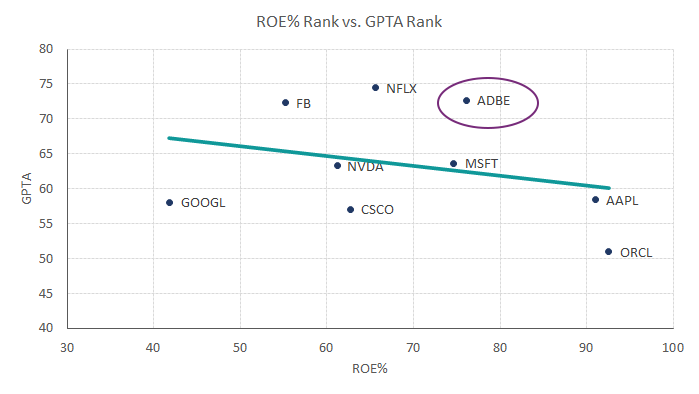

Compared to other large tech companies, Adobe is the only company with a high rank on these two quality metrics: ROE and Gross Profitability.

Value

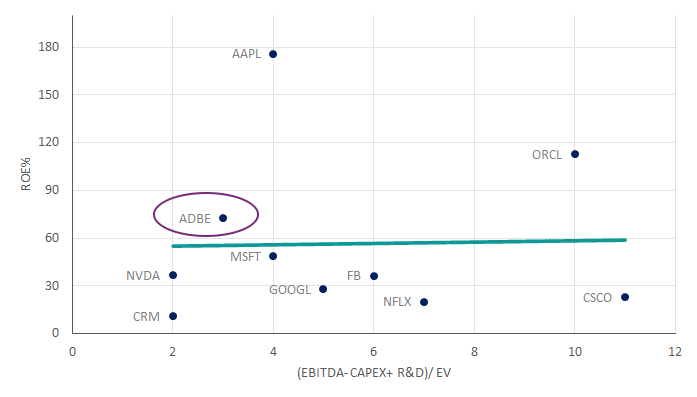

As for the valuation factors, and after backtesting hundreds of metrics over the last twenty years, we concluded that EBITDA – Capex + R&D / Enterprise Value is a good metric for identifying undervalued companies. This ratio explains how much EBITDA is being generated per 1 unit of EV after accounting for capital expenditures and R&D.

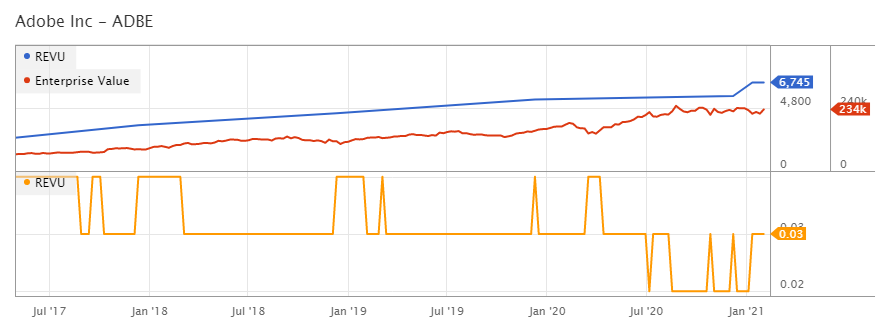

Adobe’s profitability was steadily increasing, which gave the numerator a boost since capital expenditures were constant; As shown below, EBITDA – Capex + R&D increased at a faster pace than Enterprise Value.

When pairing quality with value metrics by plotting the above ratio against ROE of big tech companies, Adobe had a better positioning with a higher valuation level leading to an expected price appreciation.

Momentum

Normalized Average True Range is a momentum factor used in our factor-based model to identify if the company is experiencing unusual short-term volatility. Adobe’s rank of 94.7% is among the highest levels compared to its peers in the tech sector.

As depicted below, Adobe’s stock price increased by 60% following the early pandemic emergence last March 2020. Starting September 2020, the price has been range-bound between $460 – $500. Our entry point was at $459.44, thus at the lower part of the horizontal band.

Stocks fluctuating within a horizontal trend tends to consolidate to become potential runners. Once the upper resistance is breached, the stock price is often starting a new upward trend while achieving new all-time highs.

Investment Risks

Despite a stellar competitive advantage, a strong track record of earnings growth, and high profitability metrics, Adobe’s business model faces various risks and challenges.

Product Enhancement

Currently, no competitor offers a suite of products competing against Adobe. The business risk lies more in new industry standards that might be implemented as remote working and eLearning is emerging. The continuity of Adobe’s products depends on offering new products or enhancing the features of existing ones to meet evolving customer requirements. Otherwise, operating results might suffer, and recurring subscription revenue could be jeopardized.

Copyright Infringement

The other main risk comes from intellectual property rights, subject to an infringement or unauthorized copying. Some companies might also develop and offer similar products at lower prices, resulting in lost revenues and value reduction.

Privacy Issues

Finally, privacy became increasingly important during recent years and will always be a concern for users. Adobe will still need to make its users comfortable using its products and services by ensuring compliance with laws across various jurisdictions.

Final Thoughts

Last year, companies struggled with an uncertain business environment due to COVID-19. In contrast, Adobe thrived in this challenging environment. With the emerging trend to implement digital and e-commerce solutions, the company has grown and is expected to continue this growth pace and increase its total addressable market.

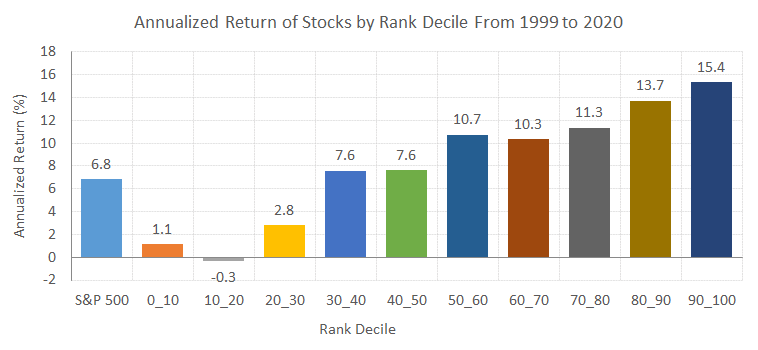

Adobe was among the newly added holdings to our Factor-Based US Large Cap Equity Strategy and is considered an attractive investment opportunity with limited downside risk. Companies in the first decile of our ranking system have historically outperformed the S&P 500 TR by 8.6% each year, as shown below.

Looking for a model portfolio strategy with stocks like this one? Adobe is a position in our Factor-Based US Large Cap Equity Strategy since February 1st, 2021. Our Strategy holds 25 quality companies trading at a reasonable price that consistently generate wealth for their shareholders.

The Portfolio Management Team